- United States

- /

- Software

- /

- NasdaqCM:MARA

Marathon Digital Holdings' (NASDAQ:MARA) growing losses don't faze investors as the stock surges 17% this past week

For us, stock picking is in large part the hunt for the truly magnificent stocks. Mistakes are inevitable, but a single top stock pick can cover any losses, and so much more. One bright shining star stock has been Marathon Digital Holdings, Inc. (NASDAQ:MARA), which is 642% higher than three years ago. It's also good to see the share price up 83% over the last quarter. Anyone who held for that rewarding ride would probably be keen to talk about it.

Since it's been a strong week for Marathon Digital Holdings shareholders, let's have a look at trend of the longer term fundamentals.

However if you'd rather see where the opportunities and risks are within MARA's industry, you can check out our analysis on the US Software industry.

Given that Marathon Digital Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years Marathon Digital Holdings saw its revenue grow at 126% per year. That's much better than most loss-making companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 95% per year, over the same period. Despite the strong run, top performers like Marathon Digital Holdings have been known to go on winning for decades. In fact, it might be time to put it on your watchlist, if you're not already familiar with the stock.

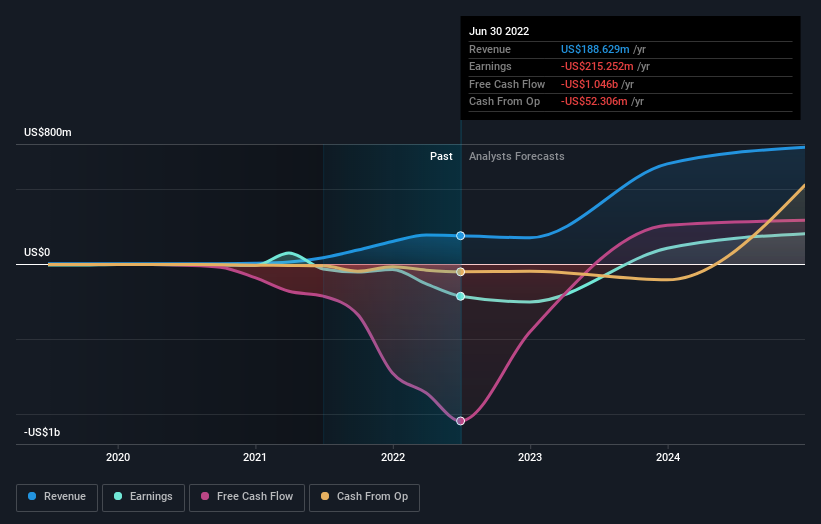

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on Marathon Digital Holdings

A Different Perspective

While the broader market lost about 18% in the twelve months, Marathon Digital Holdings shareholders did even worse, losing 67%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 15% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Marathon Digital Holdings you should be aware of, and 1 of them is a bit unpleasant.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:MARA

MARA Holdings

Operates as a digital asset technology company in the United States and Europe.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives