- United States

- /

- Software

- /

- NasdaqGS:INTU

Intuit (INTU): Reassessing Valuation After New USDC Partnership and Reinforced AI‑Driven Growth Outlook

Reviewed by Simply Wall St

Intuit (INTU) just gave investors a fresh catalyst by unveiling a multi year partnership with Circle to weave USDC stablecoin rails into TurboTax, QuickBooks, and Credit Karma, while also doubling down on AI and growth guidance.

See our latest analysis for Intuit.

Those moves help explain why Intuit’s recent 7 day share price return of 3.15 percent and year to date share price return of 8.42 percent contrast with a softer 1 year total shareholder return of 6.48 percent. This suggests momentum is rebuilding after a choppy few months.

If Intuit’s push into AI powered finance has your attention, it could be a good moment to see what other innovators are doing across high growth tech and AI stocks.

With shares still trading at a double digit discount to both intrinsic value estimates and bullish analyst targets, yet boasting premium growth expectations, the real question is whether this is a buying window or if markets already see what comes next.

Most Popular Narrative: 16.1% Undervalued

With Intuit’s fair value estimate sitting well above the last close of $675.21, the most followed narrative points to meaningful upside from here.

The analysts have a consensus price target of $819.73 for Intuit based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $971.0, and the most bearish reporting a price target of $600.0.

Want to see how steady double digit growth, rising margins, and a rich future earnings multiple can still justify upside from here? The full narrative breaks down the precise revenue path, profit expansion, and discount rate assumptions that underpin this premium yet still bullish valuation.

Result: Fair Value of $805.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sluggish Mailchimp growth and Credit Karma’s cyclicality could quickly undermine the bullish case if execution stumbles or consumer credit conditions tighten.

Find out about the key risks to this Intuit narrative.

Another Angle on Valuation

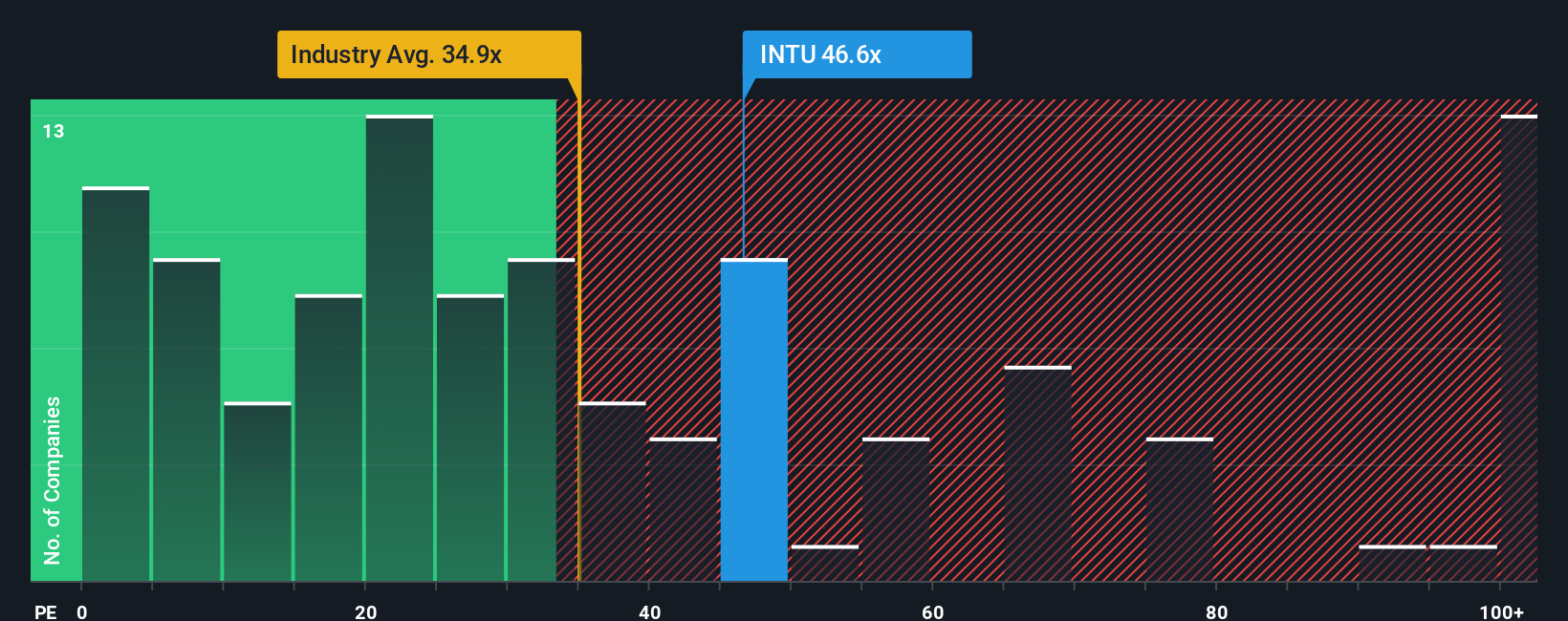

Step away from fair value models and Intuit suddenly looks pricey. It trades on a 45.6 times earnings multiple versus 32.4 times for the US Software industry and a fair ratio of 40.6 times, implying investors are already paying up for execution and AI upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intuit Narrative

If you see the story differently, or would rather dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Intuit.

Looking for more investment ideas?

Before you move on, consider your next smart move with a few targeted screens that surface companies you might wish you had bought sooner.

- Capture asymmetric upside by targeting early stage businesses using these 3630 penny stocks with strong financials that already back their potential with solid financials.

- Position yourself at the frontier of automation and data using these 24 AI penny stocks to spot companies harnessing AI for scalable, real world growth.

- Focus on these 11 dividend stocks with yields > 3% that aim to combine reliable payouts with resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTU

Intuit

Provides financial management, payments and capital, compliance, and marketing products and services in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion