- United States

- /

- Software

- /

- NasdaqCM:MARA

MARA Holdings (MARA) Is Up 6.0% After Appointing Nir Rikovitch as Chief Product Officer – What's Changed

Reviewed by Simply Wall St

- MARA Holdings announced in July 2025 that it appointed Nir Rikovitch as Chief Product Officer to lead its product strategy and commercialization efforts, focusing on turning breakthrough technology into operational solutions.

- Rikovitch's significant experience in robotics and autonomous systems highlights MARA's investment in technological leadership and its ambition to strengthen its product discipline from the ground up.

- We’ll explore how Rikovitch’s expertise in intelligent infrastructure could shape MARA’s transformation plans and future market positioning.

MARA Holdings Investment Narrative Recap

Belief in MARA Holdings centers on its ability to successfully complete its transformation into a vertically integrated energy and technology provider, notably lowering operational costs and opening new revenue avenues through technology commercialization. While the appointment of Nir Rikovitch as Chief Product Officer could accelerate product development and operational efficiency, this executive change does not meaningfully alter the most pressing short term catalyst: the ability to scale and monetize AI and energy assets. Execution risk in such a transformation remains the most significant near-term challenge.

Among recent developments, the June 2025 partnership with TAE Power Solutions stands out. This collaboration aims to deliver modular, real-time load management systems to hyperscale data centers, a move directly tied to MARA’s ambitions in AI and energy infrastructure and potentially a key test for translating technological investments into operational gains.

However, despite product leadership changes, investors should also consider the contrasting risk that comes with the complexity and capital requirements of transforming into a vertically integrated provider, especially if execution falls short…

Read the full narrative on MARA Holdings (it's free!)

MARA Holdings' outlook anticipates $1.2 billion in revenue and $142.2 million in earnings by 2028. This reflects a required 21.6% annual revenue growth rate but a significant decrease in earnings of $399.1 million from the current $541.3 million.

Uncover how MARA Holdings' forecasts yield a $12.59 fair value, a 37% downside to its current price.

Exploring Other Perspectives

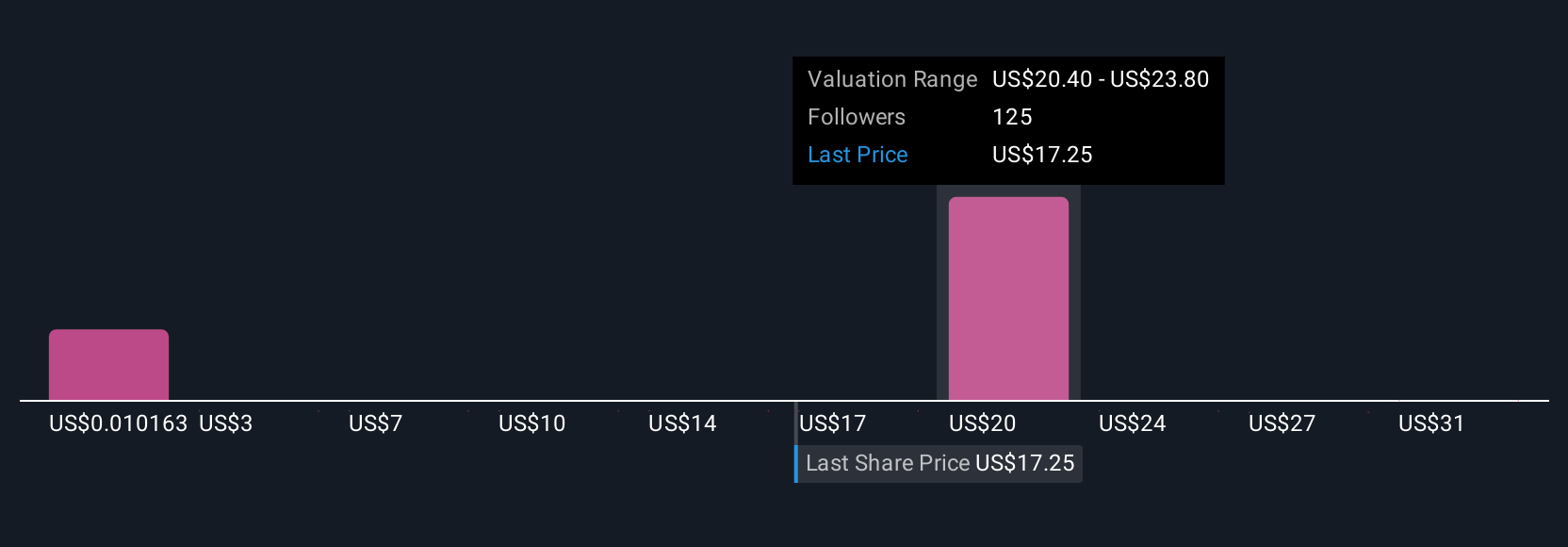

Simply Wall St Community members put MARA's fair value between US$0.01 and US$30, drawn from 9 independent estimates. While MARA's transformation into an energy and technology provider is a clear catalyst, opinions on potential outcomes vary widely so it’s worth reviewing different community perspectives before making any decisions.

Build Your Own MARA Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MARA Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free MARA Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MARA Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MARA

MARA Holdings

Operates as a digital asset technology company in the United States.

Very low and overvalued.

Similar Companies

Market Insights

Community Narratives