- United States

- /

- Software

- /

- NasdaqGS:MSTR

MicroStrategy (NasdaqGS:MSTR) Launches AI-Powered Data Solutions With Mosaic And Auto 2.0

Reviewed by Simply Wall St

MicroStrategy (NasdaqGS:MSTR) has experienced a notable 31% increase in its share price over the past month. Some significant factors during this period include the launch of new AI-driven data management and analytics solutions, enhancing the company's position in the evolving tech landscape. However, despite these product advancements, the company's substantial net loss reported for Q1 2025 and Follow-on Equity Offering contrasted with broad market movements. While the market was mixed with concerns over future Fed interest rate decisions and tariff discussions, MicroStrategy's positive price move reflects investor optimism potentially influenced by its strategic product developments in the AI sector.

Find companies with promising cash flow potential yet trading below their fair value.

Over the past five years, MicroStrategy has delivered a very large total shareholder return of over 3000%. This performance, however, contrasts with the company's recent standing against the market, where it exceeded both the US market and software industry returns of 7.2% and 14% respectively over the past year.

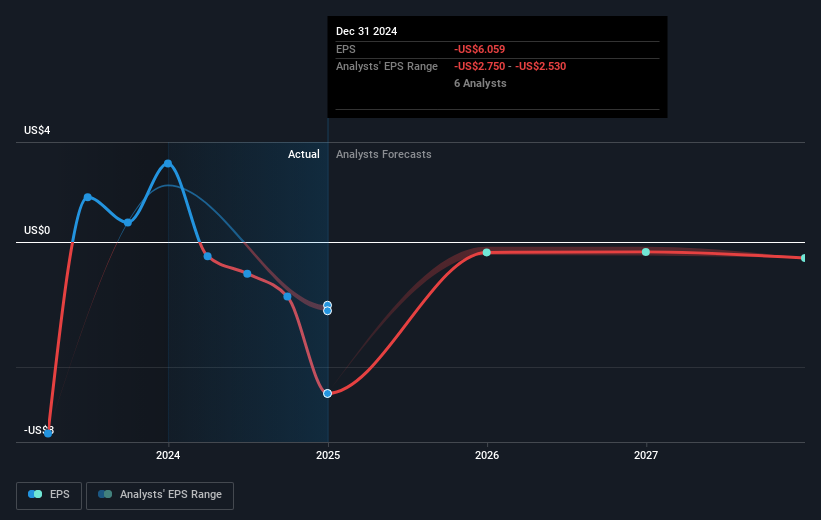

The developments highlighted in the introduction, such as AI-driven product launches, may influence future revenue streams and potentially improve the company’s earnings forecasts. Despite these advancements, the Q1 2025 net loss remains a critical factor that could impact investor confidence. The substantial Follow-on Equity Offering highlights an effort to bolster its financial position, yet it remains essential to monitor how these elements collectively shape earnings projections moving forward.

MicroStrategy's recent share price movement, while optimistic, is set against a consensus analyst price target of US$502.79, suggesting room for growth. It remains important for investors to consider these dynamics in light of the company's revenue performance and broader market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSTR

MicroStrategy

Provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives