- United States

- /

- IT

- /

- NasdaqGM:GDS

Revisiting GDS Holdings (NasdaqGM:GDS) Valuation After New Institutional Backing and AI Growth Tailwinds

Reviewed by Simply Wall St

GDS Holdings (NasdaqGM:GDS) is back on institutional radar, with Baron Emerging Markets Fund reinitiating its position just as Goldman Sachs elevates cloud and data centers, including GDS, to favored status amid accelerating AI demand.

See our latest analysis for GDS Holdings.

Those endorsements seem to be resonating, with the share price at $36.23 and a robust year to date share price return of 56.3 percent. A 73.9 percent one year total shareholder return suggests momentum in the story is clearly building despite some volatility along the way.

If this AI and cloud driven move has caught your attention, it could be a good moment to explore other potential winners across high growth tech and AI stocks as the theme broadens out.

With AI driven demand surging, analyst targets implying upside, and a new REIT platform expected to unlock value, is GDS still trading at a discount to its long term cash flow potential, or is future growth already priced in?

Most Popular Narrative: 24.9% Undervalued

With GDS Holdings last closing at $36.23 against a narrative fair value near $48, the valuation story hinges on aggressive long term cash flow potential.

The successful implementation of China's first data center ABS and C-REIT IPOs has pioneered a pathway for GDS to repeatedly recycle capital at cap rates (and multiples) well above the company's own market valuation, allowing the company to fund new growth while improving leverage and enhancing ROIC, supporting stronger net earnings over time.

Want to see what happens when rapid revenue expansion, higher margins, and a lofty future earnings multiple all come together in one model? The narrative’s cash flow math is far bolder than the current share price suggests. Curious which assumptions really stretch the valuation ceiling, and which are surprisingly conservative? Read on to uncover the full playbook behind that upside.

Result: Fair Value of $48.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure and ongoing reliance on capital recycling could quickly undermine the upside case if demand or funding conditions weaken.

Find out about the key risks to this GDS Holdings narrative.

Another View on Value

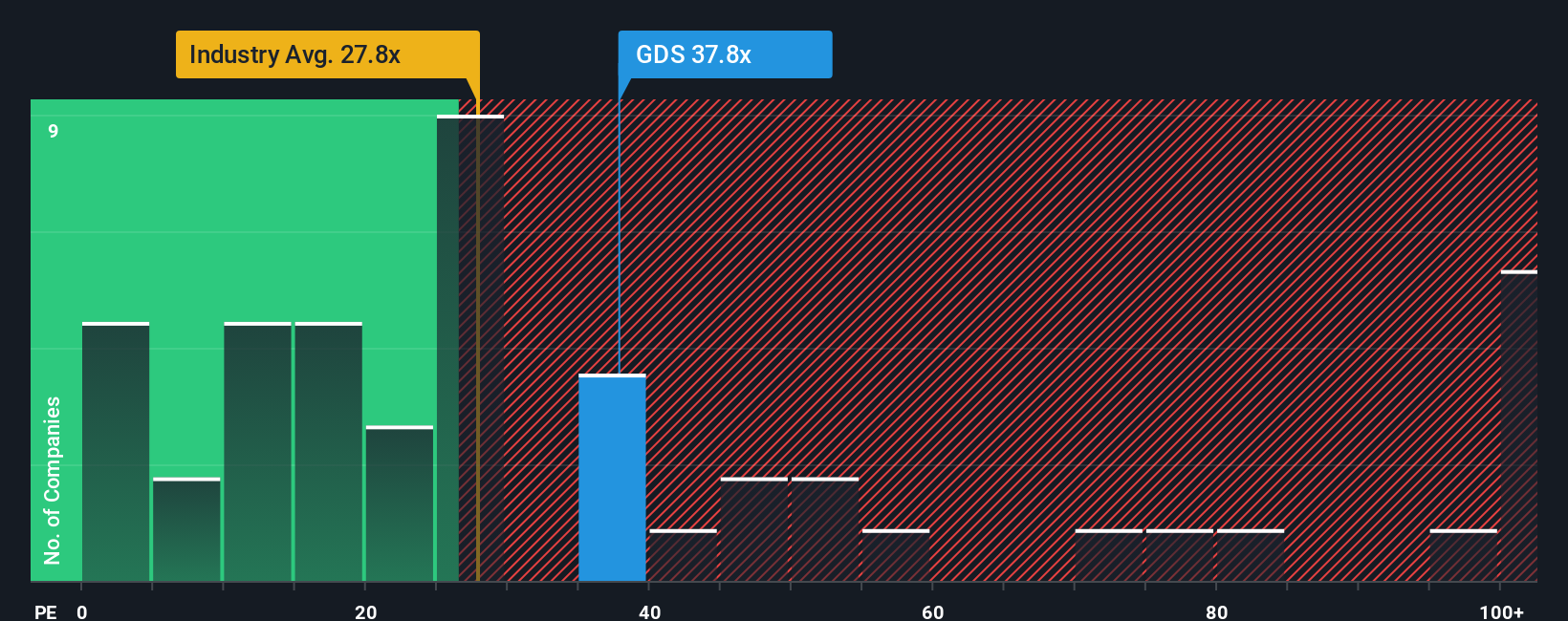

While the narrative fair value points to upside, our valuation using a single earnings ratio paints a tougher picture. GDS trades on about 44 times earnings, far richer than both the US IT sector at roughly 30.9 times and peers at 26.3 times, and even above a fair ratio of 22.5 times that the market could eventually gravitate toward. This raises the risk that sentiment, not fundamentals, may have to work much harder from here. How comfortable are you paying a growth multiple that already bakes in so much of tomorrow?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GDS Holdings Narrative

If you see the numbers differently or want to dig into the assumptions yourself, you can build a personalized view in under three minutes: Do it your way.

A great starting point for your GDS Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning targeted stock ideas that match your style, so you are not chasing yesterday's winners and can identify your next potential opportunity.

- Explore potential mispricing by reviewing these 909 undervalued stocks based on cash flows, where strong cash flow analysis suggests the market has not fully recognized the underlying value.

- Participate in the AI theme by focusing on these 25 AI penny stocks that are positioned to benefit directly from adoption and related infrastructure spending.

- Support your passive income plan by targeting these 12 dividend stocks with yields > 3% that offer attractive yields while seeking to maintain balance sheet quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GDS

GDS Holdings

Develops and operates data centers in the People's Republic of China.

Low risk with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion