- United States

- /

- Software

- /

- NasdaqGS:INTU

Intuit (INTU) Launches New App Partner Program With Four Tiers And Enhanced APIs

Reviewed by Simply Wall St

Intuit (INTU) recently launched the Intuit App Partner Program, aiming to enhance its app ecosystem for QuickBooks and Enterprise Suite users. This launch, coupled with strong Q3 earnings reporting a notable revenue increase to $7,754 million, may have supported the 28% price rise in Intuit's stock over the last quarter. Though the broader market experienced positive sentiment with the S&P 500 and Nasdaq reaching new highs, Intuit's advancements and robust guidance likely added weight to its performance amid economic optimism and tech sector activity.

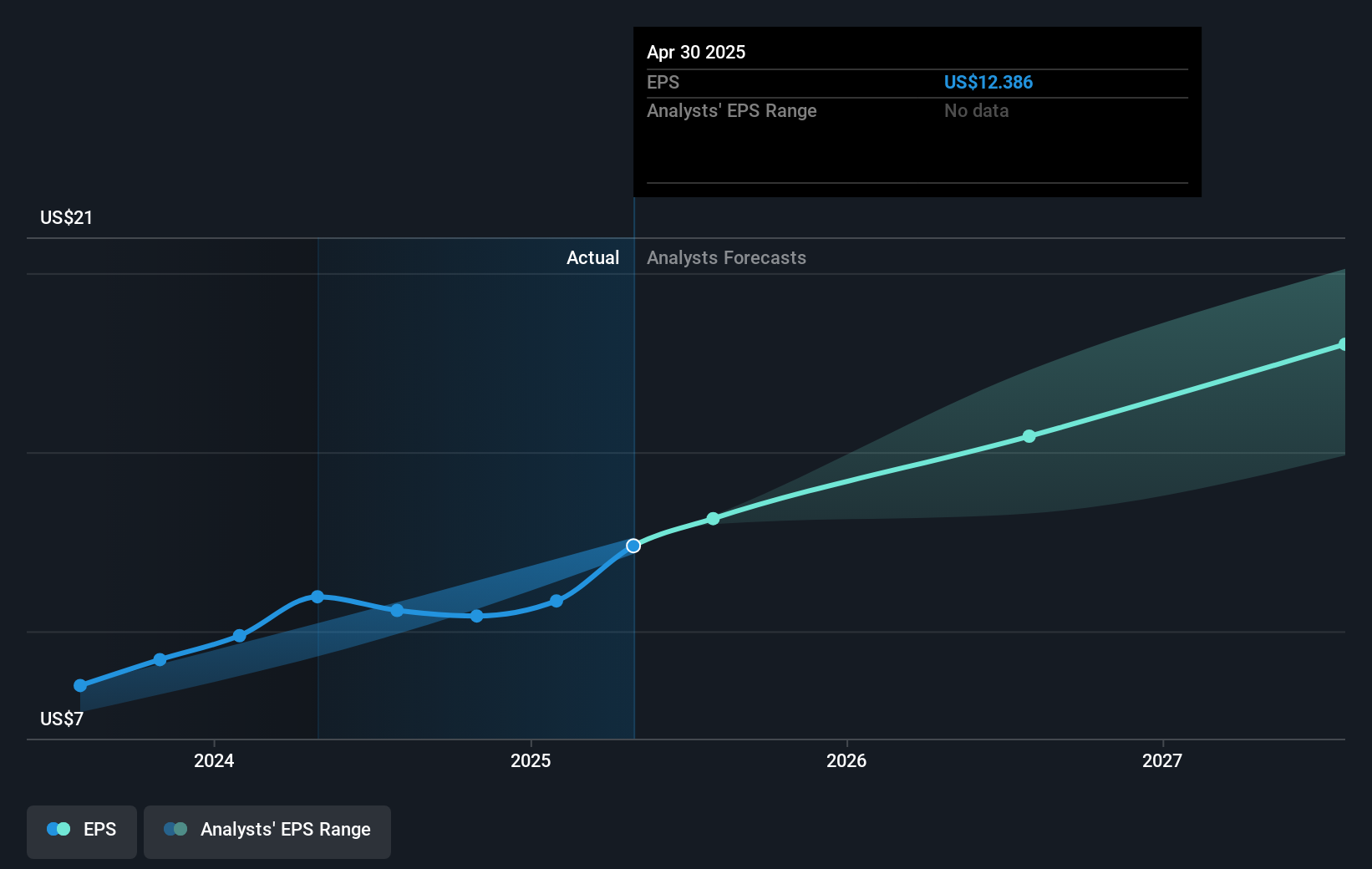

Intuit's recent launch of the Intuit App Partner Program is expected to enhance its app ecosystem and benefit QuickBooks and Enterprise Suite users. This initiative plays into the company's narrative of leveraging AI-driven services and automation to boost efficiency and customer satisfaction. The integration of AI could potentially increase Intuit's revenue growth and customer base by improving service offerings, driving higher adoption rates and increasing the average revenue per customer. This aligns with analysts' assumptions of a 13.1% annual revenue growth over the next three years. However, the associated costs and implementation challenges could impact net margins if not managed effectively.

Over the past five years, Intuit's total shareholder return was 164.40%. In comparison, the company's earnings have grown by 13.2% annually over the same period, showcasing substantial growth. While Intuit's stock exceeded the US overall market return of 17.7% over the past year, it underperformed relative to the US Software industry, which returned 29.7% in the same timeframe. This underscores the importance of the current strategic initiatives in driving further performance improvements.

With the stock's recent price movement, reaching US$798.73, and considering an analyst consensus price target of approximately US$816.84, Intuit's shares are currently trading at a 2.27% discount to this target. This suggests that analysts generally perceive the stock to be fairly priced, reflecting expectations of ongoing revenue and earnings growth supported by AI and automation innovations.

Understand Intuit's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTU

Intuit

Provides financial management, compliance, and marketing products and services in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives