- United States

- /

- Software

- /

- NasdaqGS:MSFT

Microsoft (MSFT): Exploring Valuation After Recent Share Price Gains and Ongoing Tech Sector Shifts

Reviewed by Simply Wall St

Microsoft (MSFT) shares have edged slightly higher this week, keeping pace with broader technology trends. Investors are weighing the company’s steady performance and recent results in light of shifting sentiment across the sector, with a close eye on overall valuation.

See our latest analysis for Microsoft.

After a steady climb through much of 2024, Microsoft’s share price momentum has been reinforced recently, with a 1.37% gain over the past day and a year-to-date share price return of 21.88%. Add in a robust one-year total shareholder return of 23.63% and strong multi-year performance, and it’s clear the company’s longer-term growth story is still intact, even as investors reassess sector valuations and growth potential.

If you’re weighing where tech leadership and consistent growth intersect, consider broadening your search and discover See the full list for free.

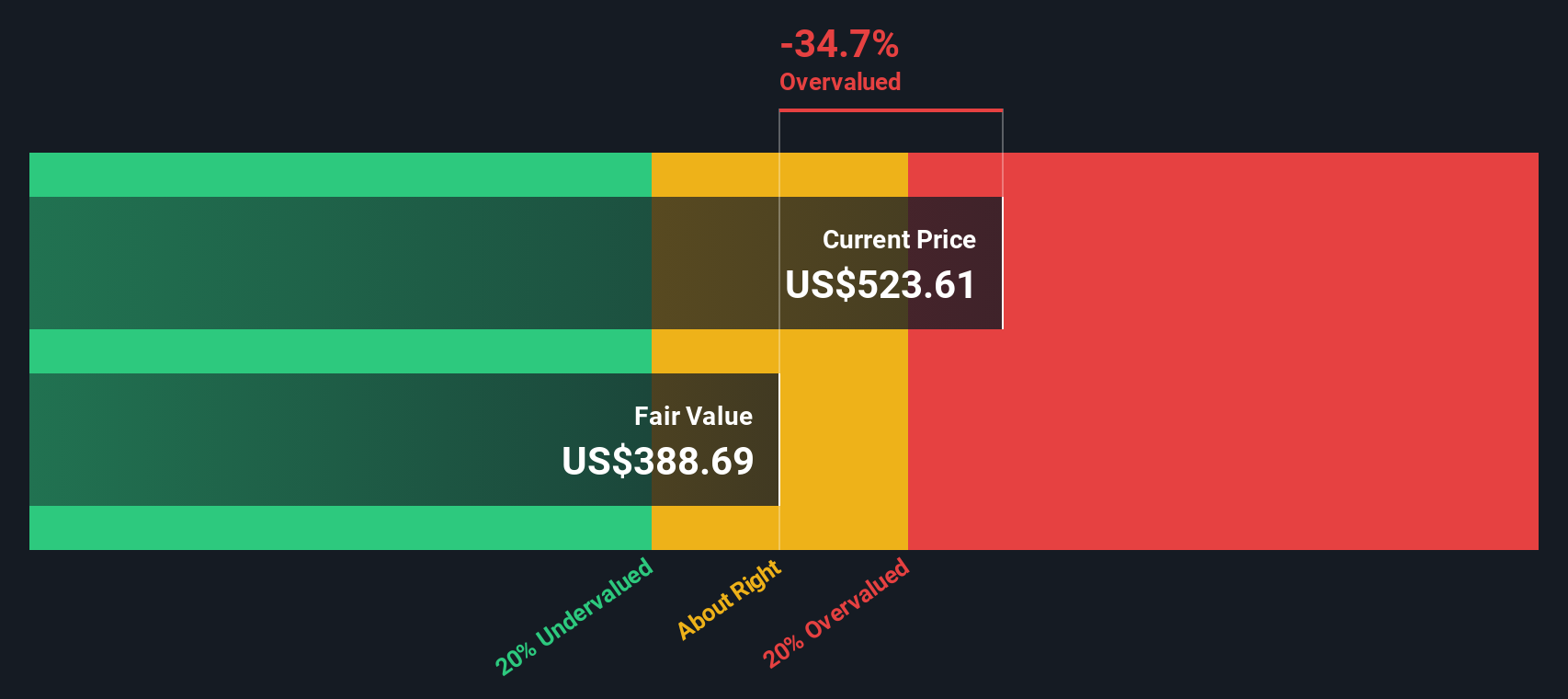

Strong performance and ambitious forecasts have pushed Microsoft’s valuation to new highs. With ongoing profit growth and analyst targets above current prices, is there still room for upside, or has future growth already been factored in?

Most Popular Narrative: 2% Overvalued

Microsoft’s share price recently surged above the fair value set by the most followed narrative. The result signals that current market optimism exceeds the narrative’s fair value calculation, raising questions about what drives that premium.

The world has been captivated by the artificial intelligence boom, and no company has ridden the wave of investor enthusiasm quite like Microsoft. Buoyed by its strategic partnership with OpenAI and the integration of AI across its product ecosystem, the company's valuation has soared to unprecedented heights. However, once the initial euphoria of the AI party subsides, a more sobering reality comes into focus.

What’s behind this bold estimate? Microsoft’s projected profit margins, ongoing capital investments, and the strength of its future product lineup all factor in. The narrative’s valuation hinges on just a handful of ambitious assumptions. Want to know which ones change the game? See how one calculation alters the outlook for the tech giant’s next phase.

Result: Fair Value of $500 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued success in Microsoft's AI initiatives or a turnaround in its gaming division could challenge the prevailing view of overvaluation.

Find out about the key risks to this Microsoft narrative.

Another View: Discounted Cash Flow Perspective

Taking a step back from narrative-driven valuations, our DCF model points to a different picture. It suggests Microsoft is currently trading about 16% below its fair value, which highlights a potential undervaluation compared to market sentiment. Could this more fundamental approach offer a hidden opportunity as projections shift?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Microsoft for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Microsoft Narrative

If these perspectives don't quite fit your view or you'd like to interpret the numbers in your way, try building your own narrative in just a few minutes. Do it your way

A great starting point for your Microsoft research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the next opportunity to pass you by. Smart investors use the Simply Wall Street Screener to discover strategies that others might overlook.

- Target reliable income streams and boost your portfolio with strong yield picks by starting with these 16 dividend stocks with yields > 3%.

- Capitalize on tomorrow’s breakthroughs by searching for promising innovators with these 26 AI penny stocks.

- Seize overlooked bargains and tap into hidden value when you use these 905 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices, and solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

The silent giant behind virtually every advanced chip powering AI, smartphones, and modern infrastructure.

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

Looking to be second time lucky with a game-changing new product

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026