- United States

- /

- Software

- /

- NasdaqGS:MGIC

Does Magic Software Enterprises (NASDAQ:MGIC) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Magic Software Enterprises Ltd. (NASDAQ:MGIC) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Magic Software Enterprises

What Is Magic Software Enterprises's Net Debt?

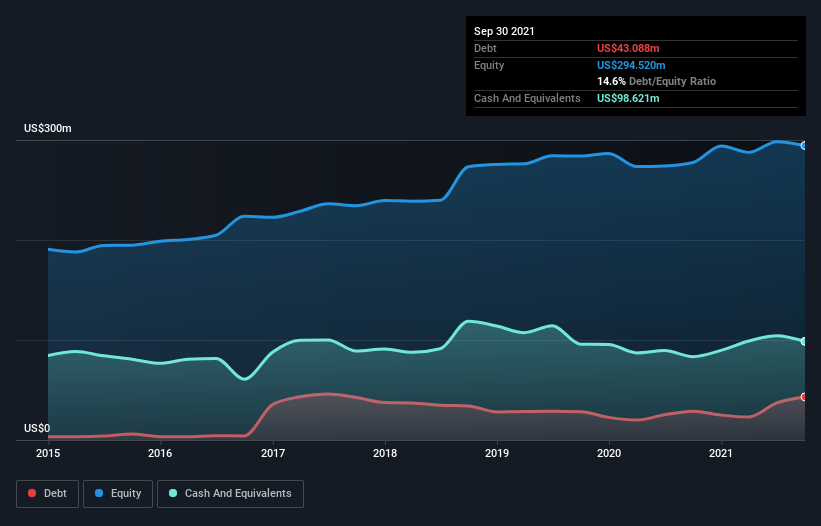

You can click the graphic below for the historical numbers, but it shows that as of September 2021 Magic Software Enterprises had US$43.1m of debt, an increase on US$28.8m, over one year. But on the other hand it also has US$98.6m in cash, leading to a US$55.5m net cash position.

How Healthy Is Magic Software Enterprises' Balance Sheet?

According to the last reported balance sheet, Magic Software Enterprises had liabilities of US$95.6m due within 12 months, and liabilities of US$80.9m due beyond 12 months. Offsetting this, it had US$98.6m in cash and US$134.2m in receivables that were due within 12 months. So it can boast US$56.3m more liquid assets than total liabilities.

This short term liquidity is a sign that Magic Software Enterprises could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Magic Software Enterprises boasts net cash, so it's fair to say it does not have a heavy debt load!

Also positive, Magic Software Enterprises grew its EBIT by 28% in the last year, and that should make it easier to pay down debt, going forward. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Magic Software Enterprises's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Magic Software Enterprises has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Magic Software Enterprises generated free cash flow amounting to a very robust 100% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Magic Software Enterprises has net cash of US$55.5m, as well as more liquid assets than liabilities. And it impressed us with free cash flow of US$41m, being 100% of its EBIT. So is Magic Software Enterprises's debt a risk? It doesn't seem so to us. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Magic Software Enterprises you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MGIC

Magic Software Enterprises

Provides proprietary application development, vertical software solutions, business process integration, information technologies (IT) outsourcing software services, and cloud-based services worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Nova Ljubljanska Banka d.d. future looks bright with a profit margin change of 38%

Viohalco S.A. (VIO.AT): Greece's Leading Integrated Metals Processor

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!