- United States

- /

- Software

- /

- NasdaqGS:IDCC

How InterDigital’s (IDCC) Upgraded Q3 2025 Guidance Is Shaping Its Investment Story

Reviewed by Sasha Jovanovic

- InterDigital raised its third quarter 2025 earnings guidance, now expecting revenue between US$155 million and US$159 million and diluted EPS between US$1.39 and US$1.56, up from previous forecasts.

- This revised outlook follows increased analyst earnings estimates and strong momentum ratings, highlighting rising confidence in the company’s financial performance.

- We’ll examine how InterDigital’s improved guidance and higher analyst estimates may influence its investment narrative and future expectations.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

InterDigital Investment Narrative Recap

To own shares of InterDigital, one needs confidence in its ability to steadily monetize intellectual property across smartphones and emerging technologies while managing volatile license renewals. The recent upward revision of Q3 2025 guidance bolsters conviction in near-term licensing strength, primarily driven by major agreements, but it does not fully resolve concerns about revenue sustainability as growth in new verticals remains an open question.

The July 2025 announcement of InterDigital’s new eight-year license deal with Samsung is especially relevant, supporting both the recent guidance raise and reinforcing short-term earnings visibility. While this agreement underpins the immediate catalyst of recurring revenue from large OEMs, it’s important to balance optimism with awareness of how future contract renegotiations or regulatory shifts could alter earnings patterns.

On the other hand, investors should be aware that if expectations for rapid expansion into non-smartphone verticals prove overly optimistic…

Read the full narrative on InterDigital (it's free!)

InterDigital's outlook anticipates $633.9 million in revenue and $173.4 million in earnings by 2028. This reflects a 10.8% annual revenue decline and a $290.1 million earnings decrease from current earnings of $463.5 million.

Uncover how InterDigital's forecasts yield a $323.75 fair value, a 5% downside to its current price.

Exploring Other Perspectives

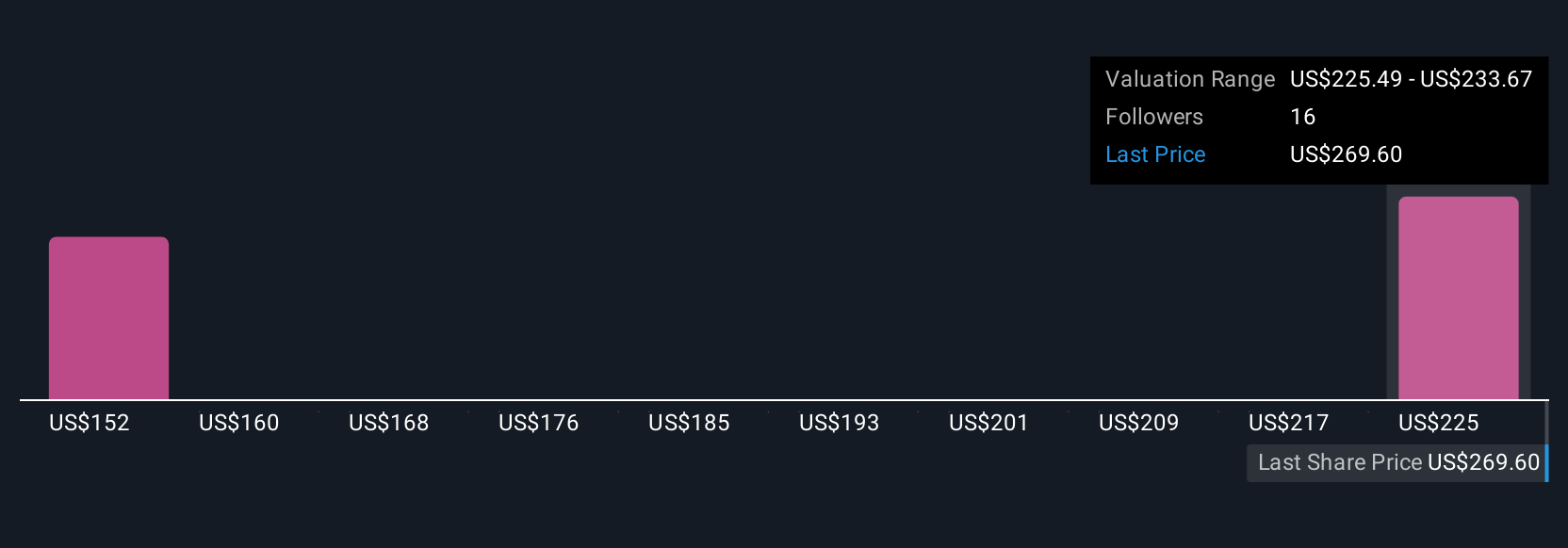

Simply Wall St Community members estimate InterDigital's fair value between US$142.85 and US$323.75, based on three independent assessments. With current guidance fueled by major contract momentum, consider how new verticals could affect future stability and growth.

Explore 3 other fair value estimates on InterDigital - why the stock might be worth as much as $323.75!

Build Your Own InterDigital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your InterDigital research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free InterDigital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate InterDigital's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives