- United States

- /

- Software

- /

- NasdaqGS:KLTR

Kaltura, Inc.'s (NASDAQ:KLTR) Prospects Need A Boost To Lift Shares

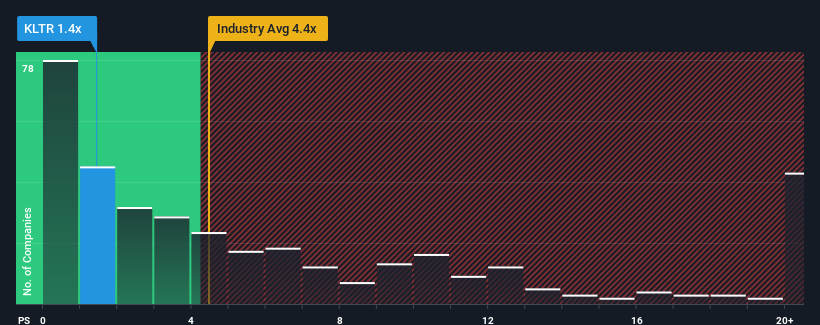

You may think that with a price-to-sales (or "P/S") ratio of 1.4x Kaltura, Inc. (NASDAQ:KLTR) is definitely a stock worth checking out, seeing as almost half of all the Software companies in the United States have P/S ratios greater than 4.4x and even P/S above 11x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Kaltura

How Kaltura Has Been Performing

With revenue growth that's inferior to most other companies of late, Kaltura has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kaltura.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Kaltura's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.4% last year. This was backed up an excellent period prior to see revenue up by 45% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 0.1% over the next year. With the industry predicted to deliver 15% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Kaltura's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Kaltura's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Kaltura's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Kaltura that you should be aware of.

If these risks are making you reconsider your opinion on Kaltura, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kaltura might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KLTR

Kaltura

Provides various software-as-a-service (SaaS) products and solutions and a platform-as-a-service (PaaS) in the United States, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives