- United States

- /

- Software

- /

- NasdaqGS:INTA

Could Intapp (INTA)'s Success with Tech-Savvy Tax Firms Reveal a Broader Competitive Edge?

Reviewed by Sasha Jovanovic

- Intapp recently announced that tax advisory firm Ostberg Sinclair & Co has implemented its Intapp Collaboration platform, based on Microsoft 365, to enhance communications and document management in support of the firm's expansion objectives.

- This move highlights expanding adoption of Intapp's solutions by newer, growth-focused clients in the tax advisory space, adding further validation to its Microsoft 365-based offerings.

- We'll examine how this client win, especially with a tech-enabled tax advisory firm, could influence Intapp's broader investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Intapp Investment Narrative Recap

For investors considering Intapp, the central thesis rests on broad cloud adoption and successful partner ecosystem expansion to unlock new client segments and scale revenues. The Ostberg Sinclair deal is a positive signal for Intapp’s traction with growing clients, but as a single implementation, it has limited immediate impact on Intapp’s main short term catalysts, namely, accelerating revenue growth through upselling and partner-led sales, and does little to shift the primary risk of margin pressure if partners underdeliver.

Most relevant to this announcement is the recent migration of Blank Rome to Intapp’s Cloud Infrastructure, which, like the Ostberg Sinclair deployment, underlines progress in cloud adoption among professional services clients. Taken together, these client wins affirm the company’s bet on vertical SaaS and cloud, but highlight continued execution risks tied to partner performance and the pace of migration.

Yet, in contrast, investors should be aware that reliance on external partners introduces varying levels of cost control and could affect...

Read the full narrative on Intapp (it's free!)

Intapp's outlook calls for $701.6 million in revenue and $34.2 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 13.2% and an increase in earnings of $52.5 million from the current earnings of -$18.3 million.

Uncover how Intapp's forecasts yield a $63.25 fair value, a 58% upside to its current price.

Exploring Other Perspectives

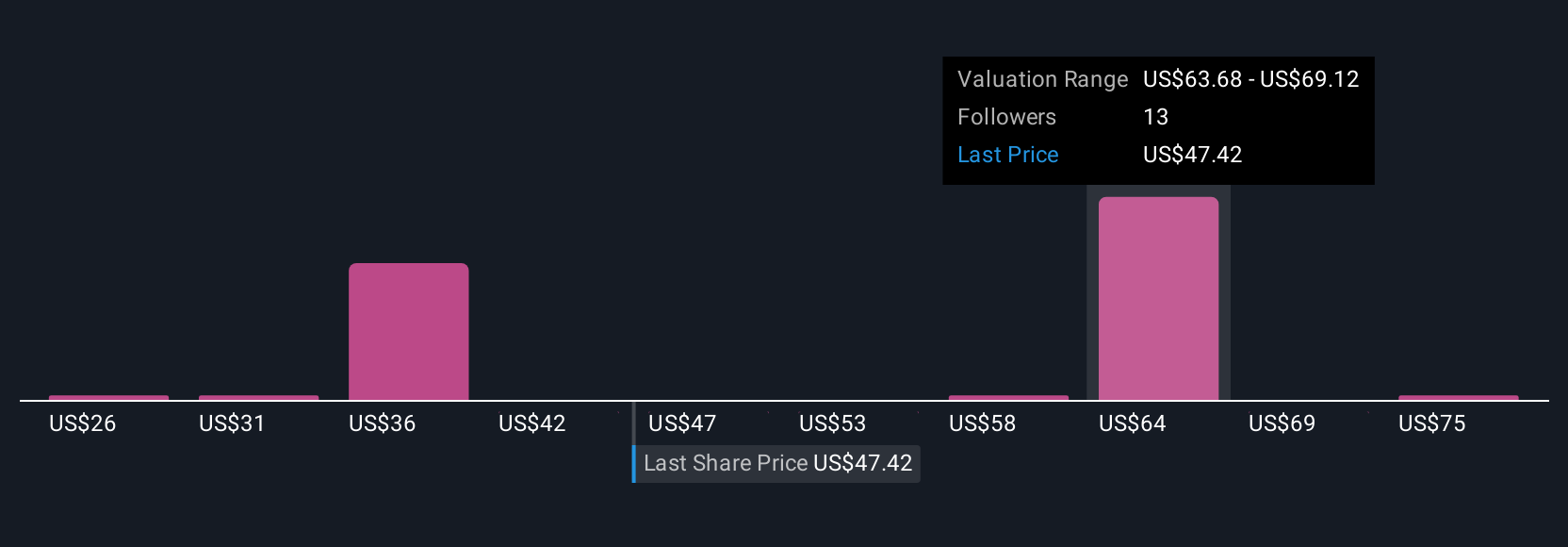

Six members of the Simply Wall St Community offered fair value estimates for Intapp, ranging widely from US$25.60 to US$80 per share. While many focus on growth and cloud adoption as key drivers, the risk of partner underperformance could weigh heavily on future margins for all market participants to consider.

Explore 6 other fair value estimates on Intapp - why the stock might be worth 36% less than the current price!

Build Your Own Intapp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intapp research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Intapp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intapp's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTA

Intapp

Through its subsidiary, Integration Appliance, Inc., provides AI-powered solutions in the United States, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives