- United States

- /

- Software

- /

- NasdaqGS:NBIS

Nebius Group (NBIS) Is Up 18.8% After Striking Multi-Billion Dollar AI Chip Deal With Microsoft

Reviewed by Sasha Jovanovic

- On September 8, Microsoft announced a five-year, multi-billion dollar AI infrastructure agreement with Nebius Group, under which Nebius will provide access to over 100,000 Nvidia chips to support Microsoft's large language model and AI assistant development initiatives.

- This major deal establishes Nebius Group as a critical supplier in the global AI cloud ecosystem and highlights its rapid U.S. expansion, including a recent land purchase in Alabama to bolster its data center footprint.

- We'll explore how Nebius's landmark Microsoft partnership could accelerate its revenue outlook and reshape the company's long-term investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Nebius Group Investment Narrative Recap

To believe in Nebius Group as a shareholder, you need confidence in the continued explosion of demand for AI computing infrastructure and the company’s ability to deliver rapid capacity growth without sacrificing profitability. The landmark Microsoft deal is poised to reinforce Nebius's short-term revenue trajectory by providing reliable, high-value contracts, but the biggest immediate risk remains the high pace of capital spending and potential shareholder dilution from ongoing equity offerings. The deal may accelerate growth, making execution and capital discipline even more critical over the next year.

Among Nebius’s recent actions, the $1 billion follow-on offering announced just days after the Microsoft agreement stands out. This funding is meant to supply the hardware and data center capacity needed to fulfill these large new contracts, but it also underscores the pressure to maintain strong financial footing and balance growth with dilution concerns as expansion ramps up.

In contrast, investors should also be alert to the growing risk from further equity raises and how new shares could impact future returns...

Read the full narrative on Nebius Group (it's free!)

Nebius Group's narrative projects $3.2 billion revenue and $428.7 million earnings by 2028. This requires 133.9% yearly revenue growth and a $238.5 million earnings increase from $190.2 million today.

Uncover how Nebius Group's forecasts yield a $153.00 fair value, a 20% upside to its current price.

Exploring Other Perspectives

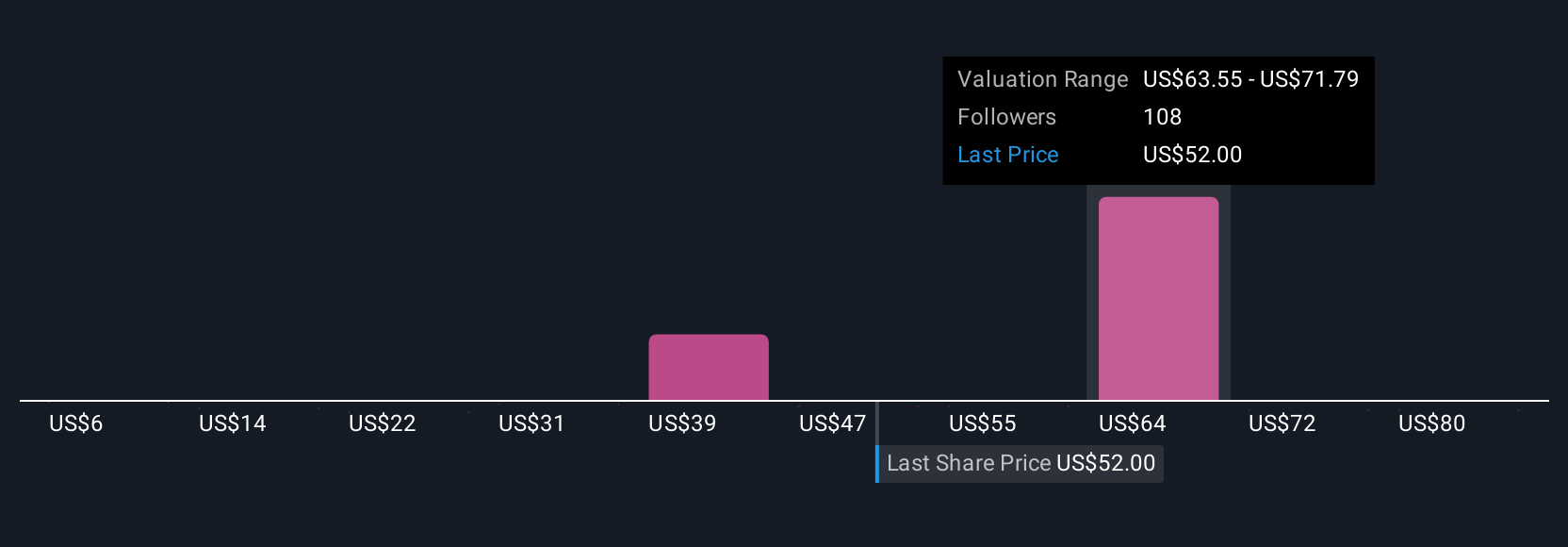

Simply Wall St Community members provided 37 different fair value estimates for Nebius, ranging from US$9.17 to US$333.76 per share. With aggressive growth targets driving financing activity, your perspective on the company’s capital and expansion risk may shape how you interpret these contrasting opinions.

Explore 37 other fair value estimates on Nebius Group - why the stock might be worth less than half the current price!

Build Your Own Nebius Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nebius Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Nebius Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nebius Group's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nebius Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIS

Nebius Group

A technology company, engages in building full-stack infrastructure to service the global AI industry in the Netherlands, Europe, North America, and Israel.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives