- United States

- /

- Software

- /

- NasdaqGS:MSTR

MicroStrategy (MSTR) Is Up 7.7% After Crypto Tax Relief Eases Balance Sheet Risk – What's Changed

Reviewed by Sasha Jovanovic

- The U.S. Treasury and IRS issued interim guidance allowing large C Corporations like Strategy (MSTR) to exclude unrealized cryptocurrency gains when calculating liability under the 15% corporate alternative minimum tax.

- This decision removes a significant financial overhang for firms with substantial digital asset holdings, reducing the risk of forced asset sales to cover potential tax bills and providing more stability for such companies' corporate treasury approaches.

- We'll explore how this relief from unrealized crypto tax exposure shapes Strategy's investment narrative by mitigating a major balance sheet risk.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Strategy's Investment Narrative?

For those considering Strategy Inc., the investment story has always required conviction in the enduring relevance of both Bitcoin and the company's aggressive treasury allocation approach. The recent IRS and Treasury guidance exempting unrealized crypto gains from the 15% corporate alternative minimum tax is a gamechanger, directly addressing what was arguably the most significant near-term financial risk to Strategy: the possibility of massive tax liability forcing the sale of digital assets. This decision appears to reset the short-term risk profile, potentially shifting attention to execution of its core business model, preferred stock dividend sustainability, and legal matters such as the ongoing class action lawsuit. Share price momentum has started to return, but it’s this reduction in balance sheet uncertainty that stands out as the key near-term catalyst, while raising new questions about what comes next for corporate Bitcoin strategies as regulations continue to evolve.

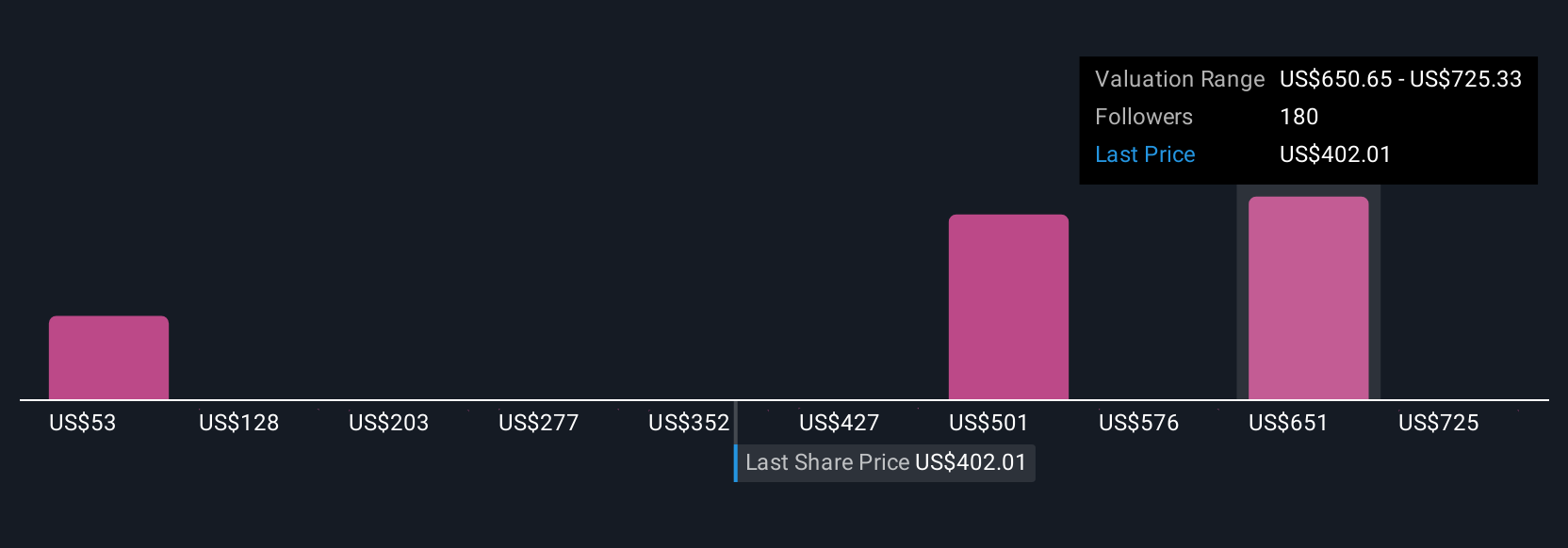

But while tax risk has faded, legal challenges may not be so easily resolved. Our valuation report here indicates Strategy may be undervalued.Exploring Other Perspectives

Explore 17 other fair value estimates on Strategy - why the stock might be worth less than half the current price!

Build Your Own Strategy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Strategy research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Strategy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Strategy's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSTR

Strategy

Operates as a bitcoin treasury company in the United States, Europe, the Middle East, Africa, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026