- United States

- /

- Software

- /

- NasdaqGS:IDCC

Why InterDigital (IDCC) Is Up 5.8% After Securing U.S. Defense Contract for AI Spectrum Sharing

- InterDigital, Inc. was awarded a contract by the U.S. Department of War to lead research and demonstrations of advanced spectrum coexistence technologies for both civil and military applications, collaborating with DeepSig and Skylark Wireless on AI-driven solutions for mid-band frequency sharing.

- This initiative leverages InterDigital's proven expertise in wireless and AI technologies to help defense and commercial communications systems operate more efficiently within the same spectrum bands.

- We'll explore how leading a U.S. Department of Defense project in spectrum coexistence could reshape InterDigital's growth outlook and industry role.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

InterDigital Investment Narrative Recap

To see value in InterDigital, you have to believe the company can maintain and expand its licensing revenue beyond the smartphone market, while continuing to lead in wireless standards development. The recently announced U.S. Department of War contract positions InterDigital as a technology leader in spectrum sharing, but its near-term impact on the company’s most important catalyst, the pace and scale of non-smartphone licensing growth, appears limited. However, investors should keep in mind that the biggest risk remains the uncertain pace of revenue contribution from adjacent markets like IoT and automotive, which could lag optimistic projections.

A relevant recent announcement came with the resolution of the Samsung arbitration, leading to an eight-year, over US$1 billion license deal, representing a 67 percent increase over the previous agreement. This not only boosts recurring revenue with the world’s largest smartphone maker but also sets a higher standard for future renewal negotiations, highlighting the size and importance of smartphone royalties as a short-term catalyst compared to the emerging but still unproven opportunities targeted by the new federal contract.

Yet, against this backdrop of strong recurring smartphone revenue, investors should not overlook the challenge of scaling monetization in untapped sectors...

Read the full narrative on InterDigital (it's free!)

InterDigital's outlook projects $633.9 million in revenue and $173.4 million in earnings by 2028. This implies a 10.8% annual decline in revenue and an earnings decrease of $290.1 million from current earnings of $463.5 million.

Uncover how InterDigital's forecasts yield a $328.75 fair value, a 8% downside to its current price.

Exploring Other Perspectives

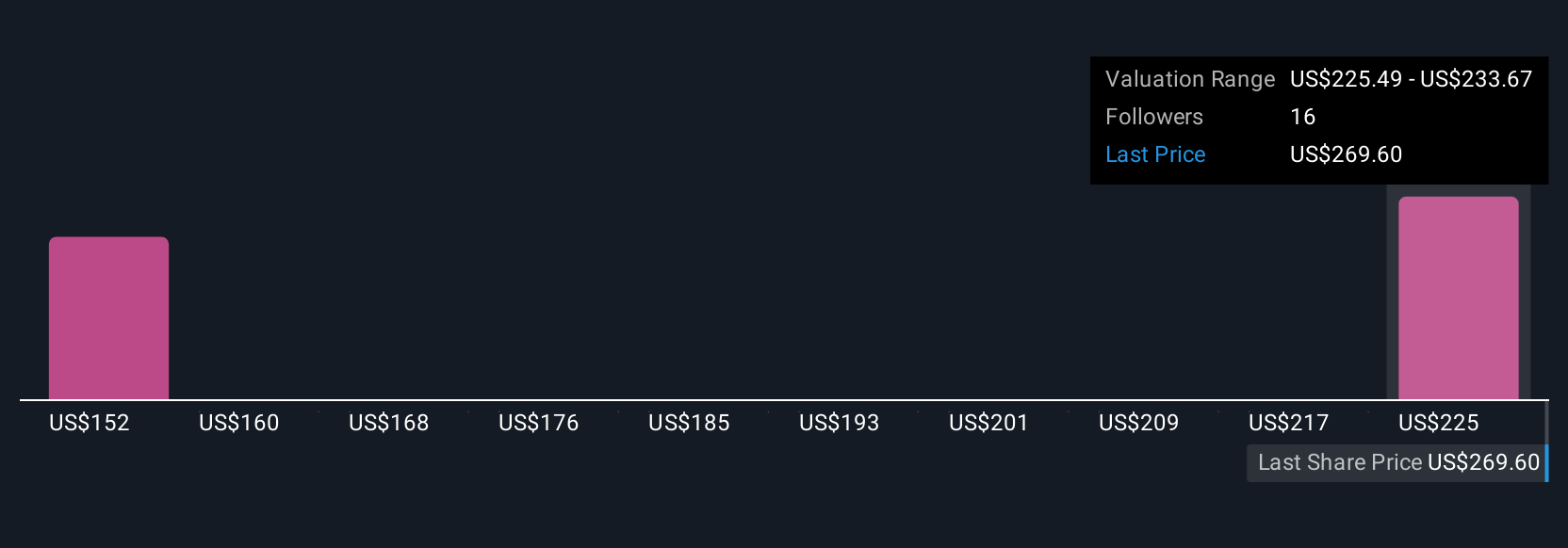

Three fair value estimates from the Simply Wall St Community place InterDigital between US$143 and US$329 per share. Strong smartphone deal momentum contrasts with continued uncertainty about expanding revenue streams beyond existing contracts, pointing to wide variations in how participants assess the company’s future growth.

Explore 3 other fair value estimates on InterDigital - why the stock might be worth as much as $328.75!

Build Your Own InterDigital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your InterDigital research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free InterDigital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate InterDigital's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

CSL Limited: Temporary Headwinds for a Long-Term Healthcare Leader

What IREN's decision to buy over 50,000 NVIDIA GPUs could mean for its future

AI short positioning & India emerging market opportunties

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026