- United States

- /

- Software

- /

- NasdaqGS:INTU

Intuit (INTU): A Fresh Look at Valuation Following New AI Partnerships and Platform Upgrades

Reviewed by Simply Wall St

Intuit (INTU) is back in the spotlight after announcing a new partnership with Cherry Bekaert. The goal is to bring its AI-powered Enterprise Suite to a broader set of mid-market businesses. At the same time, the company rolled out AI-driven improvements across its Credit Karma and TurboTax offerings.

See our latest analysis for Intuit.

Intuit’s recent moves, including its push into AI-powered ERP and upgrades to Credit Karma and TurboTax, are drawing notice. However, the stock itself has been struggling to gain traction. The share price has slipped about 9% over the past quarter and, despite a strong three-year total shareholder return of nearly 74%, the one-year total return is actually negative. This suggests momentum has cooled after previous years of outperformance.

If Intuit’s leadership in AI fintech has you interested in what other innovators are up to, now is a perfect moment to explore the landscape of next-generation software with our See the full list for free.

But with shares down this year even as AI innovation accelerates, is Intuit trading at an attractive discount? Or are investors already factoring in the company’s future growth potential, leaving little room for upside?

Most Popular Narrative: 19.5% Undervalued

The most widely followed narrative places Intuit’s fair value at $807, a substantial premium over the last close of $650.11. With analysts expecting future earnings growth and margin expansion, attention is squarely on the company’s ability to sustain innovation and maintain momentum across multiple segments.

The accelerating adoption of Intuit's AI-driven all-in-one platform, including virtual teams of AI agents and human experts, positions the company to consolidate customers' tech stacks, drive automation of workflows, and unlock substantial ROI for customers. This supports higher average revenue per customer and net margin expansion over time.

Want to know the growth blueprint behind this high valuation? The heart of the narrative lies in aggressive transformation, bold profit margin assumptions, and future growth forecasts that challenge industry averages. Which specific financial leaps and new customer trends are driving such valuation ambition? Uncover the details behind this premium before they hit next quarter’s headlines.

Result: Fair Value of $807 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower-than-expected Mailchimp growth or weakness in international markets could undermine Intuit’s ambitious projections and limit upside for investors who are watching closely.

Find out about the key risks to this Intuit narrative.

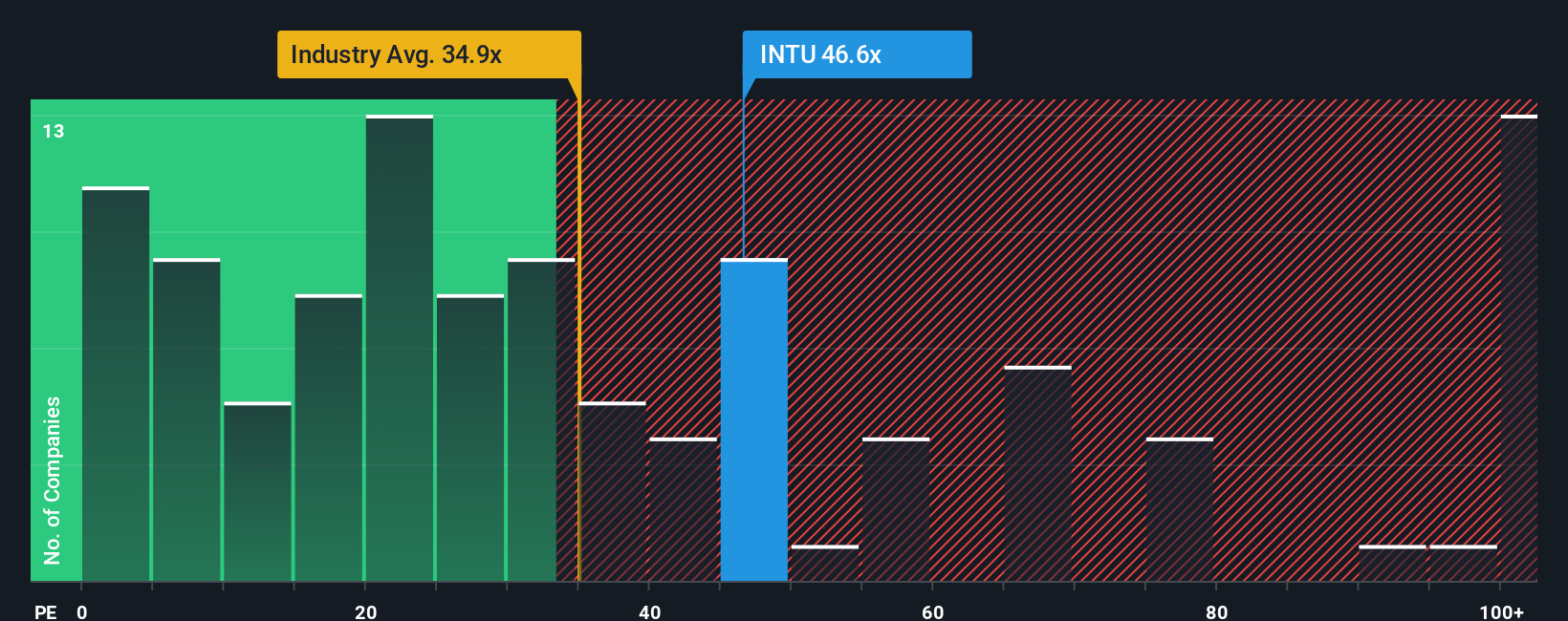

Another View: The Market Multiple Angle

Taking a look from a different angle, Intuit’s price-to-earnings ratio is currently 46.8x, higher than both the US Software industry average (32.1x) and its own fair ratio of 43.4x. This premium suggests investors expect Intuit to outpace peers, but it also means any stumble could hit the stock harder. With growth moderating, could this valuation leave little margin for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intuit Narrative

If the consensus story does not quite fit or you want to dig deeper, building your own data-driven narrative is easy and takes just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Intuit.

Looking for More Investment Ideas?

Supercharge your portfolio by tapping into investment themes most investors overlook. Don’t miss out on bold opportunities transforming markets right now.

- Tap potential future leaders in artificial intelligence with these 27 AI penny stocks poised for breakout growth as new technologies reshape entire industries.

- Strengthen your portfolio’s resilience by targeting these 15 dividend stocks with yields > 3% delivering stable yields above 3% and robust financial health.

- Catch early-stage momentum and seek big upside from these 3592 penny stocks with strong financials making waves with strong financials and disruptive innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTU

Intuit

Provides financial management, payments and capital, compliance, and marketing products and services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives