- United States

- /

- Software

- /

- NasdaqGS:GEN

Gen Digital (GEN): Evaluating Valuation as Norton Unveils New Cybersecurity Enhancements for Small Business

Reviewed by Simply Wall St

Gen Digital (GEN) is stepping up its fight against cyber threats with the introduction of new Dark Web Monitoring and Social Media Monitoring features for its Norton Small Business platform. Announced amidst a surge in data breaches and scams targeting small businesses, this upgrade aims to provide more proactive, real-time security. For investors, the timing could be especially intriguing. These features are rolling out as Gen’s own threat report highlights a double-digit spike in attacks, suggesting Norton is responding directly to market demands and pain points.

This announcement comes after a year of share price momentum for Gen Digital. The stock has delivered an impressive 18% total return over the past twelve months, building on a multi-year run that has seen over 40% growth in three years and more than 56% over five years. While the past month showed a slight pullback, the longer-term trend remains positive, hinting at enduring confidence in the company’s evolving product lineup and ability to adapt to emerging digital threats. The launch itself fits into a broader pattern of continual feature upgrades and ongoing revenue and profit growth, with annual net income up 14% and revenue growth steadily advancing.

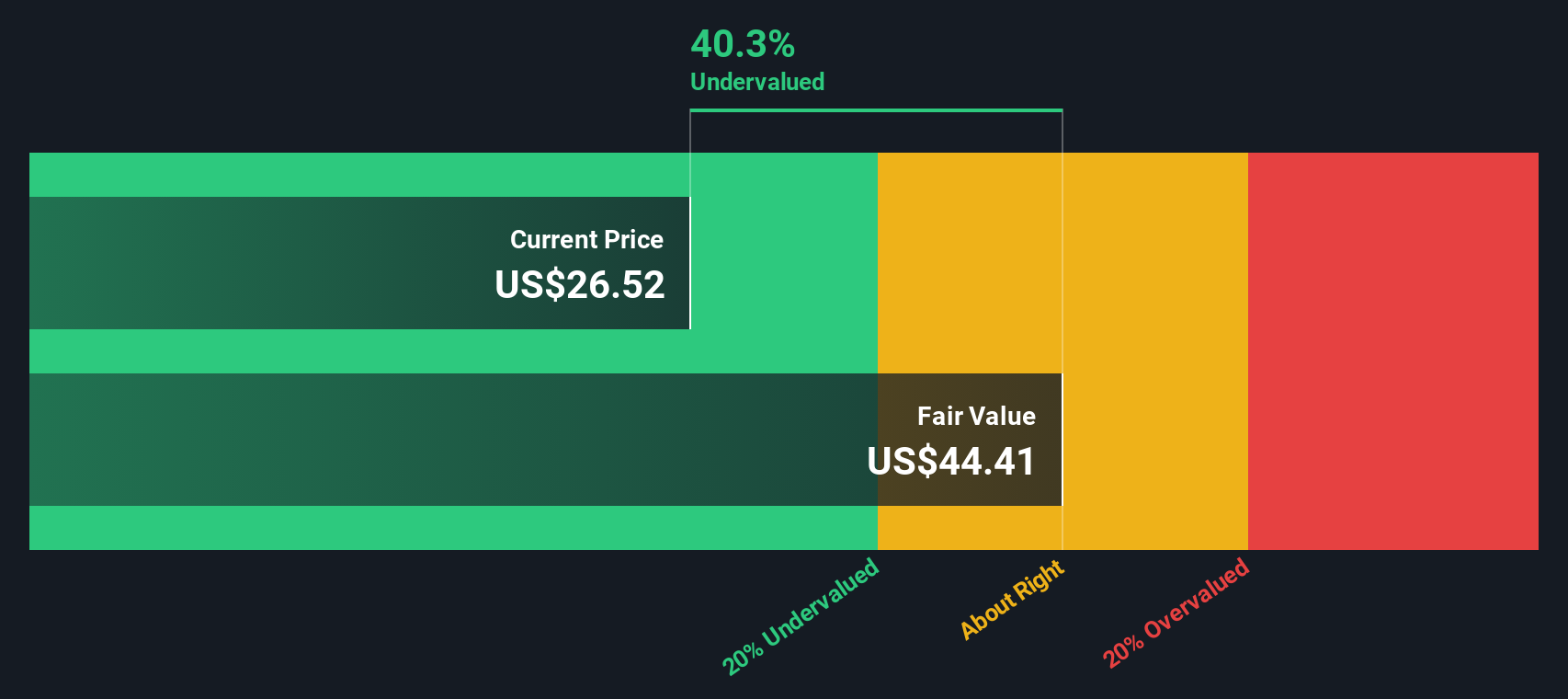

Given Gen Digital’s expanding security offerings and the expectations for future digital risks, the key question is whether there is still upside at current prices or if the stock’s growth is already reflected in its valuation.

Most Popular Narrative: 13.6% Undervalued

According to the most widely followed narrative, Gen Digital appears undervalued based on projected earnings, revenue growth, and margin expansion, suggesting meaningful upside potential from current prices.

The transition to a high-margin, recurring-revenue subscription model, now bolstered by MoneyLion's rapidly scaling, soon-to-be-membership-based financial wellness business, enhances revenue predictability, boosts ARPU, and expands operating margins. There is further upside potential as financial wellness features and cross-segment bundling are incorporated into the core offering.

Want to know what’s fueling this optimism? This narrative banks on aggressive revenue and profit margin growth, plus a premium profit multiple that not every tech stock can claim. Curious how recurring income, platform innovation, and market expansion are expected to power this valuation? The full narrative breaks down the big financial levers behind the target price. Take a look and see what could drive the next leg up for Gen Digital.

Result: Fair Value of $34.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising competition and challenges with integrating recent acquisitions could put pressure on Gen Digital's growth and may test the bullish outlook.

Find out about the key risks to this Gen Digital narrative.Another View: Discounted Cash Flow Puts More Spotlight on Undervaluation

Taking a different angle, the SWS DCF model also signals that Gen Digital is currently undervalued. DCF analysis looks beyond earnings multiples by weighing actual cash flows and future growth. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Gen Digital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Gen Digital Narrative

If you have a different outlook or want to dig deeper into the numbers yourself, you can piece together your own narrative in just a few minutes. Do it your way.

A great starting point for your Gen Digital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your horizons and give your portfolio an edge by tapping into new investment angles that others might overlook. These standout opportunities could set you apart from the crowd. Don’t let your next smart move pass you by.

- Amplify your returns by uncovering unique value plays with opportunities among undervalued stocks based on cash flows.

- Strengthen your passive income by targeting companies that consistently offer robust yields through dividend stocks with yields > 3%.

- Take advantage of unstoppable tech by positioning yourself in innovative breakthroughs within AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:GEN

Gen Digital

Engages in the provision of cyber safety solutions for or individuals, families, and small businesses.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026