Intuit (NASDAQ:INTU) First Quarter 2023 Results

Key Financial Results

- Revenue: US$2.60b (up 29% from 1Q 2022).

- Net income: US$40.0m (down 83% from 1Q 2022).

- Profit margin: 1.5% (down from 11% in 1Q 2022). The decrease in margin was driven by higher expenses.

- EPS: US$0.14 (down from US$0.83 in 1Q 2022).

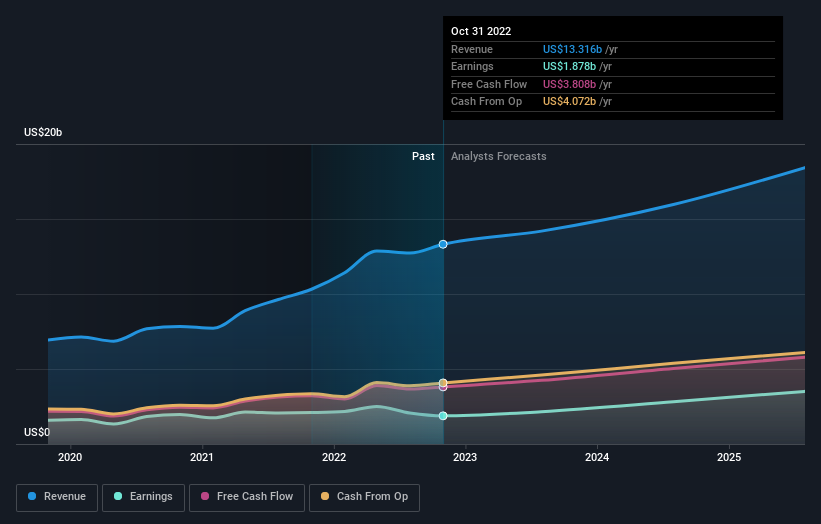

All figures shown in the chart above are for the trailing 12 month (TTM) period

Intuit Revenues and Earnings Beat Expectations

Revenue exceeded analyst estimates by 3.9%. Earnings per share (EPS) also surpassed analyst estimates.

Looking ahead, revenue is forecast to grow 12% p.a. on average during the next 3 years, compared to a 13% growth forecast for the Software industry in the US.

Performance of the American Software industry.

The company's shares are up 5.1% from a week ago.

Risk Analysis

Be aware that Intuit is showing 2 warning signs in our investment analysis that you should know about...

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:INTU

Intuit

Provides financial management, payments and capital, compliance, and marketing products and services in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion