- United States

- /

- Software

- /

- NasdaqGS:INTU

Intuit (NasdaqGS:INTU) Raises 2025 Earnings Guidance; Reports Strong Q3 Growth

Reviewed by Simply Wall St

Intuit (NasdaqGS:INTU) recently raised its earnings guidance for fiscal 2025 and reported strong third-quarter results, with revenue up significantly from the previous year. This positive momentum contributed to a 17.79% price increase over the last quarter, contrasting with broader market trends where tech shares faced declines due to trade worries and Apple-related tariff threats. Although the overall market experienced fluctuations with a 1.4% drop in recent trading, Intuit's robust financial performance and optimistic outlook likely added confidence amid these external pressures, setting it apart from the tech sector's struggles during the period.

We've discovered 1 weakness for Intuit that you should be aware of before investing here.

Intuit's recent earnings guidance and strong third-quarter results highlight a significant boost in investor confidence, reflected in its impressive quarterly share price increase. This momentum could further enhance the company's AI-driven strategies mentioned in the narrative, possibly accelerating growth in revenue and earnings. Over the past five years, Intuit has delivered a commendable total shareholder return of 142.19%, considerably outperforming its recent one-year performance relative to the broader US software industry, which achieved higher returns than Intuit.

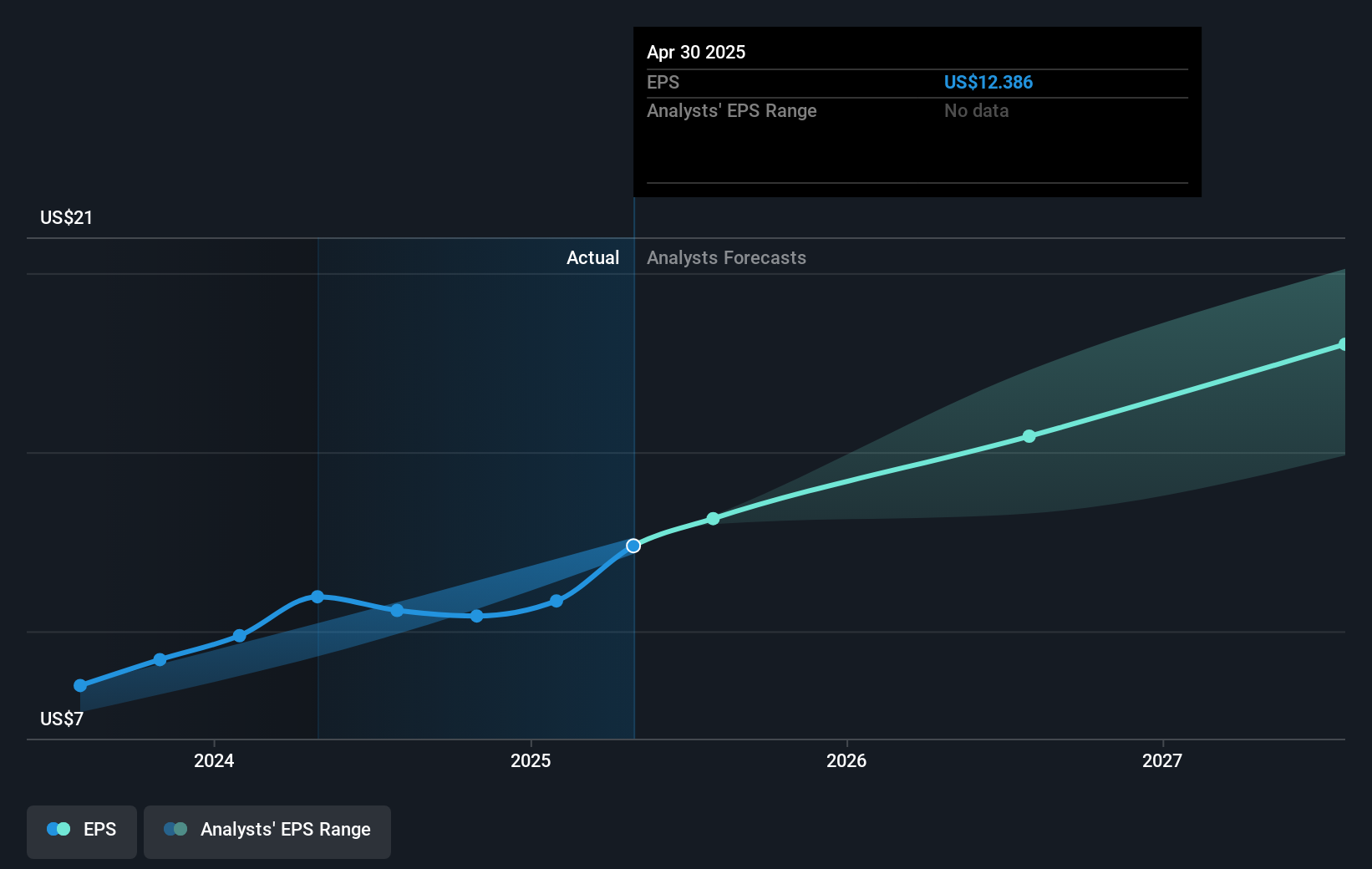

The positive financial outlook may impact revenue forecasts positively, especially as Intuit continues to expand its AI-powered services, potentially boosting customer adoption and retention. Analysts' earnings forecasts hinge on maintaining this upward trajectory, with expectations that depend on a sustained increase in profit margins and revenue growth. With a current share price of US$626.55, Intuit trades at a discount to the consensus analyst price target of US$697.18, suggesting room for future growth if current business strategies successfully materialize. However, robust execution of AI initiatives will be crucial to justifying these optimistic forecasts.

Dive into the specifics of Intuit here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTU

Intuit

Provides financial management, payments and capital, compliance, and marketing products and services in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion