- United States

- /

- Software

- /

- NasdaqCM:GRRR

Gorilla Technology Group (NasdaqCM:GRRR): Valuation Spotlight After Landmark AI Data Centre Partnership with Freyr

Reviewed by Kshitija Bhandaru

Gorilla Technology Group (NasdaqCM:GRRR) just finalized a three-year, $1.4 billion partnership with Freyr to build a network of AI-driven data centres in Southeast Asia. The project will begin with a $300 million launch phase next quarter.

See our latest analysis for Gorilla Technology Group.

The scale of Gorilla Technology Group's new AI data centre deal comes as the company's recent 1-year total shareholder return sits at just over 4%, pointing to steady rather than explosive gains even after the news. Momentum has been relatively modest lately; however, this partnership hints the market could be reassessing Gorilla's growth story.

If this kind of strategic move has you curious about what else is on the rise, it’s worth discovering See the full list for free.

With shares trading well below analyst price targets and recent gains remaining modest, the question now is whether Gorilla Technology Group is offering an undervalued entry point, or if the market has already accounted for its next chapter of growth.

Most Popular Narrative: 43.4% Undervalued

With Gorilla Technology Group's fair value estimate at $36.50, well above the recent close of $20.67, the stage is set for major upside if growth materializes. This difference spotlights big expectations. Now let's hear what drives the most popular narrative behind that bullish outlook.

Expansion and deepening of multiyear contracts in smart city, government, logistics, and environmental monitoring projects across diverse regions, including Taiwan, the U.K., Middle East, Southeast Asia, and nascent entry into the U.S., are increasing revenue visibility and creating recurring, high-margin revenue streams, pointing toward sustainable top-line growth and improved operating leverage. Robust demand for AI-driven security and analytics solutions, supported by rapidly growing adoption of digital transformation and the exponential rise of connected devices (IoT), is expanding Gorilla's addressable market; solidifying its position as a preferred vendor and positioning the company for accelerated revenue growth.

What secret assumptions are fueling this massive gap to the fair value? The narrative leans on bold growth pivots, margin leaps, and a financial comeback. Are you curious which forecasts make up the backbone of this price target? Only reading the full narrative will reveal the standout numbers and the bold strategies they are wagering on.

Result: Fair Value of $36.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on large, multi-year contracts and the risk of shareholder dilution from future equity raises could quickly shift the market's optimism.

Find out about the key risks to this Gorilla Technology Group narrative.

Another View: Are Shares Really a Bargain?

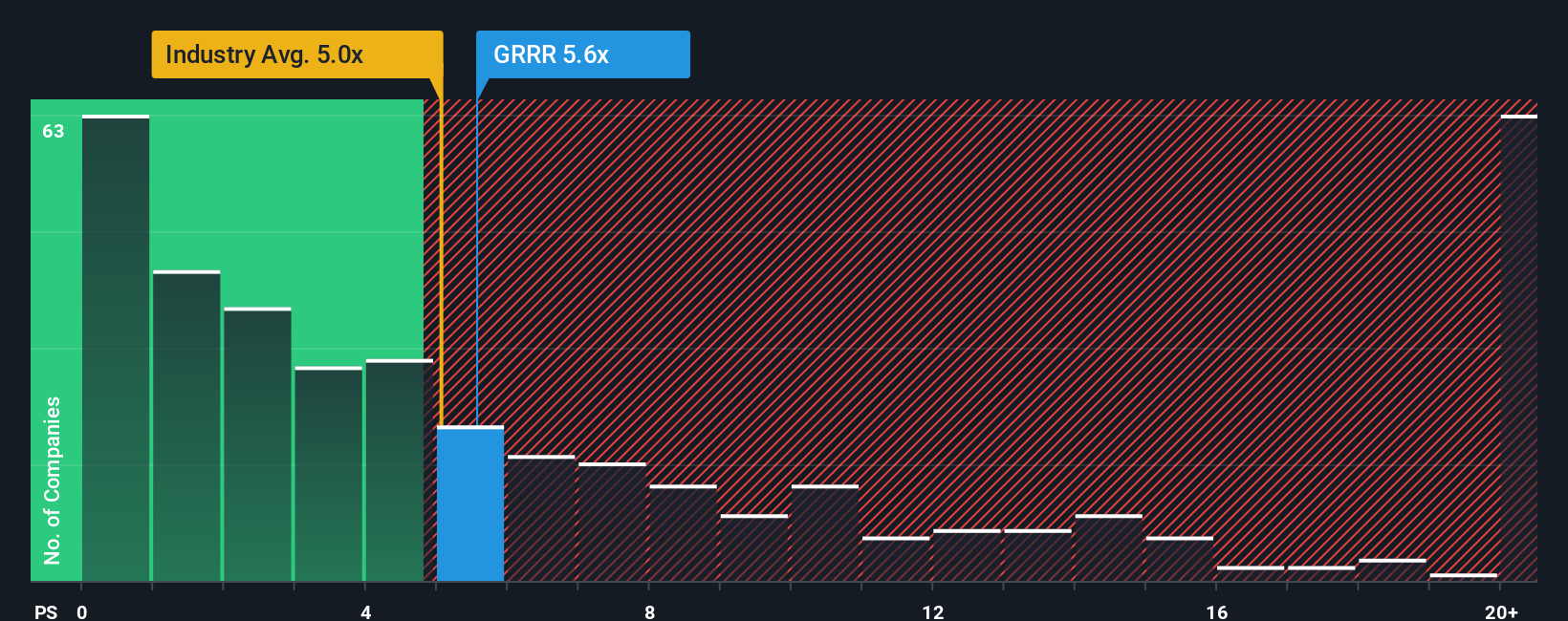

While analyst narratives point to big upside, Gorilla Technology Group’s price-to-sales multiple stands at 6.3x, which is much steeper than both its peers (4.2x) and the broader US Software industry (5.3x). Even when compared to its fair ratio of 5.3x, shares look expensive. Does this premium signal a pricing risk if growth slows, or could it reflect hidden opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gorilla Technology Group Narrative

If you think there’s another angle to the story, why not dive into the numbers yourself and put together your own take in just a few minutes: Do it your way.

A great starting point for your Gorilla Technology Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors don't limit themselves to a single opportunity. Expand your potential by checking out top stocks in other fast-growing themes. These are too good to overlook.

- Spot game-changing value by tracking these 895 undervalued stocks based on cash flows based on robust cash flow analysis and market mispricing.

- Capture the AI edge by finding innovation leaders through these 25 AI penny stocks shaping artificial intelligence and automation trends worldwide.

- Get ahead of the next leap in digital money by scanning these 78 cryptocurrency and blockchain stocks for real growth in the cryptocurrency and blockchain ecosystem.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GRRR

Gorilla Technology Group

Provides solutions in security, network, business intelligence, and Internet of Things (IoT) technology in Taiwan and the United Kingdom.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives