- United States

- /

- IT

- /

- NasdaqGS:KC

Kingsoft Cloud Holdings (NASDAQ:KC) shareholders are up 10% this past week, but still in the red over the last three years

Kingsoft Cloud Holdings Limited (NASDAQ:KC) shareholders should be happy to see the share price up 14% in the last month. But that is meagre solace in the face of the shocking decline over three years. The share price has sunk like a leaky ship, down 81% in that time. So it's about time shareholders saw some gains. But the more important question is whether the underlying business can justify a higher price still. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

Check out our latest analysis for Kingsoft Cloud Holdings

Given that Kingsoft Cloud Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Kingsoft Cloud Holdings grew revenue at 18% per year. That's a pretty good rate of top-line growth. So it's hard to believe the share price decline of 22% per year is due to the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

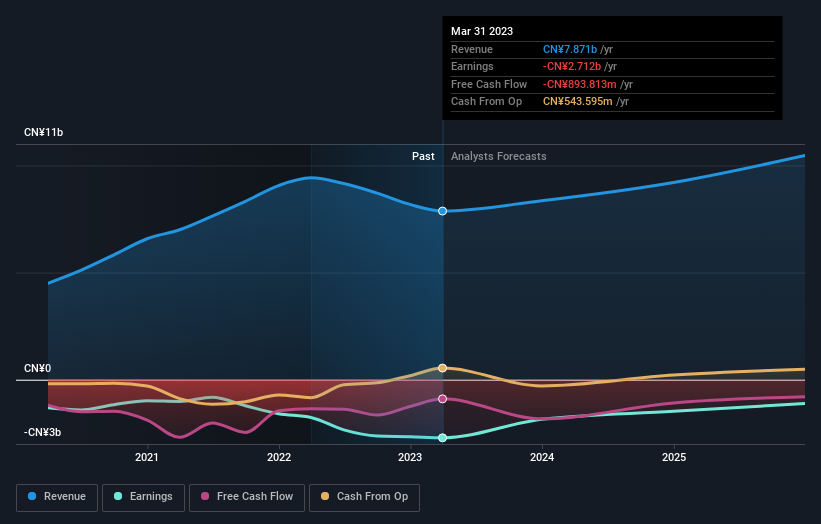

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Kingsoft Cloud Holdings is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Kingsoft Cloud Holdings will earn in the future (free analyst consensus estimates)

A Different Perspective

It's nice to see that Kingsoft Cloud Holdings shareholders have gained 28% (in total) over the last year. This recent result is much better than the 22% drop suffered by shareholders each year (on average) over the last three. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. It's always interesting to track share price performance over the longer term. But to understand Kingsoft Cloud Holdings better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Kingsoft Cloud Holdings (including 1 which is a bit unpleasant) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kingsoft Cloud Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KC

Kingsoft Cloud Holdings

Provides cloud services to businesses and organizations primarily in China.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives