- United States

- /

- Software

- /

- NasdaqGS:MSTR

MicroStrategy (NasdaqGS:MSTR) Shares Surge 24% Following US$1.24 Dividend Announcement

Reviewed by Simply Wall St

MicroStrategy (NasdaqGS:MSTR) announced a quarterly cash dividend of $1.24 per share on its 8.00% Series A Perpetual Strike Preferred Stock, which will be paid on March 31, 2025. This dividend announcement is a key event that coincided with a notable increase in MicroStrategy's share price, which rose 24% over the last week. This sharp rise came amidst a mixed market performance where the S&P 500 and Nasdaq experienced declines in four of the past six weeks, reflecting economic uncertainty and tariff concerns. While broader market indices like the Dow Jones and Nasdaq struggled to rebound from a month-long slump, the positive sentiment surrounding MicroStrategy's dividend announcement seemed to have provided a boost to its stock price. Meanwhile, the tech-heavy Nasdaq saw losses, with popular stocks like Tesla and Nvidia declining, further highlighting the contrast in MicroStrategy's strong market performance during this period.

The past five years have witnessed remarkable growth for MicroStrategy's shares, with a total return of over 2800%. This performance sets MicroStrategy apart, given its outperformance of the broader US market's 9% return over the past year. A significant factor in this period has been MicroStrategy's alignment with Bitcoin; as a member of initiatives like Bitcoin for Corporations, the company has attracted attention for its commitment to integrating digital currencies within its operations. Furthermore, the release of AI-enhanced products such as MicroStrategy ONE and its availability on AWS Marketplace expanded its digital footprint, potentially contributing to its long-term share price appreciation.

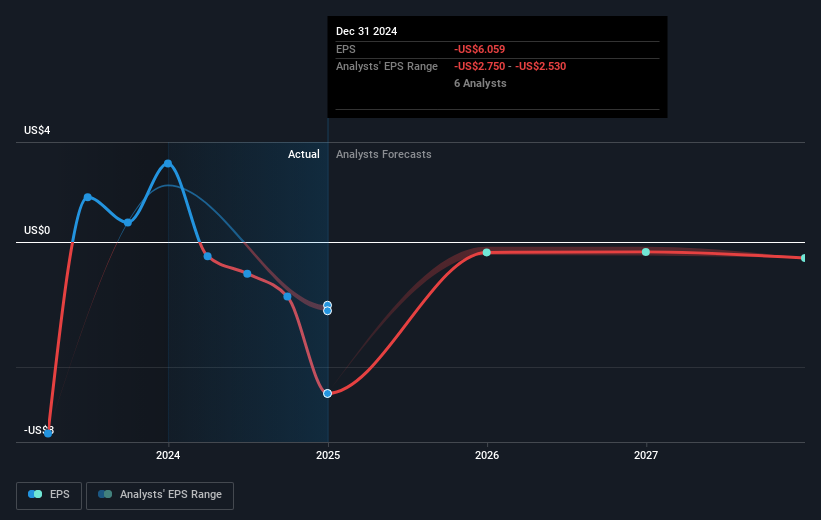

In addition, the partnership with Microsoft in June 2023 to enhance integration with Azure has likely bolstered MicroStrategy's analytics capabilities, appealing to enterprise clients. Despite these innovations, it's important to note the company's financial challenges, including substantial losses over recent quarters, highlighting the volatility that has accompanied its growth journey. As MicroStrategy navigates these developments, they illustrate the complex factors influencing its long-term performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade MicroStrategy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSTR

MicroStrategy

Provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally.

Moderate growth potential low.