- United States

- /

- Pharma

- /

- NYSE:MRK

3 Dividend Stocks To Consider With Yields Up To 4.2%

Reviewed by Simply Wall St

As the U.S. stock market experiences volatility amid anticipation of new tariff announcements from President Trump, investors are keenly observing how these trade measures might impact economic growth and inflation. In such an uncertain environment, dividend stocks can offer a measure of stability and income through regular payouts, making them attractive options for those seeking to balance risk with potential returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.82% | ★★★★★★ |

| Douglas Dynamics (NYSE:PLOW) | 5.07% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.05% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.19% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.61% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.40% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.98% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.61% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.62% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.75% | ★★★★★★ |

Click here to see the full list of 159 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

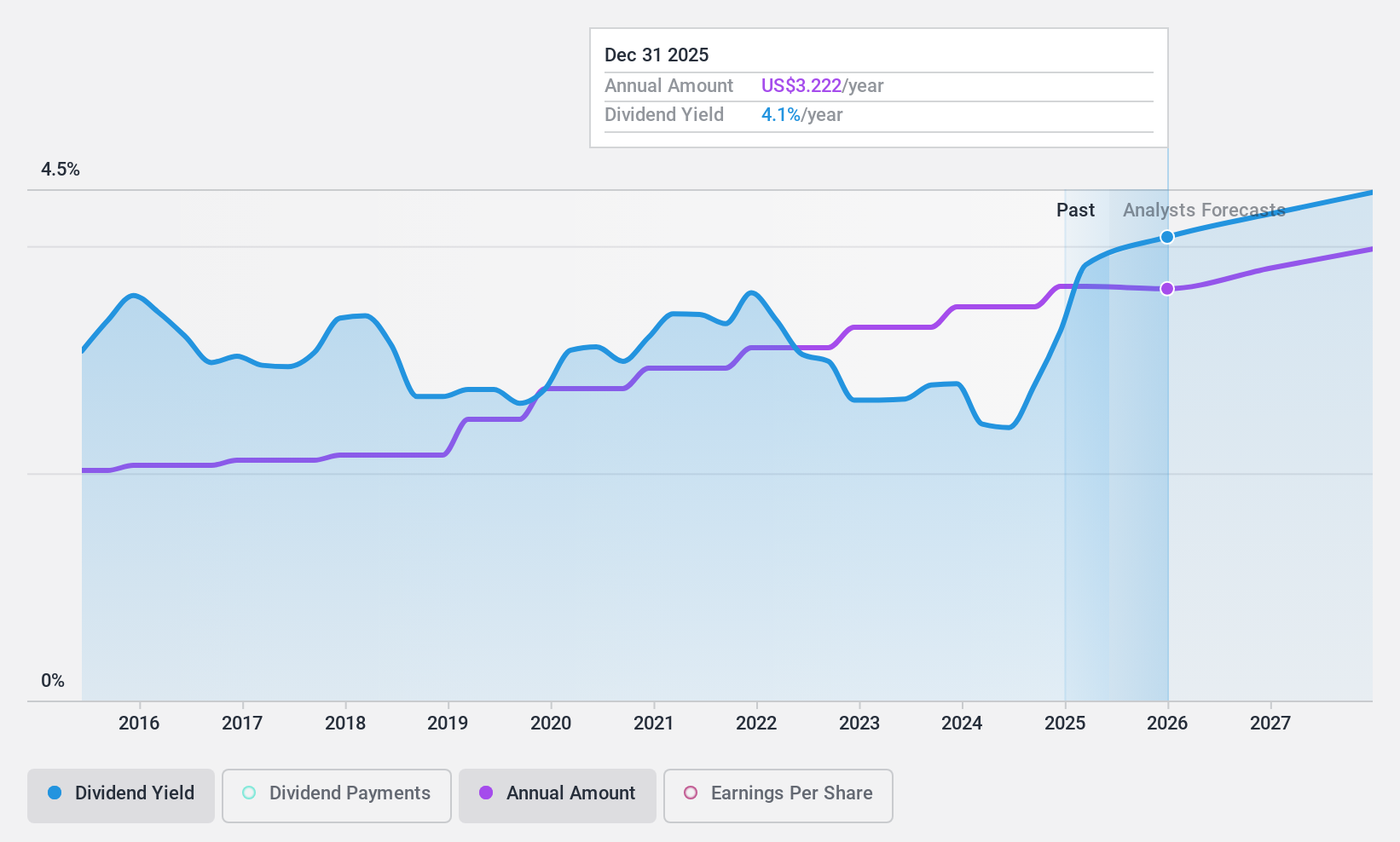

Magic Software Enterprises (NasdaqGS:MGIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Magic Software Enterprises Ltd. offers proprietary application development, vertical software solutions, business process integration, IT outsourcing software services, and cloud-based services both in Israel and internationally, with a market cap of $637.80 million.

Operations: Magic Software Enterprises Ltd. generates revenue through its proprietary application development, vertical software solutions, business process integration, IT outsourcing services, and cloud-based offerings across both domestic and international markets.

Dividend Yield: 4.2%

Magic Software Enterprises recently declared a semi-annual dividend of 32.7 cents per share, totaling $27.6 million for the year, covering 75% of its distributable profits. Despite a reasonable payout ratio and strong cash flow coverage, dividends have been volatile over the past decade. The company is trading at a good value compared to peers but faces an impending merger with Matrix I.T Ltd., potentially leading to delisting from NASDAQ and TASE.

- Take a closer look at Magic Software Enterprises' potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Magic Software Enterprises is priced lower than what may be justified by its financials.

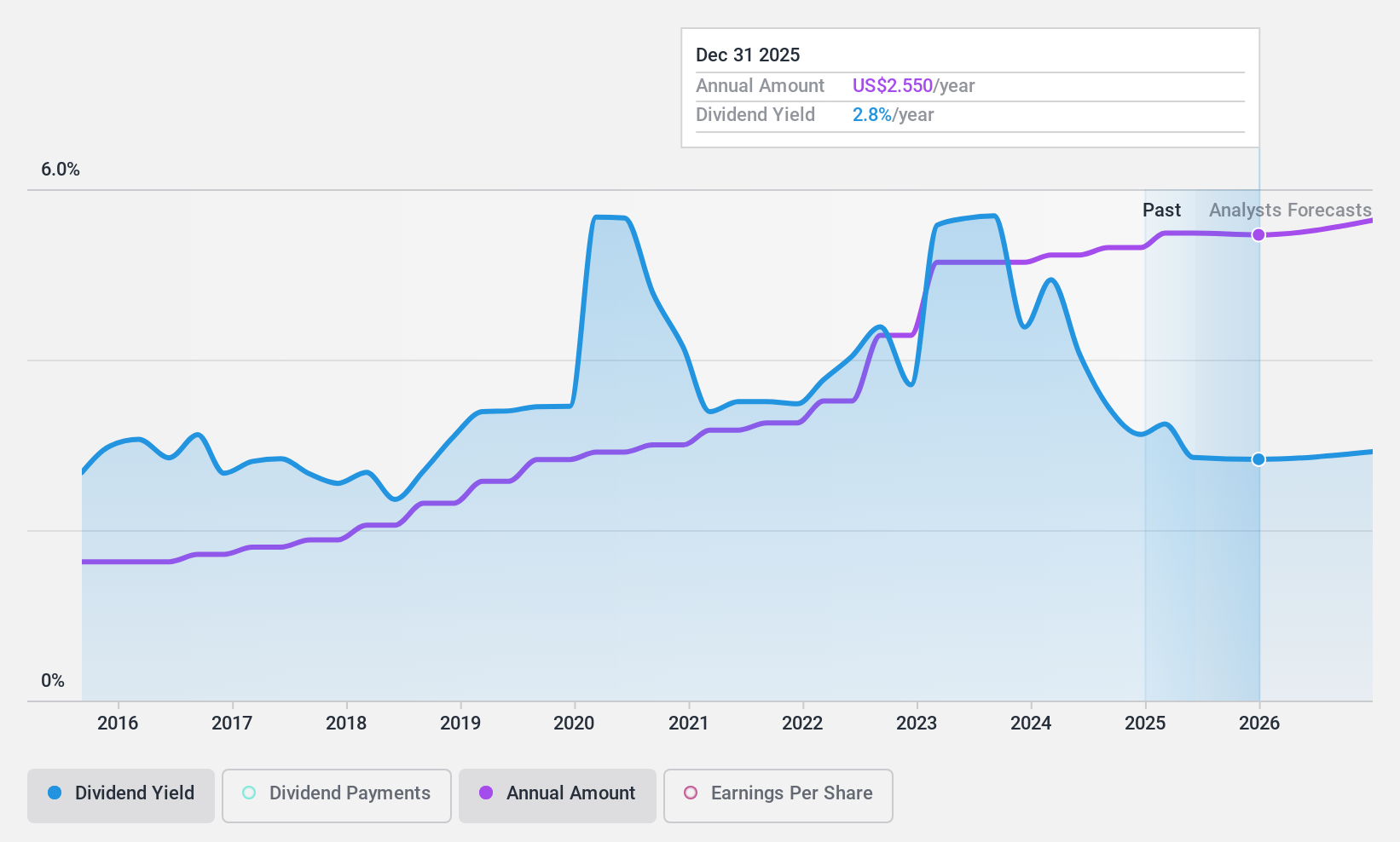

Northrim BanCorp (NasdaqGS:NRIM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Northrim BanCorp, Inc. is a bank holding company for Northrim Bank, offering commercial banking products and services to businesses and professionals, with a market cap of $404.24 million.

Operations: Northrim BanCorp's revenue segments include Specialty Finance ($6.81 million), Home Mortgage Lending ($34.34 million), and Community Banking excluding Specialty Finance ($110.79 million).

Dividend Yield: 3.5%

Northrim BanCorp's dividend payments have been stable and reliable over the past decade, with recent increases reflecting a growing trend. The payout ratio of 37.1% suggests dividends are well-covered by earnings, and future forecasts indicate continued coverage. Although its dividend yield of 3.46% is below the top tier in the U.S., earnings growth and trading at a significant discount to estimated fair value enhance its appeal as a dividend stock.

- Navigate through the intricacies of Northrim BanCorp with our comprehensive dividend report here.

- Our expertly prepared valuation report Northrim BanCorp implies its share price may be lower than expected.

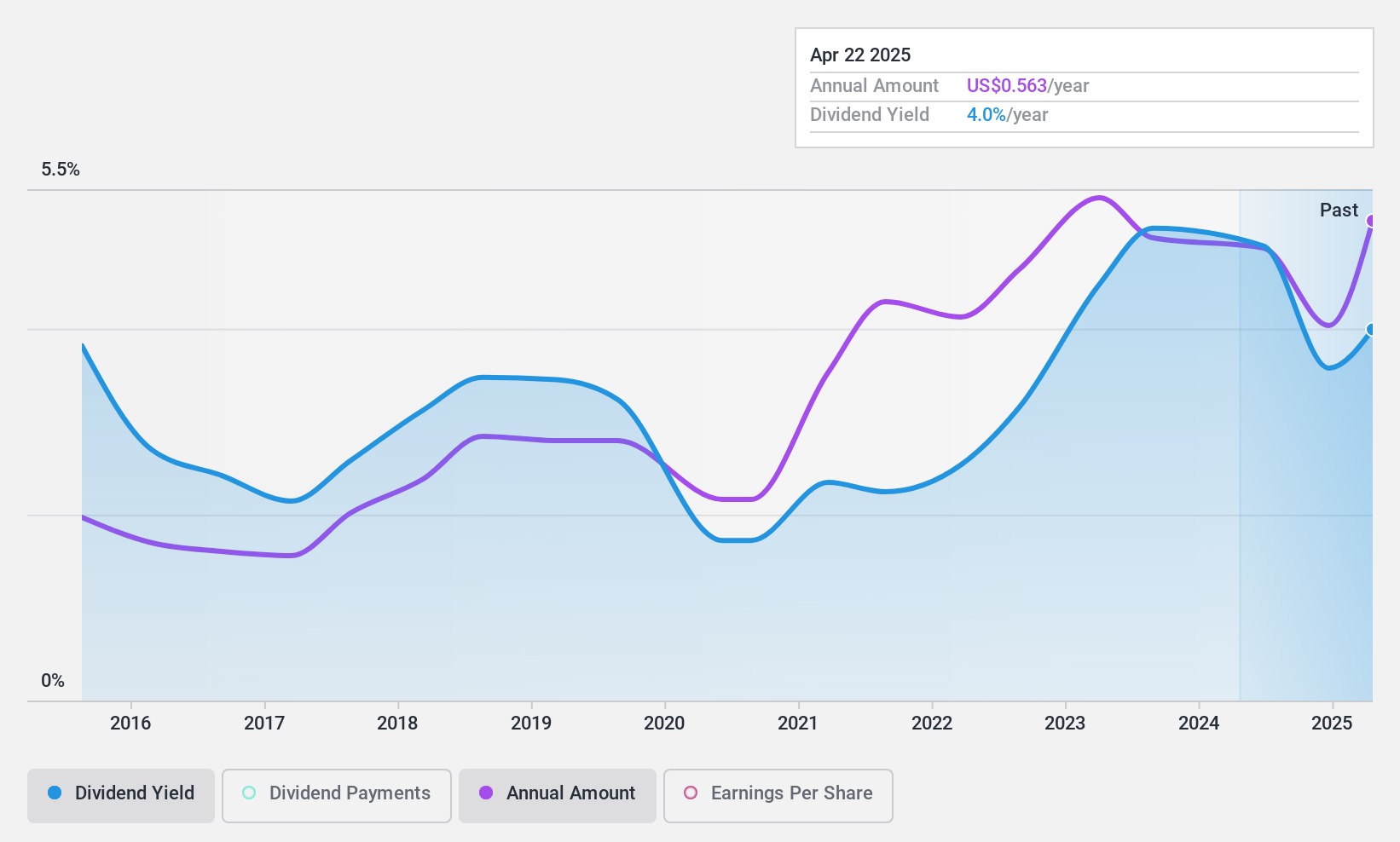

Merck (NYSE:MRK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Merck & Co., Inc. is a global healthcare company with operations spanning pharmaceuticals, vaccines, and animal health, and has a market cap of approximately $226.74 billion.

Operations: Merck & Co., Inc. generates revenue primarily from its Pharmaceutical segment, which accounts for $57.40 billion, and its Animal Health segment, contributing $5.88 billion.

Dividend Yield: 3.7%

Merck's dividend payments have been stable and reliable over the past decade, supported by a payout ratio of 45.6%, indicating dividends are well-covered by earnings. Despite a lower yield of 3.72% compared to top U.S. dividend payers, its consistent growth in dividends enhances its attractiveness for income investors. Recent developments include positive trial results for WINREVAIR and ongoing share repurchase programs, reflecting strong cash flow management which further supports Merck's ability to sustain its dividend payouts.

- Dive into the specifics of Merck here with our thorough dividend report.

- The analysis detailed in our Merck valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Navigate through the entire inventory of 159 Top US Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRK

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion