- United States

- /

- Software

- /

- NasdaqGS:IDCC

InterDigital (IDCC): Evaluating Valuation Following Recent Share Price Surge

Reviewed by Kshitija Bhandaru

See our latest analysis for InterDigital.

InterDigital’s share price is on a roll lately, benefiting from building momentum and renewed optimism among investors. While the 1-year total shareholder return stands at a modest 1.5%, it is the sustained gains over the past several months that have people taking a second look. This suggests sentiment around long-term prospects is improving alongside a string of positive results and developments.

If tech’s steady streak has you looking for the next wave, now is a great opportunity to discover fast growing stocks with high insider ownership.

Yet with shares reaching new highs, investors may be wondering whether InterDigital is trading at an attractive valuation, or if the current price already reflects all future growth potential. Could this be a compelling entry point, or has the market priced it in?

Most Popular Narrative: 10% Overvalued

InterDigital's most closely followed valuation narrative signals that the latest fair value estimate of $323.75 sits meaningfully below the last close at $356.10. This creates a contrast between significant recent gains and the rigorous financial assumptions behind the fair value calculation.

The recent 67% uplift in the Samsung license and an all-time high annualized recurring revenue, driven by multi-year agreements with major OEMs, have set highly optimistic expectations for continued outsized growth in future contract renewals. This could potentially inflate valuation multiples and overstate the sustainable revenue trajectory.

Surprised the stock looks expensive even after blockbuster deals? There are bold assumptions about multi-year earnings, revenue declines, and where future profit margins land. Want to see which of these big moving parts really tilt that fair value balance? The full narrative reveals what's propelling and challenging the current valuation.

Result: Fair Value of $323.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected success in non-smartphone licensing and sustained high-margin agreements could quickly shift perceptions regarding InterDigital’s long-term growth potential.

Find out about the key risks to this InterDigital narrative.

Another View: Multiples Suggest Value Compared to Peers

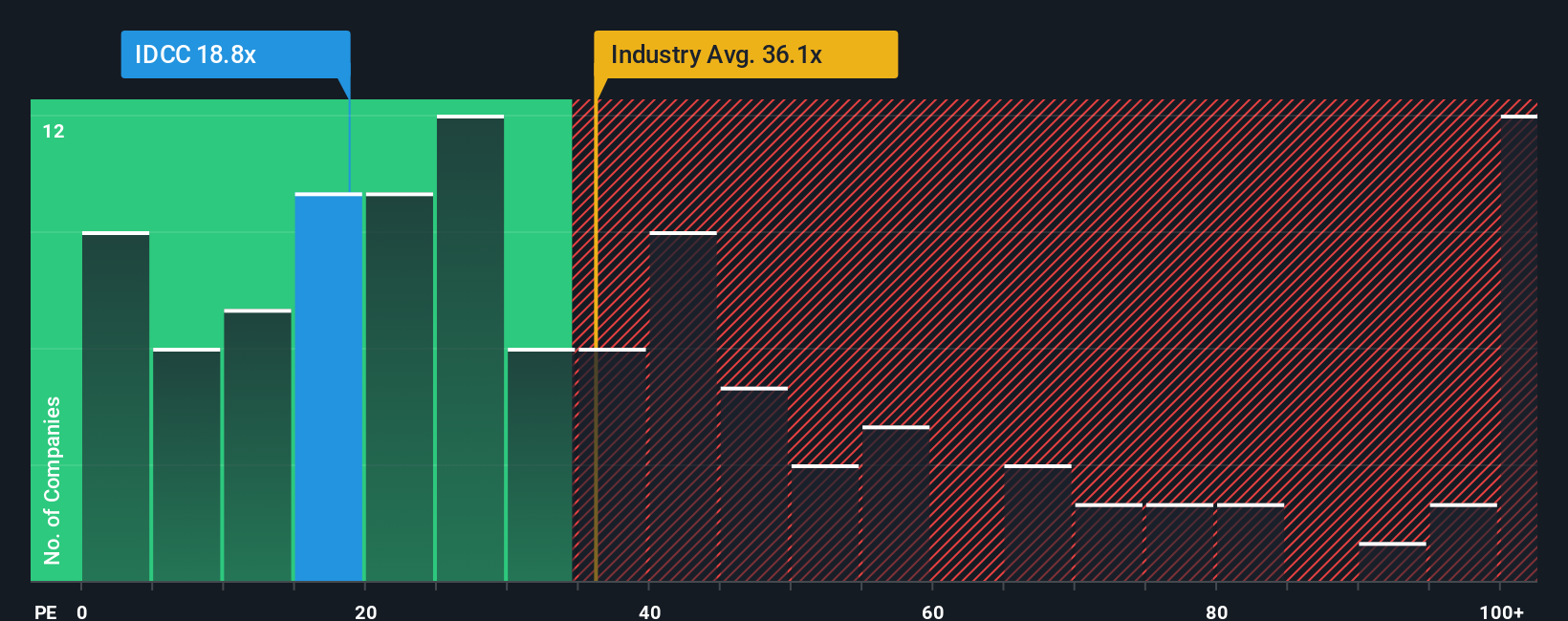

Looking beyond fair value estimates, InterDigital’s price-to-earnings ratio is currently 19.8x. That is considerably lower than both the US Software sector average of 35.5x and its closest peer average of 31.9x, yet it is notably above the fair ratio of 14.9x. This gap highlights room for risk if the market pivots, or potential reward if optimism holds. Do these lower multiples mean the market is underappreciating InterDigital, or is its premium justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own InterDigital Narrative

If you have other ideas or want to dig deeper into the data, you can piece together your own perspective in just a few minutes, so Do it your way.

A great starting point for your InterDigital research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for watching from the sidelines when there are standout opportunities waiting for you? Sharpen your edge with fresh picks across different sectors:

- Catch companies with robust cash flows and upside potential by reviewing these 900 undervalued stocks based on cash flows, which reveals strong prospects at attractive valuations.

- Tap into cutting-edge innovation in medicine and technology with these 31 healthcare AI stocks, and see which businesses are revolutionizing the healthcare landscape.

- Accelerate your search for future leaders by scanning these 3563 penny stocks with strong financials, where agile firms are making big moves in high-growth markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A Quality Compounder Marked Down on Overblown Fears

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion