- United States

- /

- Software

- /

- NasdaqGS:INTU

Does Intuit’s AI Innovation Signal a Good Entry Point After 5.6% Drop?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Intuit is actually a good deal at its current price, you are not alone. There is a lot to consider before buying in.

- In the past week, Intuit shares slipped by 2.2%, contributing to a 5.6% drop over the past month. However, the stock is still up 5.3% year to date and has delivered close to a 100% return over five years.

- Recent headlines highlight Intuit’s continued innovation in AI-powered financial tools and its ongoing acquisitions to expand its product ecosystem. These factors have kept the stock in the spotlight and influenced recent price moves. These developments signal management's bold approach in an increasingly competitive market.

- When we run Intuit through our valuation checks, it scores 3 out of 6 for being undervalued, which puts it right at the tipping point depending on which method you use. Let’s break down those different approaches to valuation, but stick around because at the end we will share an even better way to figure out if Intuit really deserves a place in your portfolio.

Find out why Intuit's 6.3% return over the last year is lagging behind its peers.

Approach 1: Intuit Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This approach provides a sense of what the business is worth based on expected cash generation, rather than simply reviewing current profits or sales.

For Intuit, the current Free Cash Flow stands at approximately $6.0 Billion. According to analyst projections and extended estimates, Intuit's Free Cash Flow is expected to grow steadily each year, reaching about $8.1 Billion in 2027. It is forecasted to climb to nearly $11.7 Billion by 2030. After five years, these numbers are extrapolated based on trend assumptions by Simply Wall St.

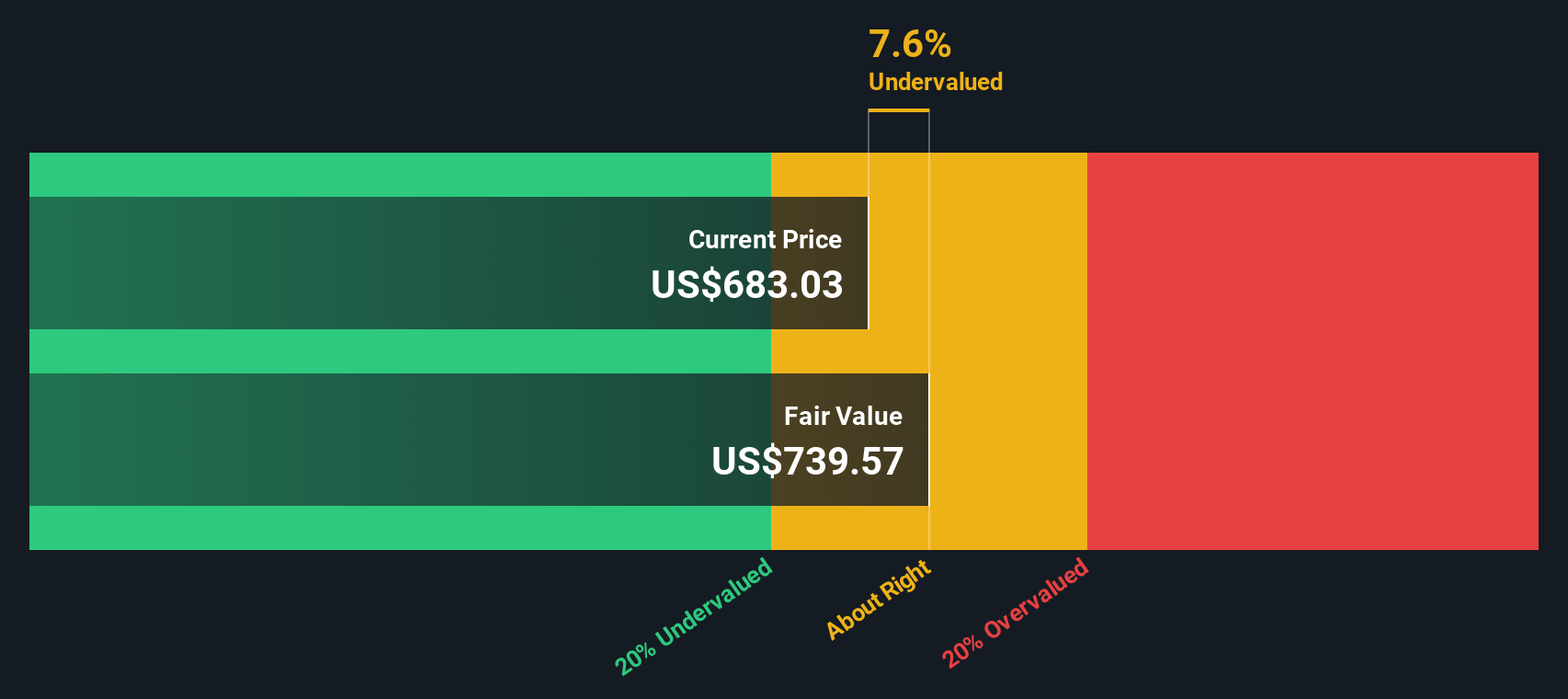

Taking these cash flow projections into account, the DCF model arrives at an estimated intrinsic value of $739.40 per share. With Intuit currently trading at a price representing an 11.3% discount to this estimate, the stock appears to be undervalued according to DCF analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Intuit is undervalued by 11.3%. Track this in your watchlist or portfolio, or discover 853 more undervalued stocks based on cash flows.

Approach 2: Intuit Price vs Earnings

For profitable companies like Intuit, the Price-to-Earnings (PE) ratio is often a preferred valuation metric because it directly relates the company's share price to its current earnings. This approach provides investors with a clear sense of how much they are paying for each dollar of earnings generated by the company.

It is important to note that what constitutes a "normal" or "fair" PE ratio depends on various factors. Companies with higher earnings growth and lower perceived risk typically command higher PE multiples, while more mature or riskier firms tend to trade at lower ratios. Market participants also compare companies’ valuations within the same industry to get a sense of relative value.

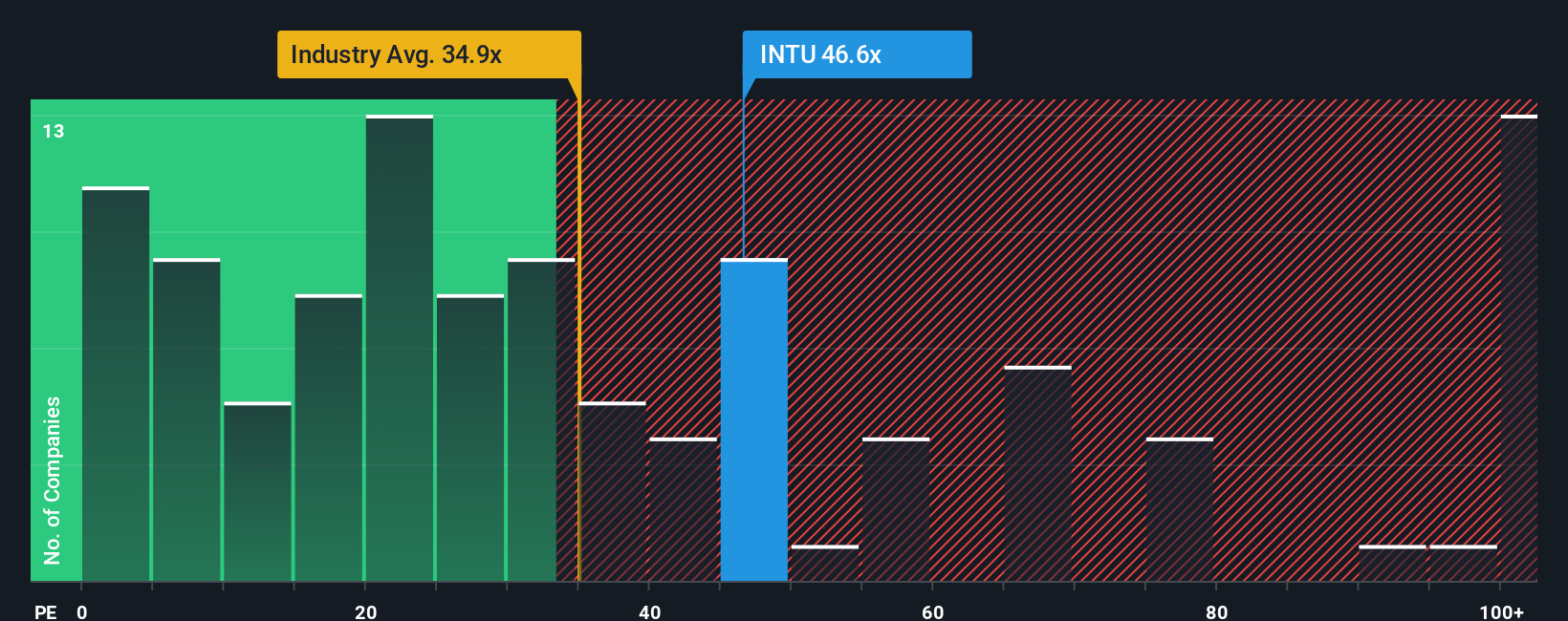

Currently, Intuit trades at a PE ratio of 47.3x. By comparison, the Software industry average stands at 34.8x, and the average PE for Intuit's close peers is 57.2x. At first glance, Intuit’s valuation is higher than the broader industry, but a bit below its peer group.

This is where Simply Wall St's proprietary “Fair Ratio” is especially useful. The Fair Ratio for Intuit is calculated at 43.7x. This metric considers Intuit's growth prospects, risk profile, profit margins, industry dynamics, and market capitalization. It offers a tailored benchmark for what would be an appropriate multiple for this specific company today. By accounting for all these factors, the Fair Ratio provides a more reliable anchor than simply comparing Intuit to generalized industry or peer averages, which may not reflect its unique qualities.

With Intuit’s current PE ratio just a fraction above the Fair Ratio (47.3x vs 43.7x), the stock appears to be fairly valued using this method.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Intuit Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are a new approach that lets you connect your view of a company’s story, such as its strengths, risks, and strategic direction, to your own financial forecasts and fair value estimate. They help you clearly articulate why you think Intuit will succeed or face challenges, then instantly see what those assumptions mean for fair value and whether the current price is attractive.

Accessible right on Simply Wall St's Community page and used by millions, Narratives turn your research into actionable insights by linking a company’s story with the numbers that matter, including revenue, earnings, and margins, and updating your fair value as facts change. This means when news breaks or earnings are announced, your Narrative is kept relevant and reflective of the latest information, helping you decide if it’s time to buy, hold, or sell based on your scenario’s fair value compared to the live share price.

For example, one Narrative for Intuit might forecast rapid AI-driven growth and set a fair value as high as $971, while a more cautious scenario focused on international headwinds and Mailchimp risks might place fair value closer to $600. Narratives make it simple to compare these perspectives and understand what drives your conviction.

Do you think there's more to the story for Intuit? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTU

Intuit

Provides financial management, payments and capital, compliance, and marketing products and services in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives