- United States

- /

- Software

- /

- NasdaqGS:MSFT

Why Stable Tech Like Microsoft (NASDAQ:MSFT) may be a Favorite in this Earnings Season

Summary:

- MSFT has an effective payout ratio of 61% from dividends and stock buybacks.

- Expected to continue both earnings and revenue growth at 12% annually.

- Price targets indicate a 27% upside potential, this may decline on a possible earnings miss, but likely not by much.

While Microsoft Corporation (NASDAQ:MSFT) declined by 22% since January, we notice that both the fundamentals and price targets are holding firm for the company. In this article, we will re-cap the key metrics, and see what this can mean for the price in the future.

Microsoft's Fundamentals

Microsoft is a great company on many fronts. The company has a gross margin of 68.8%, and an impressive net margin of 37.6% which leaves it with a twelve-month net income of $72.5b. This gives investors a $9.69 EPS which represents a 3.7% yield on earnings. This is a pretty attractive yield for a large company such as Microsoft.

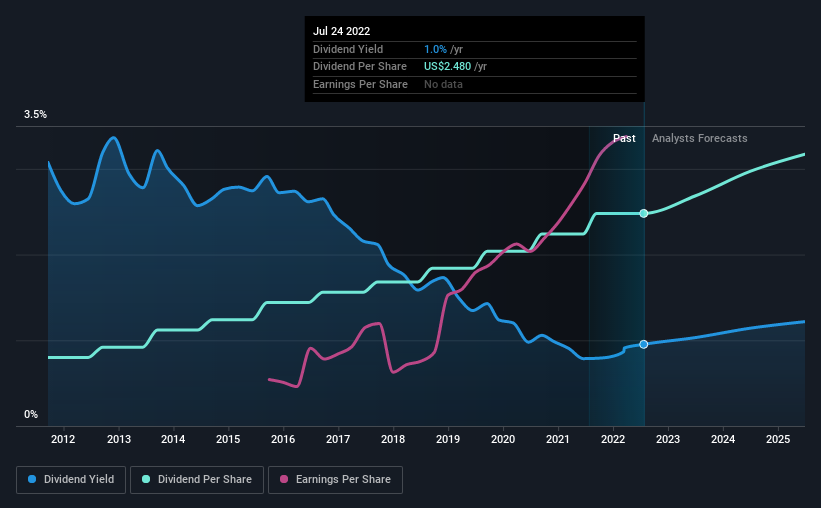

Out of this 3.7% yield, about 25% is paid as a dividend to shareholders, giving them a dividend yield of 1%. The company has also bought back $26.4b of their stock, which lifts the effective return for investors to 2.3% or a 61.5% payout from the net income. This shows that the company is dedicating a good portion of its income to shareholders, which is partly why investors are willing to stick with it for such a long time.

We can also look at the comparison between the rising EPS and dividend payments to investors and get a better sense of the performance of the company. It seems that investors have started giving Microsoft much more credit from 2017, as the then new CEO started revitalizing the mature company, indicating that they are still pricing-in a substantial amount of future growth.

Explore this interactive chart for our latest analysis on Microsoft!

Growth Potential

If you open our future growth section, you can see analysts expectations for earnings and revenue growth. Both are expected to grow around 12% annually. Growth is important for the current earnings season, as investors are hoping that the company meets targets and doesn't cut back on future guidance. For the upcoming earnings release, analysts are expecting quarterly revenue of $52.4b (TTM $198.6b) and EPS of $2.3 (TTM $9.7). The earnings are scheduled for this Tuesday after the market close, so you can put the company on your watchlist and get notified on significant changes.

It seems that Microsoft still has a lot of potential ahead, and at this pace the company is expected to reach $295.5b revenue and $105b net income by mid 2025. These estimates help us take a step back from current events, and look at the big picture for the company.

The Bottom Line

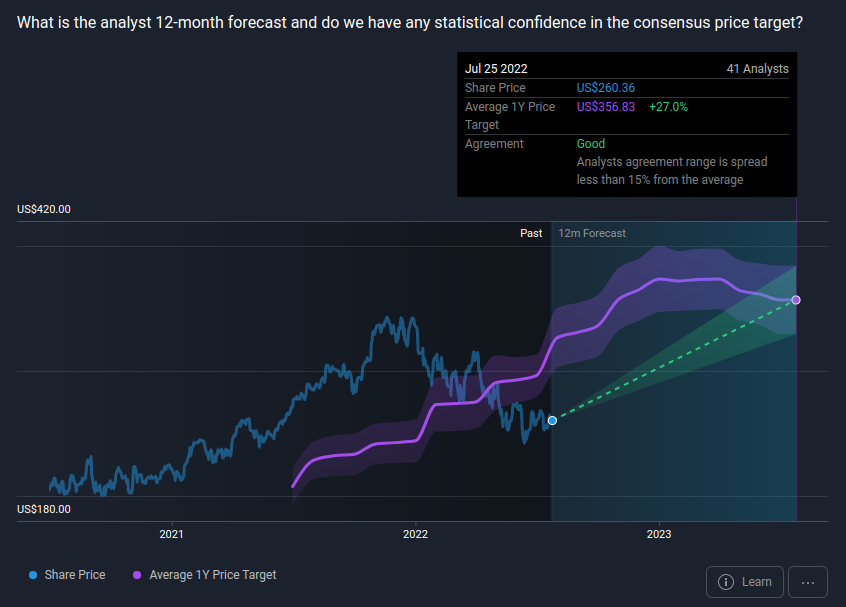

At the end of the day, investors need to know how all of this will reflect the stock price. For this purpose, we can use analysts' price targets which incorporate future earnings forecasts, and see what the stock might be worth today. Keep in mind that price targets are only one approach to assessing the potential of the stock, and future forecasts frequently change.

In the chart below, we see that analysts still hold the company in high regard, and have been consistently expecting a higher price level for Microsoft. This is reflecting the earnings capacity of the company, which analysts are good at predicting. However, we also see that Microsoft has underperformed relative to expectations, which may be in large part due to the changing price of risk (current market instability).

We can see that analysts have set the 1-Year price target at $357 for Microsoft, representing a potential 27% upside from yesterday's close. Up until 2022, the company has been trading ahead of price targets, and has only started to drift down in the last six months. Given that earnings expectations are still high, the company may still have significant upside, and should it miss on earnings day, the price target may decline, but presumably not by much.

In conclusion, the fundamentals, growth expectations and analysts' price targets display a positive picture for Microsoft's long-term stock performance, and investors can be better prepared for tomorrow's earnings call by keeping in-mind the larger picture for the company.

If you want to check out more analyses, we have put together a list of global stocks with a market capitalization above $1bn and yielding more 3%.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Quintessential serial acquirer

EU#1 - From German Startup to EU’s Biggest Company

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

The "Sleeping Giant" Stumbles, Then Wakes Up

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.