- United States

- /

- Software

- /

- NasdaqGS:MSTR

MicroStrategy (MSTR) Announces $4.2 Billion Equity Offering

Reviewed by Simply Wall St

MicroStrategy (MSTR) recently announced a $4.2 billion follow-on equity offering and added Peter L. Briger, Jr. to its Board. These corporate maneuvers and a 45% price increase could reflect a positive response to its product innovations such as Strategy Mosaic and index reclassification to the Russell Top 200 indexes. Although the broader market was flat recently, a market increase of 11% over the past year may have supported MSTR's rise while legal challenges, including a class action lawsuit regarding bitcoin investments, could have added complexity to its trajectory.

MicroStrategy has 1 weakness we think you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the past five years, MicroStrategy (MSTR) shares exhibited a very large total return of 3642.59%, reflecting impressive long-term appreciation. In the last year, MSTR outperformed the US software industry, which achieved a 19.2% return, and also exceeded the 11.4% return of the broader US market. This notable performance highlights strong market interest, potentially driven by strategic initiatives such as new product innovations and board changes.

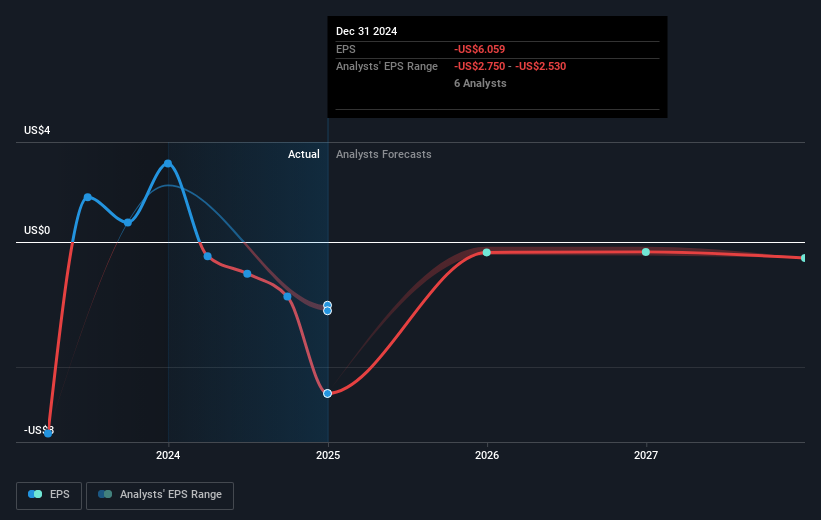

The recent 45% price surge suggests investor optimism towards MicroStrategy's recent announcements and may influence revenue and earnings forecasts positively, factoring in the introduction of Strategy Mosaic and the company's entry into the Russell Top 200 Index. Furthermore, despite recent corporate and legal challenges, such as the class action lawsuit regarding bitcoin investments, investor attention remains fixed on growth potential. Currently, MSTR's share price of US$451.02 is below the consensus analyst price target of approximately US$536.71, indicating a potential upside of around 19% from its current value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSTR

MicroStrategy

Provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives