- United States

- /

- Software

- /

- NasdaqGS:MSTR

MicroStrategy (NasdaqGS:MSTR) Launches $21 Billion Equity Offering Amid Q1 Losses

Reviewed by Simply Wall St

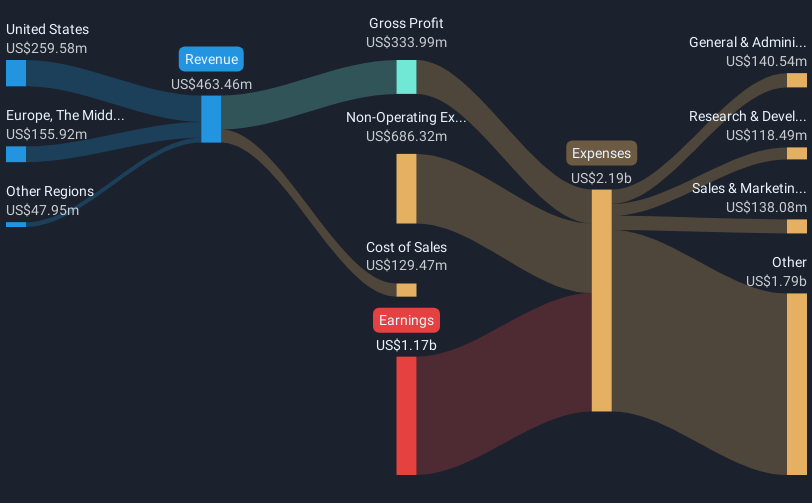

MicroStrategy (NasdaqGS:MSTR) recently announced a $21 billion follow-on equity offering and reported challenging first-quarter earnings with a revenue drop and an expanded net loss. Despite the negative financial performance, the company's stock saw a significant 25% price increase over the past month, aligning with the broader market's upward trend. The S&P 500 and Nasdaq have been buoyed by solid overall earnings and improved investor sentiment amid positive economic indicators, such as strong jobs data and the prospect of U.S.-China tariff talks. MicroStrategy's announcements may have added weight to this positive market momentum.

MicroStrategy's shareholders have seen a very large total return of 2990.38% over the past five years, reflecting a remarkable long-term performance despite the company's recent challenges. In the past year, MicroStrategy has outperformed the US software industry, which returned 15%, and the broader US market's 9.5%, highlighting the stock's resilience and investor interest.

The company's recent $21 billion follow-on equity offering and weak quarterly financial results might influence future revenue and earnings forecasts, suggesting potential investor concerns about future growth and profitability. The substantial share price increase, amidst this backdrop, brings it closer to the consensus analyst target of US$487.44, yet remains at a 27.73% discount indicating market optimism tempered by current valuation levels.

Our valuation report here indicates MicroStrategy may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSTR

MicroStrategy

Provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives