- United States

- /

- Software

- /

- NasdaqGS:HUT

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

The recent surge in the U.S. stock market, driven by a temporary easing of trade tensions between the U.S. and China, has seen key indices like the Dow Jones Industrial Average and Nasdaq Composite experience significant gains, particularly benefiting tech stocks. In this buoyant environment, identifying high-growth tech stocks involves looking at companies that are well-positioned to capitalize on technological advancements and market opportunities while demonstrating resilience amid economic fluctuations.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 27.47% | 39.60% | ★★★★★★ |

| Ardelyx | 20.57% | 59.97% | ★★★★★★ |

| AVITA Medical | 27.69% | 85.07% | ★★★★★★ |

| Clene | 65.19% | 67.34% | ★★★★★★ |

| Travere Therapeutics | 28.83% | 64.80% | ★★★★★★ |

| TG Therapeutics | 25.99% | 38.42% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.67% | 61.11% | ★★★★★★ |

| Lumentum Holdings | 21.54% | 110.32% | ★★★★★★ |

| Alkami Technology | 22.46% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

Click here to see the full list of 237 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

CarGurus (NasdaqGS:CARG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CarGurus, Inc. operates an online automotive platform for buying and selling vehicles in the United States and internationally, with a market capitalization of approximately $3.07 billion.

Operations: The company generates revenue primarily from its U.S. Marketplace segment, which accounts for $755.93 million, and its Digital Wholesale segment, contributing $82.13 million.

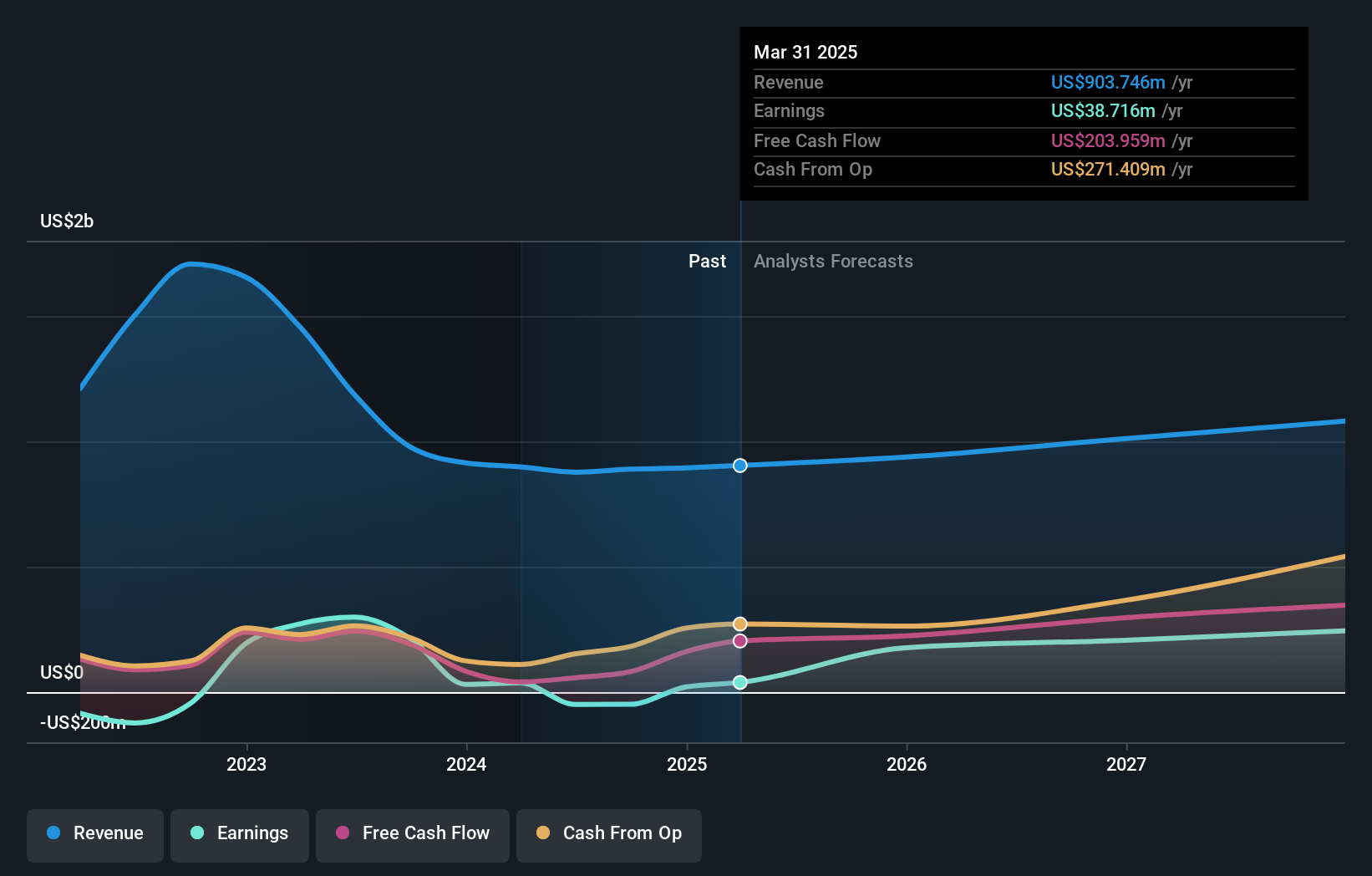

CarGurus, Inc. has demonstrated robust financial performance with a notable rebound in its quarterly earnings, as Q1 2025 saw net income soaring to $39.05 million from $21.3 million the previous year, alongside an increase in sales from $187.22 million to $212.24 million. This growth trajectory is underpinned by strategic executive shifts, with CEO Jason Trevisan taking on additional financial oversight roles, potentially steering the company through innovative fiscal strategies and operational efficiencies. Despite facing challenges like a one-off loss of $144.4M affecting past earnings quality and revenue growth forecasts trailing behind the U.S market at 6.9% annually versus 8.4%, CarGurus is poised for significant earnings expansion at an expected annual rate of 32.5%. These dynamics suggest a resilient adaptability and potential for sustained profitability within the competitive tech landscape.

- Unlock comprehensive insights into our analysis of CarGurus stock in this health report.

Gain insights into CarGurus' historical performance by reviewing our past performance report.

Hut 8 (NasdaqGS:HUT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hut 8 Corp. is a vertically integrated operator of energy infrastructure and Bitcoin mining in North America, with a market cap of $1.45 billion.

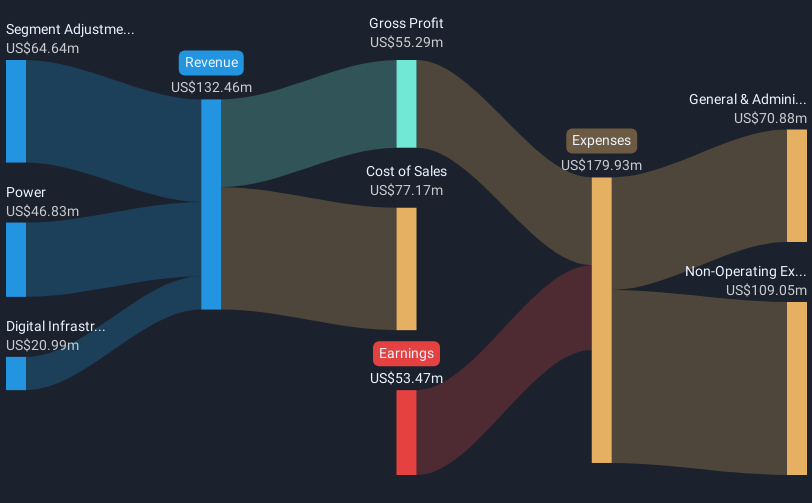

Operations: The company generates revenue primarily through its power and digital infrastructure segments, with $46.83 million from power and $20.99 million from digital infrastructure.

Despite a challenging Q1 2025, where Hut 8 reported a net loss of $133.89 million and a significant drop in revenue to $21.82 million from the previous year's $51.74 million, the company is positioning itself strategically within the tech sector through its new venture, American Bitcoin. This initiative focuses on industrial-scale Bitcoin mining and marks a pivotal shift in Hut 8's business model following its majority stake acquisition in American Data Centers Inc., now rebranded as American Bitcoin. The move underlines Hut 8’s commitment to innovating within the cryptocurrency mining industry despite recent financial volatilities, aiming to leverage technological advancements for future growth.

- Delve into the full analysis health report here for a deeper understanding of Hut 8.

Evaluate Hut 8's historical performance by accessing our past performance report.

TaskUs (NasdaqGS:TASK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TaskUs, Inc. offers outsourced digital services to companies across the Philippines, the United States, India, and other international markets with a market capitalization of approximately $1.52 billion.

Operations: TaskUs specializes in providing outsourced digital services, focusing on customer support and content moderation for global clients. The company generates revenue primarily from service fees charged to its clients across various geographical markets.

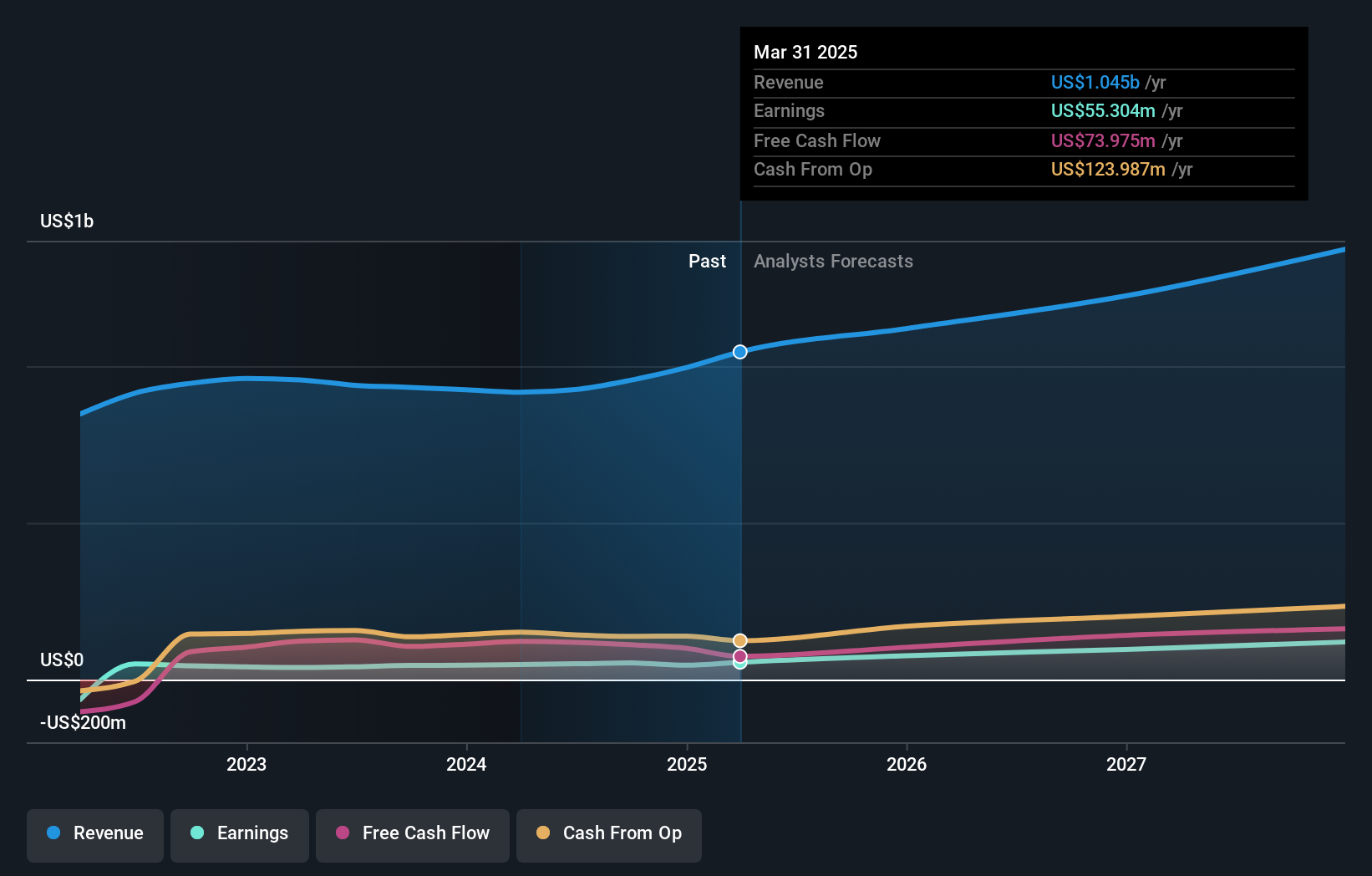

TaskUs has demonstrated a robust performance in Q1 2025 with net income rising to $21.15 million from $11.71 million the previous year, reflecting a notable increase in profitability and operational efficiency. This growth is underpinned by strategic expansions such as the recent launch of its Agentic AI Consulting practice, which positions the company at the forefront of AI-driven business process optimization. Moreover, TaskUs's deepening engagement with high-profile clients through advanced AI solutions underscores its commitment to integrating cutting-edge technology across various industries. The company's ability to nearly double its earnings per share from continuing operations year-over-year, combined with a significant buyout offer from an affiliate of Blackstone at $16.50 per share, signals strong confidence in its future trajectory and strategic direction within the tech sector.

- Take a closer look at TaskUs' potential here in our health report.

Review our historical performance report to gain insights into TaskUs''s past performance.

Where To Now?

- Get an in-depth perspective on all 237 US High Growth Tech and AI Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hut 8 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HUT

Hut 8

Operates as a vertically integrated operator of energy infrastructure and Bitcoin miners in North America.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives