- United States

- /

- IT

- /

- NasdaqGM:MDB

MongoDB (MDB): Evaluating Valuation as Earnings Loom and New AI Initiatives Shape Market Sentiment

Reviewed by Simply Wall St

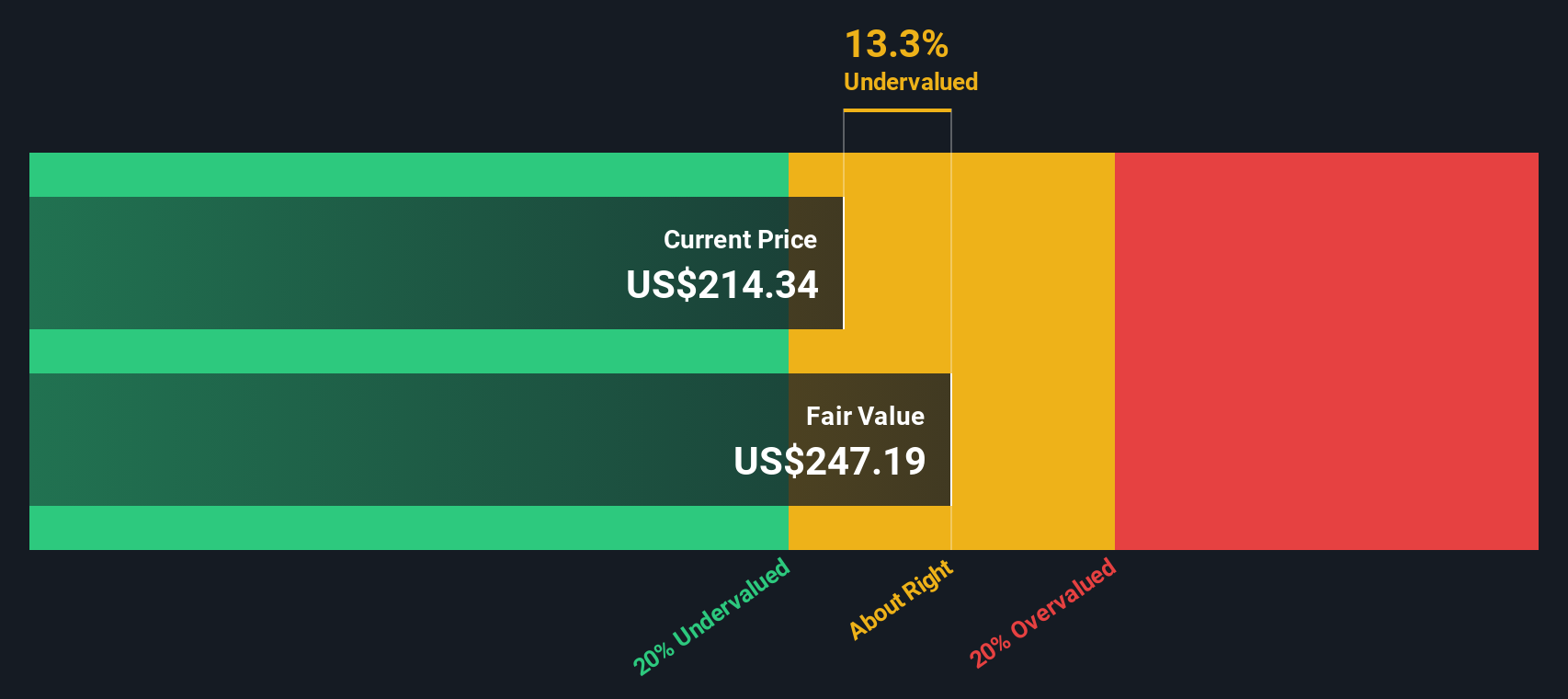

Most Popular Narrative: 19.5% Undervalued

According to community narrative, MongoDB is considered nearly 20% undervalued based on strong growth expectations and bold strategic bets in AI and app modernization.

With the rise of AI, MongoDB foresees gradual but incremental contributions to revenue growth as enterprises develop competencies in leveraging AI, impacting both revenue and future net margins.

Want to know the foundation for this bullish outlook? The narrative hints at aggressive growth rates, major market shifts, and a dramatic improvement in profitability by the end of the decade. Which assumptions back up this premium price? Brace yourself, as the drivers behind this valuation could surprise you.

Result: Fair Value of $272.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the anticipated benefits from AI may take time to materialize, and volatility in Atlas consumption could pose challenges to MongoDB’s future revenue growth.

Find out about the key risks to this MongoDB narrative.Another View: What Do Cash Flows Say?

Looking at our DCF model, the story shifts. While the earlier approach relied on assumptions for future growth, the DCF compares the present and future cash flows directly. Does this method support the optimism, or is more caution needed?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MongoDB for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MongoDB Narrative

If our view doesn’t match your perspective, you’re invited to dive into the numbers and assemble your own outlook in just a few minutes. do it your way.

A great starting point for your MongoDB research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Don’t stop with MongoDB when so many other exciting opportunities are within reach. The right investment could be just a click away, and the Simply Wall Street Screener gives you smart, targeted ways to find them. Don’t let the market move without you. Set yourself up for success with strategies built for today’s world.

- Capture long-term income streams by targeting companies offering dividend stocks with yields > 3%. This approach gives you the potential for steady returns even in uncertain markets.

- Power up your portfolio with transformative innovation by seeking out leaders in AI penny stocks. Here, artificial intelligence is opening up entirely new frontiers in growth.

- Stay ahead of the crowd by going after undervalued stocks based on cash flows. This helps you spot quality businesses that may be trading below their true worth before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MDB

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives