- United States

- /

- Software

- /

- NasdaqGS:IDCC

InterDigital (NASDAQ:IDCC) Is Paying Out A Larger Dividend Than Last Year

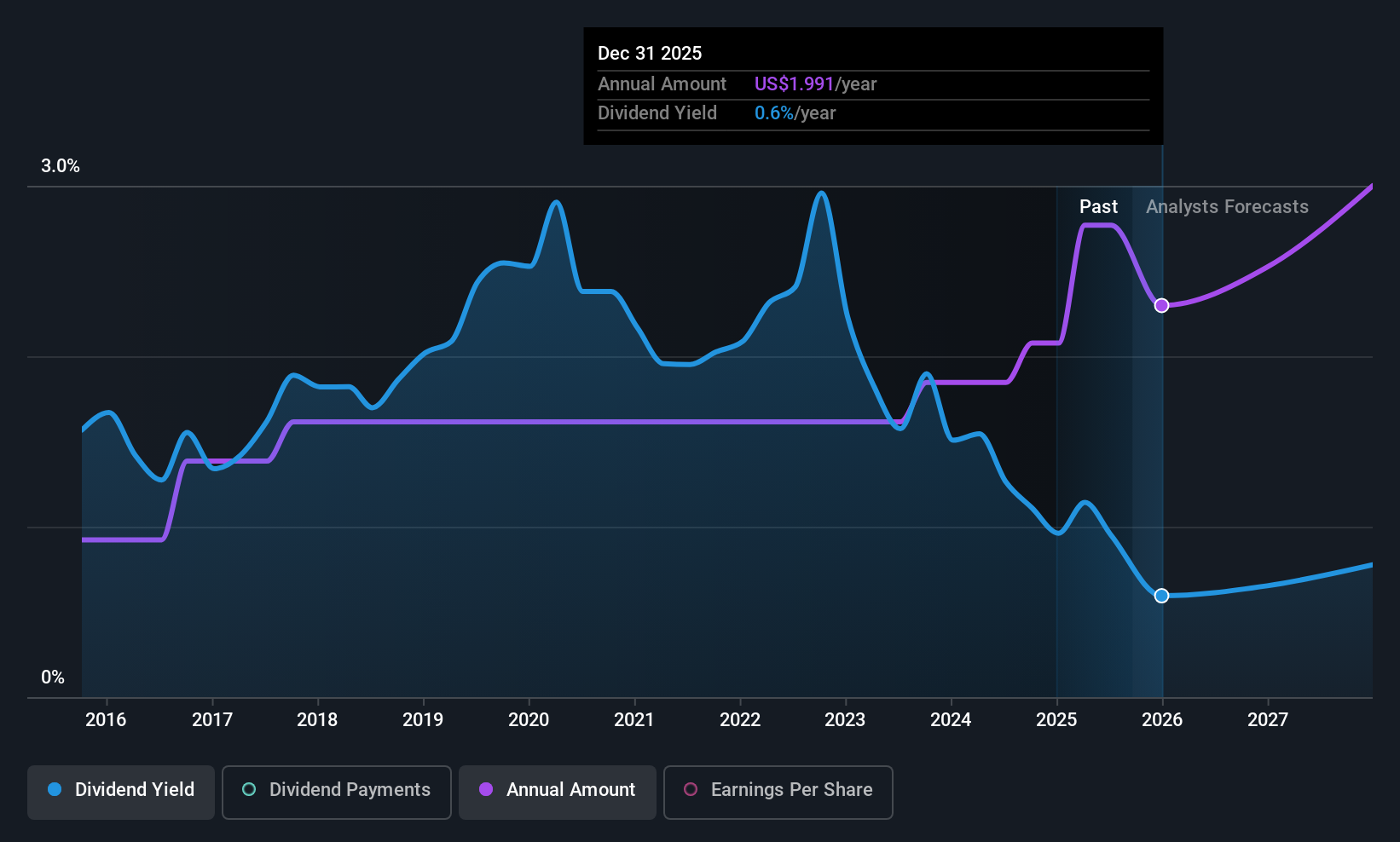

The board of InterDigital, Inc. (NASDAQ:IDCC) has announced that it will be paying its dividend of $0.70 on the 22nd of October, an increased payment from last year's comparable dividend. Based on this payment, the dividend yield for the company will be 0.7%, which is fairly typical for the industry.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that InterDigital's stock price has increased by 44% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

InterDigital's Projected Earnings Seem Likely To Cover Future Distributions

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. Before making this announcement, InterDigital was easily earning enough to cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

Looking forward, earnings per share is forecast to fall by 50.6% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could be 28%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

See our latest analysis for InterDigital

InterDigital Has A Solid Track Record

The company has an extended history of paying stable dividends. Since 2015, the dividend has gone from $0.80 total annually to $2.40. This implies that the company grew its distributions at a yearly rate of about 12% over that duration. We can see that payments have shown some very nice upward momentum without faltering, which provides some reassurance that future payments will also be reliable.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. InterDigital has seen EPS rising for the last five years, at 71% per annum. Rapid earnings growth and a low payout ratio suggest this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

InterDigital Looks Like A Great Dividend Stock

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. The distributions are easily covered by earnings, and there is plenty of cash being generated as well. We should point out that the earnings are expected to fall over the next 12 months, which won't be a problem if this doesn't become a trend, but could cause some turbulence in the next year. All of these factors considered, we think this has solid potential as a dividend stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 2 warning signs for InterDigital that investors should know about before committing capital to this stock. Is InterDigital not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Kratos Defense & Security Solutions (KTOS): Scaling "Attritable" Dominance in a New Era of Aerial Conflict.

BWX Technologies (BWXT): Powering the Nuclear Renaissance from Naval Depths to Medical Frontiers.

Merck & Co. (MRK): Scaling the "Post-Keytruda Hill" Through Diversified Blockbusters.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks