- United States

- /

- Software

- /

- NasdaqGS:MSTR

MicroStrategy (NasdaqGS:MSTR) Launches US$4 Billion Preferred Stock Follow-On Offering

Reviewed by Simply Wall St

MicroStrategy (NasdaqGS:MSTR) saw a significant price move of 70% over the last quarter. This surge comes amidst a series of developments, notably the follow-on equity offering of $4.2 billion in preferred stock. Although the market itself showed strength as the S&P 500 and Nasdaq reached record highs, other events likely influenced MicroStrategy's performance. These include its addition to the Russell Top 200 Indexes and the launch of AI-focused product Strategy Mosaic™. Meanwhile, broader tech sector trends were mixed, with some stocks experiencing losses amidst potential geopolitical concerns, which may have also affected investor sentiment.

Every company has risks, and we've spotted 1 warning sign for MicroStrategy you should know about.

MicroStrategy's total shareholder return over the past five years was very large, reflecting remarkable performance. This significant long-term return contrasts with recent market trends, as the company showed superior performance by exceeding the US Market and the Software industry over the past year. Despite geopolitical influences affecting broader sentiment, MicroStrategy's inclusion in the Russell Top 200 Index and the launch of its AI product, Strategy Mosaic™, mark critical developments potentially influencing future prospects.

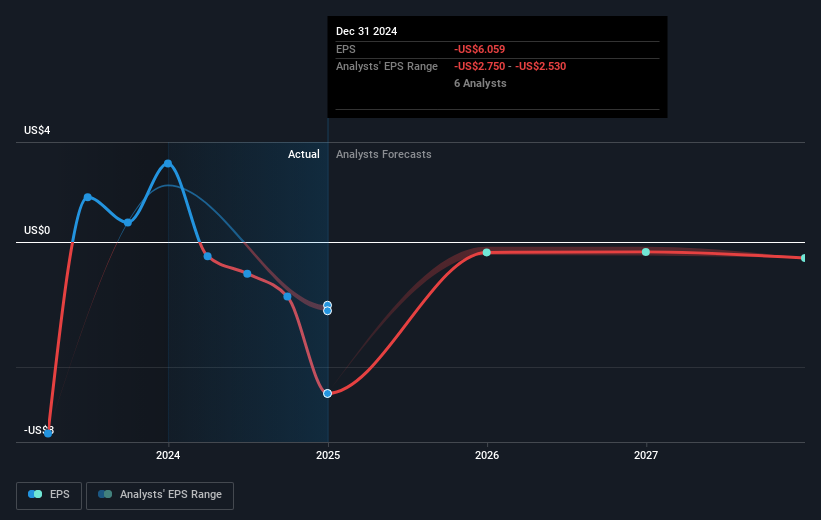

The 70% share price surge over the last quarter puts the current price in context with consensus analyst price targets, which are over 20% higher than current levels. This suggests market optimism about future growth, though analysts are not in a statistically confident range of agreement. The effect of recent equity offerings and the substantial $4.22 billion net loss reported in Q1 2025 may impact the company's revenue and earnings forecasts. Investors will be keenly observing whether these initiatives will translate into sustainable long-term profitability and whether upcoming earnings growth aligns with or diverges from current industry trends.

Our expertly prepared valuation report MicroStrategy implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSTR

MicroStrategy

Provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives