- United States

- /

- Software

- /

- NasdaqGS:MAPS

WM Technology (NASDAQ:MAPS) shareholders are up 14% this past week, but still in the red over the last three years

WM Technology, Inc. (NASDAQ:MAPS) shareholders will doubtless be very grateful to see the share price up 76% in the last quarter. But the last three years have seen a terrible decline. The share price has sunk like a leaky ship, down 89% in that time. So it's about time shareholders saw some gains. But the more important question is whether the underlying business can justify a higher price still. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

On a more encouraging note the company has added US$12m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

See our latest analysis for WM Technology

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

WM Technology became profitable within the last five years. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics might give us a better handle on how its value is changing over time.

We note that, in three years, revenue has actually grown at a 14% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating WM Technology further; while we may be missing something on this analysis, there might also be an opportunity.

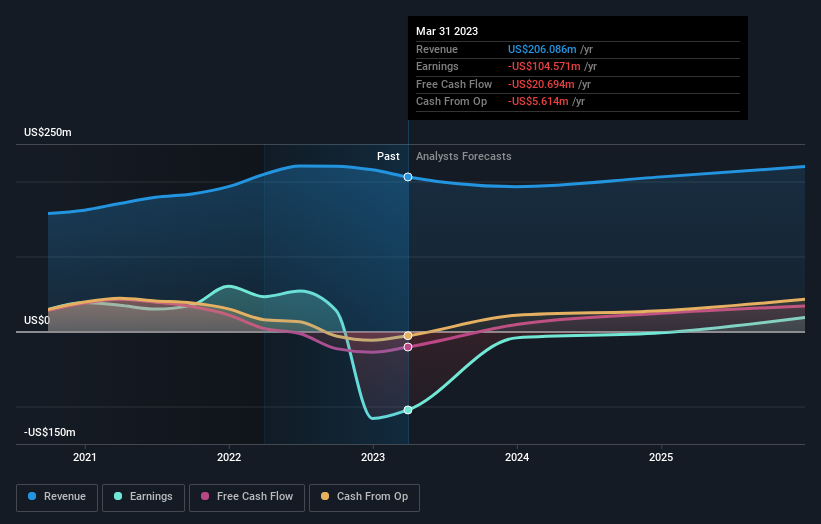

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So it makes a lot of sense to check out what analysts think WM Technology will earn in the future (free profit forecasts).

A Different Perspective

WM Technology shareholders are down 66% for the year, but the broader market is up 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 24% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It's always interesting to track share price performance over the longer term. But to understand WM Technology better, we need to consider many other factors. Even so, be aware that WM Technology is showing 1 warning sign in our investment analysis , you should know about...

We will like WM Technology better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if WM Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MAPS

WM Technology

An online cannabis marketplace, provides ecommerce and compliance software solutions to retailers and brands in cannabis market in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives