- United States

- /

- IT

- /

- NasdaqGS:KC

A Look at Kingsoft Cloud Holdings (NasdaqGS:KC) Valuation After Its Major Follow-On Equity Offering Completion

Reviewed by Kshitija Bhandaru

Kingsoft Cloud Holdings (NasdaqGS:KC) has just wrapped up a substantial follow-on equity offering. The company raised over HKD 2.8 billion through the sale of 338 million ordinary shares. This move directly impacts the company’s capital structure and available cash.

See our latest analysis for Kingsoft Cloud Holdings.

The completion of Kingsoft Cloud’s equity offering arrives after a volatile spell. Recent share price weakness has been offset by an eye-catching 356.8% total shareholder return over the past year. While momentum has cooled in the short term, confidence in the company’s trajectory remains well above where it was twelve months ago.

If you’re interested in what other tech innovators are achieving, now’s a perfect opportunity to explore the latest movers with our See the full list for free.

With shares now trading well below analyst targets but strong gains behind it, the big question is whether Kingsoft Cloud is undervalued after its latest capital raise, or if the market has fully priced in future growth.

Most Popular Narrative: 27.7% Undervalued

Kingsoft Cloud’s most widely followed narrative places its fair value well above the recent close, signaling room for further upside based on future business prospects and assumptions about earnings growth. This view sets the stage for a deeper look at the factors that drive such a positive valuation gap.

Ongoing advances in AI and generative AI adoption across multiple sectors are rapidly increasing demand for intelligent computing and scalable cloud services. This is driving strong revenue growth, evidenced by AI-related gross billings up 120%+ year over year and forming 45% of public cloud revenue. These factors indicate the addressable market and future top-line expansion remain underappreciated.

Curious which financial levers create such a dramatic gap to fair value? The secret sauce here is a bold projection of sustained revenue growth and margin gains, with analysts betting on a fundamental transformation in Kingsoft Cloud's earnings profile. Want to know if the assumptions driving this outlook are as aggressive as they sound? Uncover the full story behind these numbers.

Result: Fair Value of $18.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure and heavy reliance on a few key clients could limit the long-term upside, which is highlighted by the prevailing bullish narrative.

Find out about the key risks to this Kingsoft Cloud Holdings narrative.

Another View: What Does the DCF Model Suggest?

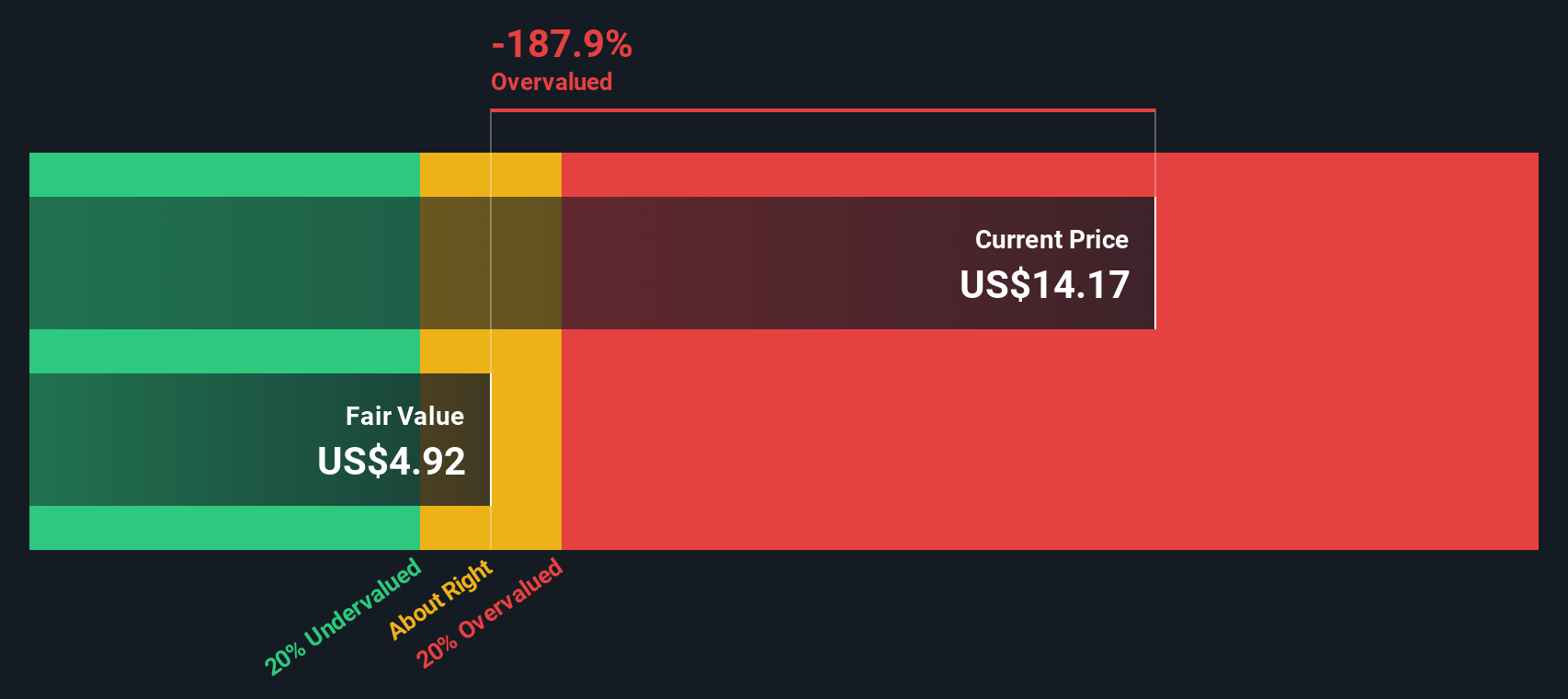

While the analyst consensus sees Kingsoft Cloud as undervalued, our DCF model tells a different story. Based on future cash flow estimates, Kingsoft Cloud is actually trading above its calculated fair value. This suggests the market might be pricing in more optimism than the company's cash generation can currently support. Could this gap signal risk, or is it just a misread of Kingsoft Cloud's growth story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kingsoft Cloud Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kingsoft Cloud Holdings Narrative

If the numbers or outlook above do not match your perspective, take a closer look for yourself and craft a personal narrative in just a few minutes, then Do it your way.

A great starting point for your Kingsoft Cloud Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the curve by taking advantage of unique stock opportunities you won’t want to miss. Make smart moves now with these powerful screeners:

- Tap into potential market leaders by assessing these 891 undervalued stocks based on cash flows, set to benefit from strong cash flows and attractive entry points.

- Gather yield and long-term stability by checking out these 18 dividend stocks with yields > 3%, offering consistent payouts above 3%.

- Jump on the next wave of technological disruption by sorting through these 26 quantum computing stocks, which is pioneering advancements in high-speed computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kingsoft Cloud Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KC

Kingsoft Cloud Holdings

Provides cloud services to businesses and organizations primarily in China.

Good value with imperfect balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)