- United States

- /

- Software

- /

- NasdaqGS:MNDY

monday.com (MNDY): A Fresh Look at Valuation After Strong Growth and New AI Feature Launches

Reviewed by Simply Wall St

Recent updates around monday.com (MNDY) highlight a series of positive developments. The company has reported accelerating annual recurring revenue and impressive customer growth, while new AI-driven features are attracting the attention of many investors.

See our latest analysis for monday.com.

After a stellar run-up last year, monday.com’s share price return has cooled, with a 3.37% gain in the past day but a 12.26% drop over the last month and a 16.78% decline year-to-date. Despite recent volatility, its three-year total shareholder return is a strong 75.01%, which suggests that long-term momentum is still very much intact.

If you’re following monday.com’s growth story, it’s a great moment to widen your search with See the full list for free.

With solid fundamentals and ambitious forecasts fueling optimism, investors are left to wonder whether monday.com is trading at a bargain relative to its growth outlook or if expectations are already fully reflected in its share price.

Most Popular Narrative: 28.6% Undervalued

With monday.com’s last close of $192.28, the most widely followed narrative places its fair value at a striking premium. The current price sits notably below what analysts consider justified, setting up a detailed story for long-term upside if key assumptions hold true.

Ongoing global shift toward digital transformation, remote/hybrid work, and rising SaaS adoption continues fueling strong demand for cloud-based productivity and collaboration platforms like monday.com, supporting high double-digit revenue growth and future ARR expansion.

Want to know what’s powering this premium price target? This narrative leans on bold forecasts about future profits and margin expansion, assumptions usually reserved for the fastest-growing tech titans. There’s a mix of rapid revenue scaling and high expectations driving this number. Curious which financial levers analysts are betting on to justify monday.com’s current valuation story? Dive in to uncover the momentum behind these projections.

Result: Fair Value of $269.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as slower customer additions among SMBs and increased competition from workflow startups could challenge monday.com's high-growth outlook.

Find out about the key risks to this monday.com narrative.

Another View: Price Multiples Tell a Different Story

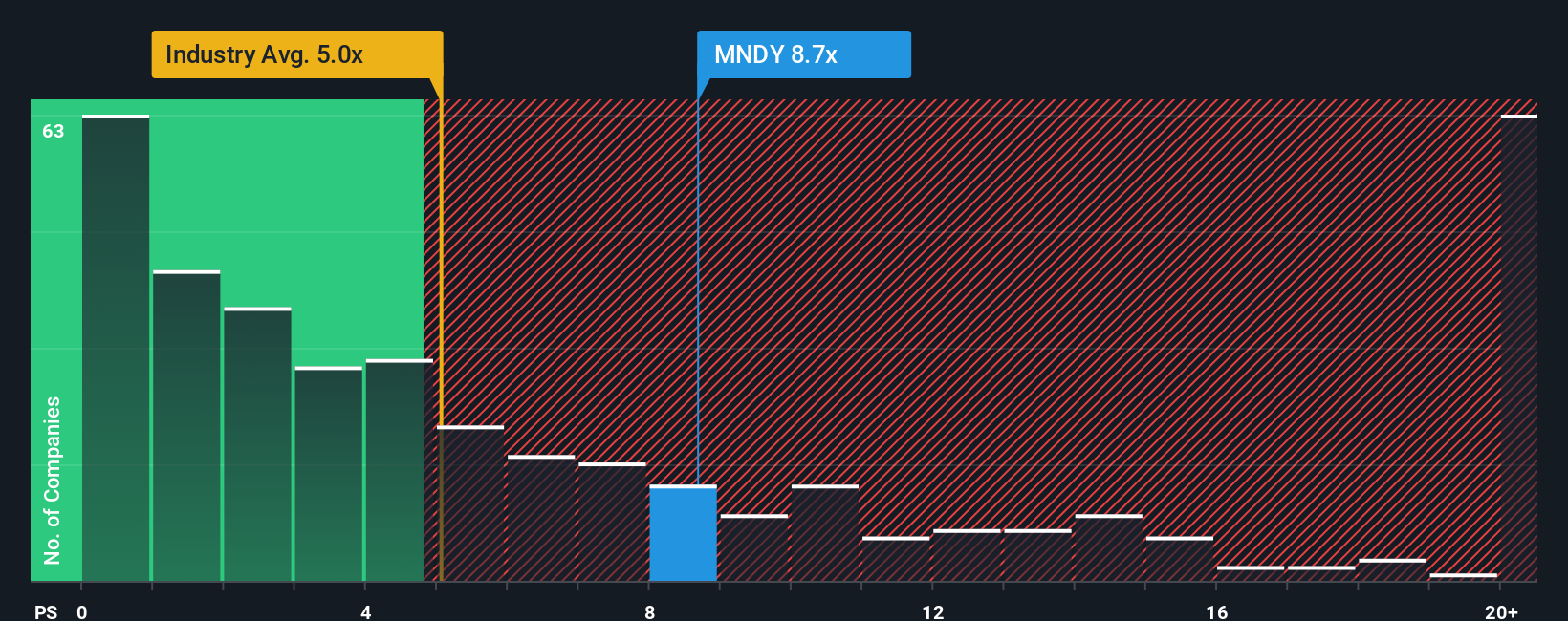

Looking at price-to-sales, monday.com trades at 9 times sales, which is higher than its US Software industry peers averaging 5.3 times and above the peer group at 7.3 times. However, compared to its fair ratio of 12 times, there could still be room for upside if you believe growth can deliver. Does this premium signal opportunity, or does it highlight valuation risk in the current environment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own monday.com Narrative

If you want to dig deeper or put a different spin on the numbers, it's easy to craft your own perspective with just a few clicks: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding monday.com.

Looking for more smart investment opportunities?

Don't let your next winning stock slip past you. The best ideas often emerge where others aren't looking, so put Simply Wall Street’s Screeners to work for you today.

- Spot high yields and future income potential by checking out these 17 dividend stocks with yields > 3% with strong dividend returns above 3%.

- Explore the promise of revolutionary breakthroughs and growth with these 27 quantum computing stocks, which is shaping tomorrow’s quantum landscape.

- Find tomorrow’s most undervalued prospects based on solid cash flows before the crowd wakes up by using these 879 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNDY

monday.com

Develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion