- United States

- /

- Software

- /

- NasdaqGS:IDCC

Expansion Into EV Charging and IoT Could Be a Game Changer for InterDigital (IDCC)

Reviewed by Sasha Jovanovic

- InterDigital, Inc. recently renewed its patent license agreement with Sharp, covering 4G, 5G, Wi-Fi, and HEVC technologies, and announced a new agreement with an electric vehicle charger manufacturer for home and commercial EV chargers.

- These developments mark an expansion into the growing IoT and EV charging sectors, highlighting InterDigital's efforts to diversify its technology licensing portfolio.

- We'll examine how the expansion into EV and IoT markets could influence InterDigital's outlook and investment narrative going forward.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

InterDigital Investment Narrative Recap

To be a shareholder in InterDigital, one typically needs to believe in the company's ability to sustain and expand recurring high-margin licensing revenue, particularly as it moves beyond smartphones into new verticals like IoT and automotive. The renewed agreement with Sharp and the new EV charger manufacturer deal are important for diversifying the licensing base, though these specific developments do not appear material enough to significantly impact the most important short term catalyst, which remains future contract renewals with large OEMs, or the main risk around slower-than-expected monetization of non-smartphone sectors.

The October 21 announcement of the new EV charger manufacturer agreement is especially relevant, as it signals progress in InterDigital’s IoT push, a critical area if the company is to validate the market’s expectations for rapid licensing expansion beyond smartphones. Whether these early steps will translate into a meaningful long-term revenue stream, however, remains closely tied to the pace and scale of actual adoption in those adjacent industries.

However, as investors look closer, the pace of real revenue ramp from new sectors is a risk that ...

Read the full narrative on InterDigital (it's free!)

InterDigital's narrative projects $633.9 million revenue and $173.4 million earnings by 2028. This requires a 10.8% annual revenue decline and a $290.1 million decrease in earnings from $463.5 million today.

Uncover how InterDigital's forecasts yield a $328.75 fair value, a 11% downside to its current price.

Exploring Other Perspectives

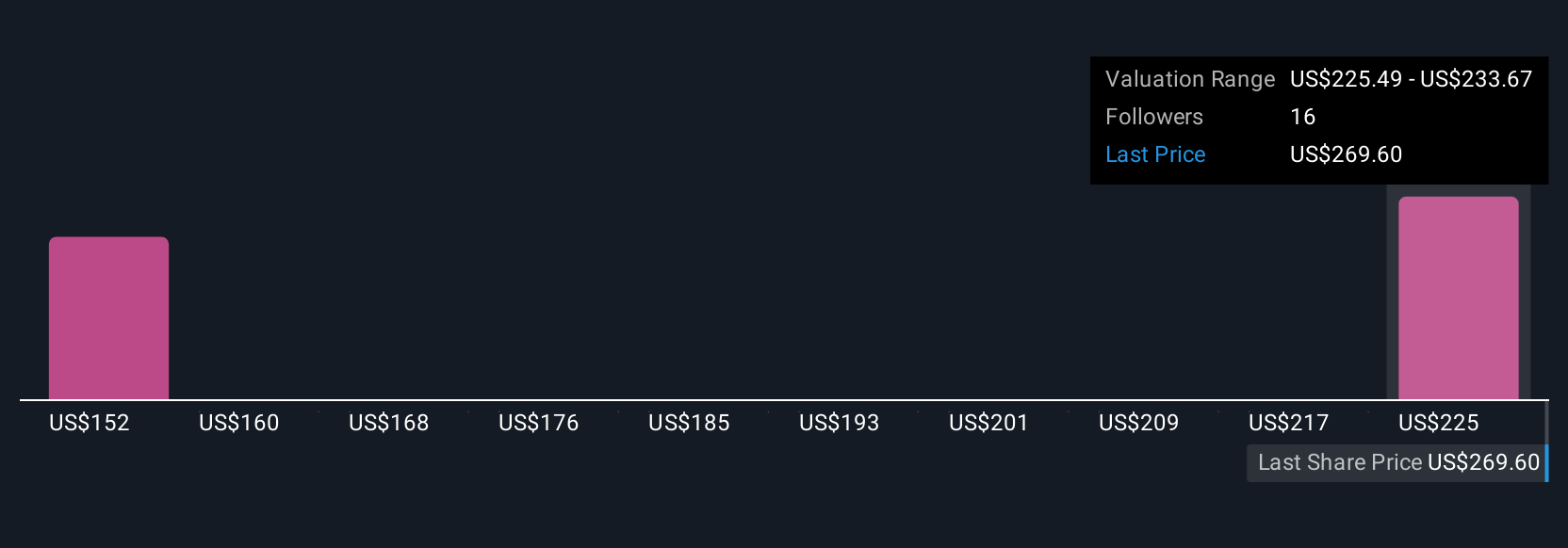

Three members of the Simply Wall St Community estimated fair values for InterDigital from US$143.83 up to US$328.75 per share. While some anticipate robust expansion into non-smartphone segments, others maintain that revenue ramp outside of core licensing could lag, impacting future performance outlooks.

Explore 3 other fair value estimates on InterDigital - why the stock might be worth as much as $328.75!

Build Your Own InterDigital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your InterDigital research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free InterDigital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate InterDigital's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives