- United States

- /

- Software

- /

- NasdaqGS:INTU

Intuit (NasdaqGS:INTU) Enhances AI Platform GenOS To Revolutionize Business Solutions

Reviewed by Simply Wall St

Intuit (NasdaqGS:INTU) has recently enhanced its Generative AI Operating System (GenOS), intending to solve customer financial problems more efficiently and contributing to the company's innovative growth. Over the last quarter, Intuit's share price climbed 28%, likely reflecting these technological advancements. The expansion of its AI capabilities, coupled with robust third-quarter earnings showing increased revenue and net income, would have strengthened investor confidence. Additionally, enhanced dividend payouts and active share buybacks could have supported this positive momentum against a broader market uptrend of 12% over the year, emphasizing Intuit's strong standing in a growing market.

Intuit has 1 warning sign we think you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

Intuit's recent enhancement of its Generative AI Operating System (GenOS) is poised to significantly impact the company's narrative centered around AI-driven innovation and customer-focused financial solutions. The development reinforces Intuit's commitment to efficiency and client satisfaction, potentially bolstering their revenue streams as it drives adoption of services like QuickBooks Live and AI-powered TurboTax. These advancements align with Intuit's focus on expanding into the mid-market segment and integrating AI for cost reduction, both critical for revenue, profitability, and net margin enhancement.

Over the past five years, Intuit's total shareholder return, comprising both share price appreciation and dividends, recorded 169.44%. In contrast, Intuit's shares outperformed the broader US Software industry over the past year, which returned 23.7%. This longer-term performance showcases not only the ongoing investor confidence but also the potential realization of the strategic focus on AI and mid-market expansion.

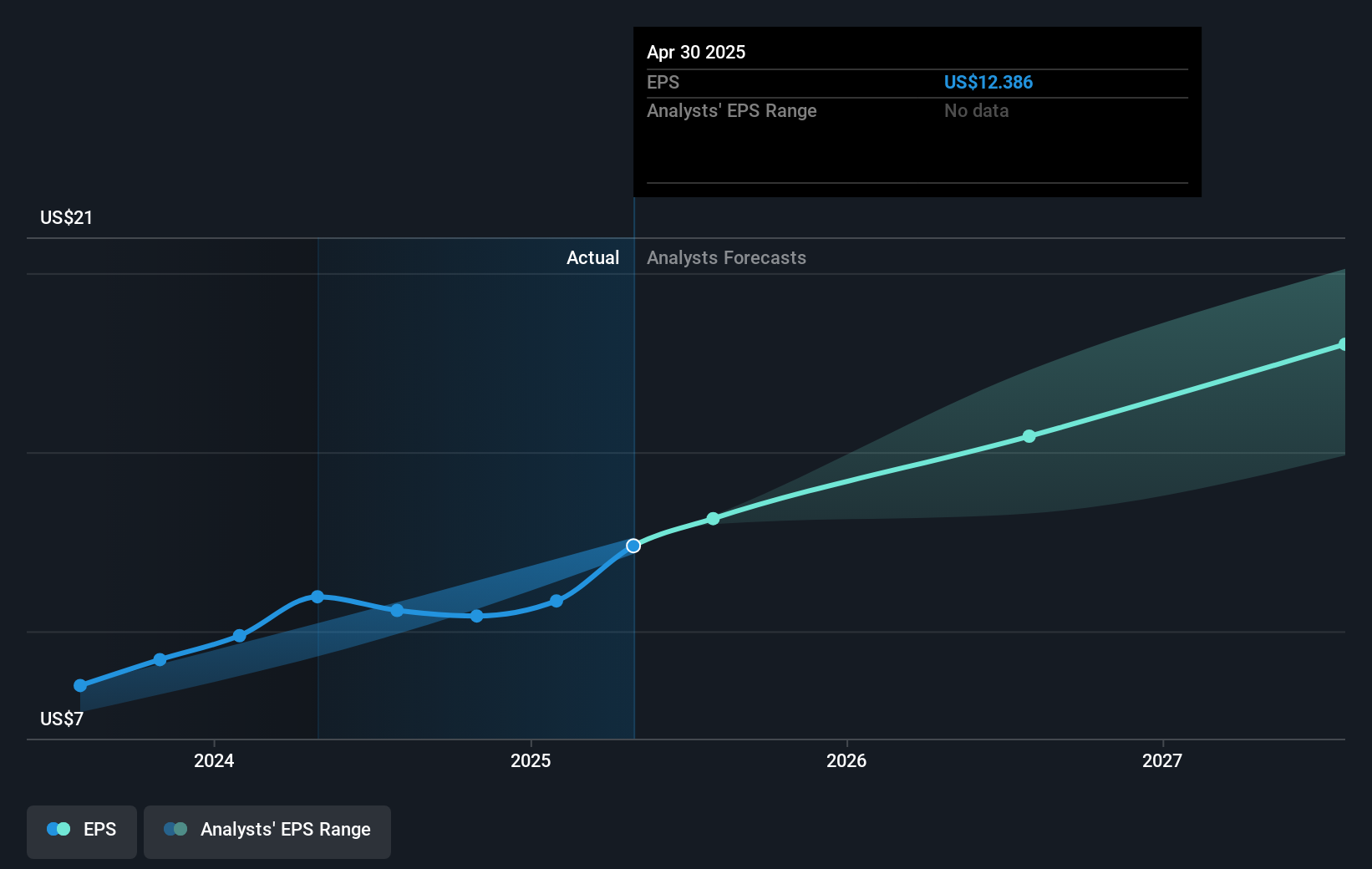

The recent technological boost has likely played a role in driving optimism in revenue and earnings forecasts. Analysts project Intuit's revenue to grow annually, influenced by higher customer adoption rates and increased average revenue per customer due to AI enhancements. Current share prices reflect a 10.1% discount to the consensus analyst price target of US$697.18, indicating room for potential upside. However, achieving these forecasts depends on maintaining a balance between scaling costs and revenue growth.

Understand Intuit's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTU

Intuit

Provides financial management, payments and capital, compliance, and marketing products and services in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion