- United States

- /

- Software

- /

- NasdaqCM:MARA

Marathon Digital Holdings, Inc.'s (NASDAQ:MARA) Share Price Is Still Matching Investor Opinion Despite 31% Slump

Marathon Digital Holdings, Inc. (NASDAQ:MARA) shares have retraced a considerable 31% in the last month, reversing a fair amount of their solid recent performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 134%.

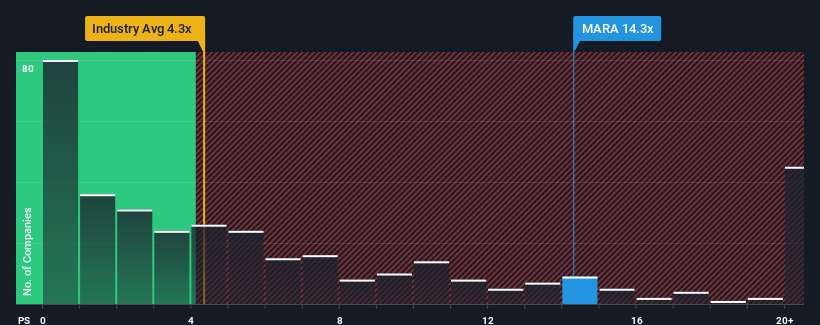

Although its price has dipped substantially, Marathon Digital Holdings may still be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 14.3x, since almost half of all companies in the Software industry in the United States have P/S ratios under 4.3x and even P/S lower than 1.7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Marathon Digital Holdings

What Does Marathon Digital Holdings' P/S Mean For Shareholders?

Marathon Digital Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Marathon Digital Holdings' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Marathon Digital Holdings would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 64% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 39% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 17% each year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Marathon Digital Holdings' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Marathon Digital Holdings' P/S

A significant share price dive has done very little to deflate Marathon Digital Holdings' very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Marathon Digital Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware Marathon Digital Holdings is showing 4 warning signs in our investment analysis, and 1 of those is potentially serious.

If you're unsure about the strength of Marathon Digital Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:MARA

MARA Holdings

Operates as a digital asset technology company in the United States.

Moderate with proven track record.