- United States

- /

- Software

- /

- NasdaqGS:MTLS

Statutory Profit Doesn't Reflect How Good Materialise's (NASDAQ:MTLS) Earnings Are

When companies post strong earnings, the stock generally performs well, just like Materialise NV's (NASDAQ:MTLS) stock has recently. Our analysis found some more factors that we think are good for shareholders.

See our latest analysis for Materialise

Examining Cashflow Against Materialise's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

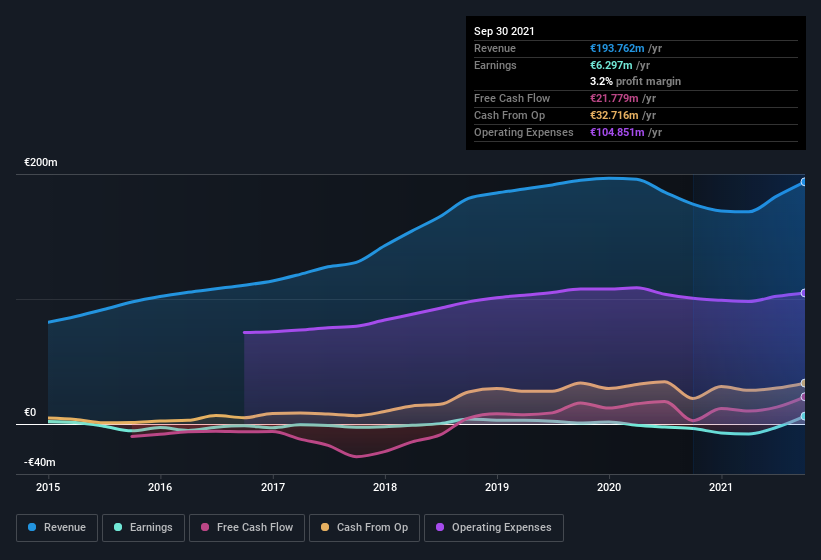

For the year to September 2021, Materialise had an accrual ratio of -0.12. That implies it has good cash conversion, and implies that its free cash flow solidly exceeded its profit last year. Indeed, in the last twelve months it reported free cash flow of €22m, well over the €6.30m it reported in profit. Materialise's free cash flow improved over the last year, which is generally good to see. However, that's not the end of the story. We must also consider the impact of unusual items on statutory profit (and thus the accrual ratio), as well as note the ramifications of the company issuing new shares.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Materialise issued 11% more new shares over the last year. That means its earnings are split among a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out Materialise's historical EPS growth by clicking on this link.

How Is Dilution Impacting Materialise's Earnings Per Share? (EPS)

We don't have any data on the company's profits from three years ago. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, if Materialise's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

How Do Unusual Items Influence Profit?

Materialise's profit was reduced by unusual items worth €3.9m in the last twelve months, and this helped it produce high cash conversion, as reflected by its unusual items. This is what you'd expect to see where a company has a non-cash charge reducing paper profits. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. In the twelve months to September 2021, Materialise had a big unusual items expense. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

Our Take On Materialise's Profit Performance

In conclusion, both Materialise's accrual ratio and its unusual items suggest that its statutory earnings are probably reasonably conservative, but the dilution means that per-share performance is weaker than the statutory profit numbers imply. Looking at all these factors, we'd say that Materialise's underlying earnings power is at least as good as the statutory numbers would make it seem. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For example, we've discovered 4 warning signs that you should run your eye over to get a better picture of Materialise.

After our examination into the nature of Materialise's profit, we've come away optimistic for the company. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:MTLS

Materialise

Provides additive manufacturing and medical software tools, and 3D printing services in the Americas, Europe, Africa, and the Asia-Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Kratos Defense & Security Solutions (KTOS): Scaling "Attritable" Dominance in a New Era of Aerial Conflict.

BWX Technologies (BWXT): Powering the Nuclear Renaissance from Naval Depths to Medical Frontiers.

Merck & Co. (MRK): Scaling the "Post-Keytruda Hill" Through Diversified Blockbusters.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks