- United States

- /

- IT

- /

- NasdaqCM:GDYN

How the Story Around Grid Dynamics Is Evolving Amid AI Sector Shifts and Growth Prospects

Reviewed by Simply Wall St

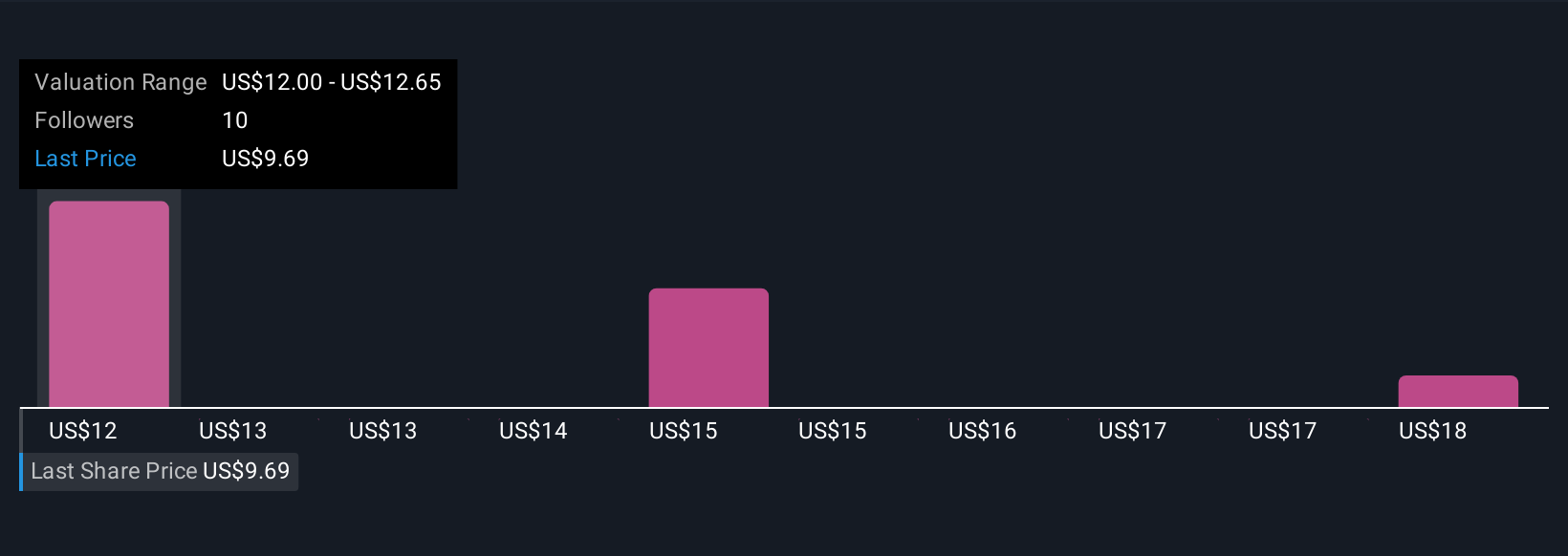

Grid Dynamics Holdings has seen its consensus analyst price target ease from $13.75 to $13.20. This reflects recent shifts in sentiment. While some investors are cautious due to current AI-related concerns affecting the sector, many analysts believe these issues are temporary and that the company's fundamentals remain attractive. Stay tuned to learn how you can keep up with the evolving narrative and future updates on Grid Dynamics Holdings.

What Wall Street Has Been Saying

🐂 Bullish Takeaways

- Analysts with a positive outlook argue that the current AI-related concerns are likely to fade. They view these issues as transitory rather than reflective of long-term challenges for Grid Dynamics Holdings.

- Many on the Street highlight Grid Dynamics's historically attractive valuation and note that recent volatility has created unique entry points for investors expecting a recovery in sentiment.

- Bullish research underscores robust execution, disciplined cost control, transparency in reporting, and a clear growth momentum as key drivers for sustained performance. Consensus estimates project organic growth in the high single digits this year, with acceleration to low double digits next year.

- Several analysts, including those from Street Research with a recent update on September 22, 2025, continue to support a Buy rating by citing the company's improving fundamentals and significant upside to price targets.

🐻 Bearish Takeaways

- Bears on the name remain cautious and point to lingering uncertainty in the AI sector as well as its near-term effects on Grid Dynamics's business outlook.

- Valuation, while attractive to some, is seen by more skeptical analysts as reflective of already priced-in upside and potential risks if industry recovery is slower than expected.

- Some research firms note that recent price target revisions, including the reduction from $13.75 to $13.20, mirror broader sector pressure and emphasize the need for continued caution.

- The main reservations expressed involve short-term demand softness and the company’s reliance on broader industry recovery trends.

What's in the News

- Grid Dynamics Holdings announced the launch of the Temporal Agentic AI Platform in collaboration with Temporal Technologies. This new platform helps enterprises build scalable and reliable AI solutions, providing enhanced observability and seamless integration with existing systems.

- The company issued Q3 and full-year 2025 financial guidance, projecting third-quarter revenue between $103 and $105 million and full-year revenue in the range of $415 to $435 million. These projections reflect strong year-over-year growth of 18.4 percent to 24.1 percent.

- Grid Dynamics supported SmartRay in deploying a new AI-powered software platform designed for robotic weld inspection. The solution aims to streamline automation, lower costs, and accelerate programming workflows for global manufacturing clients.

How This Changes the Fair Value For Grid Dynamics Holdings

- The Consensus Analyst Price Target has fallen slightly from $13.75 to $13.20.

- The Net Profit Margin for Grid Dynamics Holdings has significantly risen from 1.73% to 3.02%.

- The Future P/E for Grid Dynamics Holdings has significantly fallen from 191.40x to 105.84x.

🔔 Never Miss an Update: Follow The Narrative

Narratives are a smarter, more vibrant way to invest. They connect a company’s story to realistic forecasts and a fair value, all powered by community insights on Simply Wall St. Narratives help you make buy or sell decisions by comparing a company’s estimated fair value to its current price, and are continuously updated as new news or results emerge.

Discover the full story behind Grid Dynamics Holdings and follow the evolving narrative here to stay ahead on:

- How Grid Dynamics’s early leadership in enterprise AI and international partnerships are driving future growth opportunities and recurring revenues across industries.

- The potential rewards and real risks, from global expansion and rising margins to client concentration and fast-changing AI sector trends.

- Live, community-driven updates on revenue forecasts, profit margins, and what analysts think the stock is truly worth so you always know when the story shifts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GDYN

Grid Dynamics Holdings

Provides technology consulting, platform and product engineering, and analytics services in North America, Europe, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion