- United States

- /

- Software

- /

- NasdaqGS:IDCC

A Look at InterDigital's (IDCC) Valuation Following Legal Win Over Disney in HDR Streaming Tech Dispute

Reviewed by Simply Wall St

InterDigital (IDCC) recently secured a favorable court ruling in Munich, where it was granted an injunction against Disney for unlicensed use of its patented HDR streaming technology. This legal win strengthens InterDigital’s position in the competitive video streaming sector.

See our latest analysis for InterDigital.

InterDigital’s latest court victory comes in a year marked by expanding licensing deals with industry giants like Apple and Samsung. This reinforces the company’s reputation for patent leadership. The share price has increased, delivering an 83.54% return year-to-date and a 1-year total shareholder return of 85.55%, which suggests that momentum is building as investors gain confidence in its recurring revenue and strategic achievements.

If you’re interested in what other innovative tech companies are capturing market attention, this is a great moment to check out See the full list for free..

Yet with the stock already soaring this year, investors have to ask: is InterDigital now undervalued given its growth drivers, or has the market fully priced in its legal and licensing successes?

Most Popular Narrative: 12.6% Undervalued

InterDigital’s most widely followed narrative places its fair value at $412 per share, notably higher than its last close of $359.89. This narrative hinges on recent licensing momentum and ambitious growth assumptions that underpin the current fair value calculation.

The recent 67% uplift in the Samsung license and an all-time high annualized recurring revenue, driven by multi-year agreements with major OEMs, have set highly optimistic expectations for continued outsized growth in future contract renewals. This could potentially inflate valuation multiples and overstate sustainable revenue trajectory.

Wondering which huge financial assumptions allow for such a bold fair value? The narrative is powered by forecasts of shrinking margins, falling earnings, and a valuation multiple that would turn heads, even among tech stalwarts. You won’t believe the quantitative leap the narrative expects. See the numbers for yourself and discover the tension between historic performance and these striking new projections.

Result: Fair Value of $412 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower revenue diversification beyond smartphones or regulatory changes to global licensing standards could quickly challenge the current optimism surrounding InterDigital’s valuation.

Find out about the key risks to this InterDigital narrative.

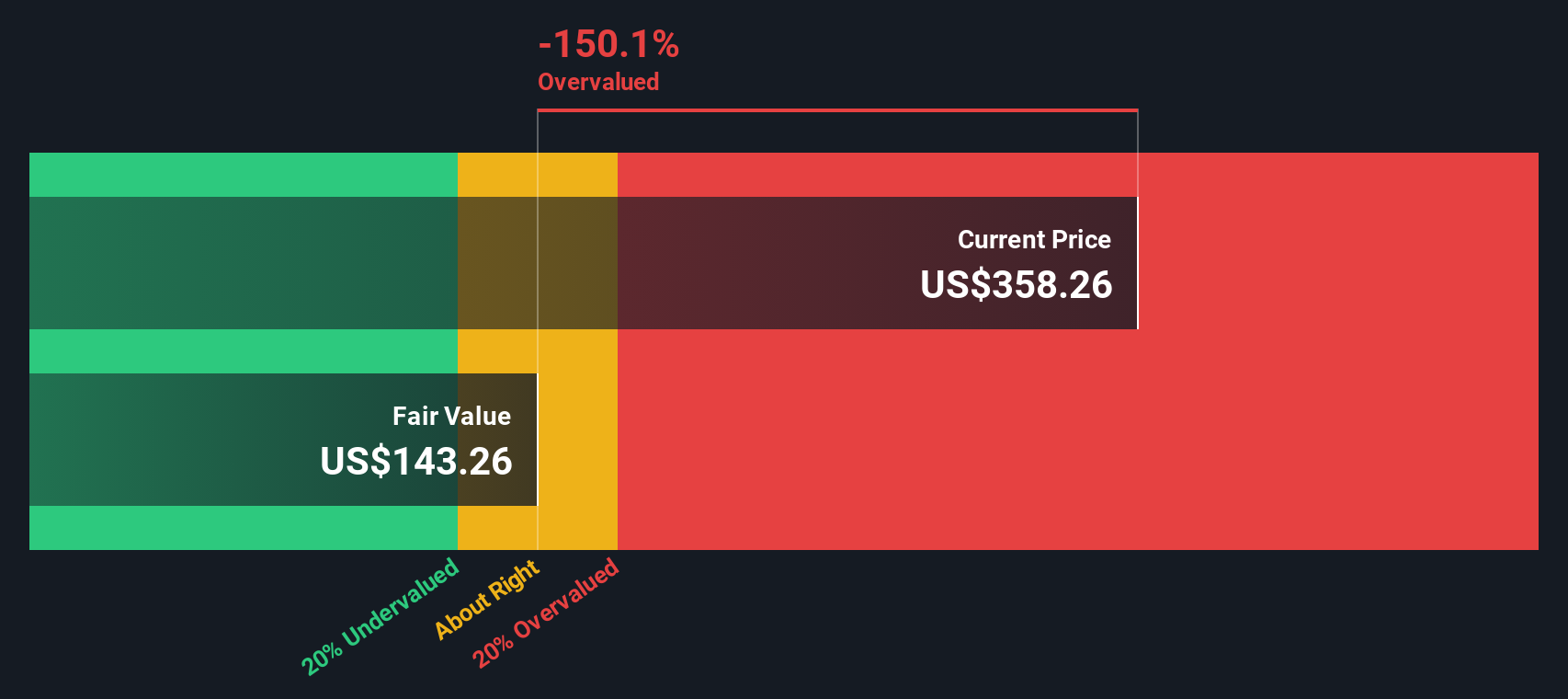

Another View: The SWS DCF Model Tells a Different Story

While the market buzz is around strong licensing momentum and lofty price targets, our SWS DCF model presents a much more conservative outlook. According to this method, InterDigital is trading well above its estimated fair value, raising tough questions about the sustainability of recent gains. Which narrative fits reality best?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out InterDigital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own InterDigital Narrative

If you see the story differently or want to dive deeper into the data, you can craft your own InterDigital narrative in just a few minutes. Do it your way.

A great starting point for your InterDigital research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You're missing out if you’re not matching your strategy to the market’s smartest opportunities. Don’t get left behind as others spot tomorrow’s winners today.

- Boost your growth potential by reviewing these 25 AI penny stocks, which are positioned to benefit from groundbreaking advancements in artificial intelligence and automation.

- Unlock reliable income streams by scanning these 15 dividend stocks with yields > 3%, featuring stocks with impressive yields and strong financial health for long-term returns.

- Get ahead of Wall Street by assessing these 82 cryptocurrency and blockchain stocks, which are expected to redefine digital payments and blockchain innovation in the coming years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.