- United States

- /

- Software

- /

- NasdaqGS:MNDY

Is monday.com (MNDY) Share Weakness Creating A Potential Value Opportunity?

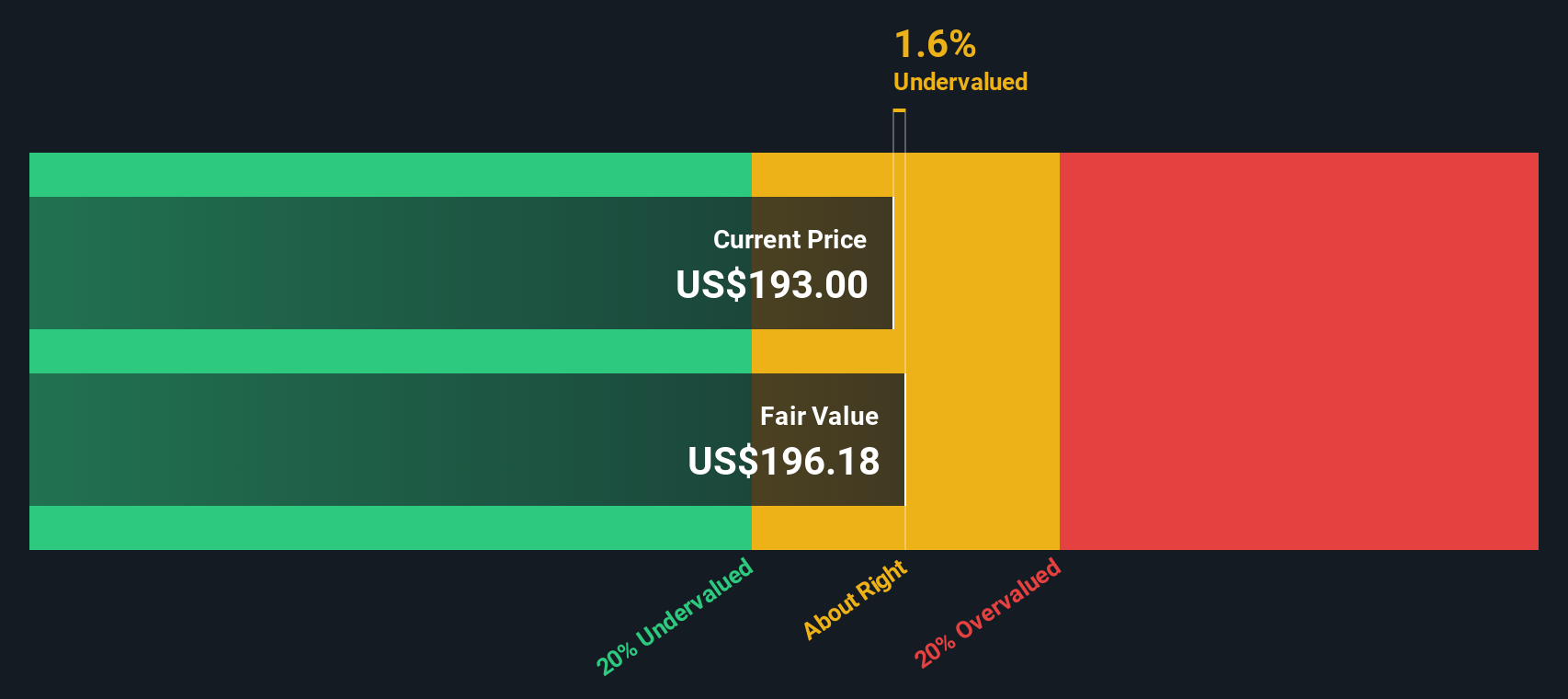

- If you are wondering whether monday.com shares are priced attractively today, the key question is how that current price stacks up against the company’s underlying fundamentals.

- The stock recently closed at US$129.32, with returns of 2.1% over the last 7 days, an 11.5% decline over the last 30 days, a 9.8% decline year to date, and a 47.9% decline over the past year. This performance may signal shifting expectations around its risk and reward profile.

- Recent coverage has focused on monday.com as a work management platform in a competitive software market, with attention on how its product adoption and customer base trends might justify its current price. This broader context helps explain why the share price has seen both shorter term resilience and longer term weakness.

- On Simply Wall St’s valuation checks, monday.com scores 3 out of 6. Next we will look at how different valuation approaches line up on the stock, and then finish with a framework that can give you an even clearer picture of value over time.

Find out why monday.com's -47.9% return over the last year is lagging behind its peers.

Approach 1: monday.com Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company could be worth today by projecting its future cash flows and then discounting those back to a present value.

For monday.com, the model used is a 2 Stage Free Cash Flow to Equity approach, based on cash flow projections in US$. The latest twelve month free cash flow is about $331.0 million. Analyst inputs cover the earlier years, and Simply Wall St then extrapolates further out to build a full 10 year path, including a projected free cash flow of $813.1 million in 2030. Each of these future cash flows is discounted back to today and added together.

On this basis, the DCF model arrives at an estimated intrinsic value of about $206.59 per share. Compared with the recent share price of $129.32, this implies the stock is trading at a 37.4% discount to that DCF estimate. This points to monday.com being undervalued on this cash flow view.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests monday.com is undervalued by 37.4%. Track this in your watchlist or portfolio, or discover 864 more undervalued stocks based on cash flows.

Approach 2: monday.com Price vs Earnings

For profitable companies, the P/E ratio is a useful way to think about what you are paying for each dollar of current earnings. This makes it a common anchor when you are comparing listed businesses.

In simple terms, higher growth expectations and lower perceived risk usually justify a higher P/E ratio. More modest growth or higher risk typically line up with a lower, more conservative multiple. So the question is not just whether a P/E looks high or low, but whether it fits the company’s profile.

monday.com currently trades on a P/E of 102.48x. That sits well above the Software industry average of 30.51x and the peer group average of 37.53x. Simply Wall St’s Fair Ratio for monday.com is 43.53x, which is its own view of what a more appropriate P/E might look like after accounting for factors such as earnings growth, profit margins, industry, market cap and company specific risks.

This Fair Ratio is more tailored than a simple industry or peer comparison because it adjusts for those business characteristics rather than assuming one size fits all. Set against the current P/E of 102.48x, the Fair Ratio of 43.53x suggests the shares are pricing in a richer earnings multiple than this framework would indicate.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1429 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your monday.com Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of monday.com’s story with the numbers behind it.

A Narrative is your own explanation of what you think is happening at the company, tied directly to your assumptions for future revenue, earnings and margins, and then to your estimate of fair value.

On Simply Wall St, Narratives sit inside the Community page, where millions of investors can build and share these story plus forecast views in an accessible format that updates automatically when fresh information, like news or earnings, is added to the platform.

By comparing each Narrative’s Fair Value with the current Price, you can quickly see whether your view suggests monday.com is priced above or below what you think it is worth. This can help guide your own decisions about when to buy or sell. For example, you might see one Narrative for monday.com that assumes very optimistic growth and a high fair value, while another assumes more cautious growth and a lower fair value, giving you a clear sense of the range of views in the market.

Do you think there's more to the story for monday.com? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNDY

monday.com

Develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

The global leader in cash handling

Wolters Kluwer - A Fundamental and Historical Valuation

METHODE ELECTRONICS (MEI): A Short Circuit or Just a Blown Fuse?

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!