- United States

- /

- IT

- /

- NasdaqGM:GDS

High Growth Tech Stocks To Watch In The US April 2025

Reviewed by Simply Wall St

As the United States market grapples with mixed performances across major indices, with the S&P 500 and Nasdaq showing slight gains while the Dow Jones Industrial Average tumbles, investors are keeping a close eye on high-growth tech stocks amid concerns about tariffs and economic outlook. In this environment, identifying promising tech stocks requires careful consideration of their adaptability to regulatory changes and their potential for innovation in a rapidly evolving sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.44% | 29.79% | ★★★★★★ |

| Arcutis Biotherapeutics | 25.76% | 58.17% | ★★★★★★ |

| TG Therapeutics | 26.03% | 37.60% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Travere Therapeutics | 28.65% | 66.06% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.72% | 58.76% | ★★★★★★ |

| TKO Group Holdings | 22.48% | 25.17% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Lumentum Holdings | 21.61% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.85% | 59.72% | ★★★★★★ |

Click here to see the full list of 232 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

GDS Holdings (NasdaqGM:GDS)

Simply Wall St Growth Rating: ★★★★☆☆

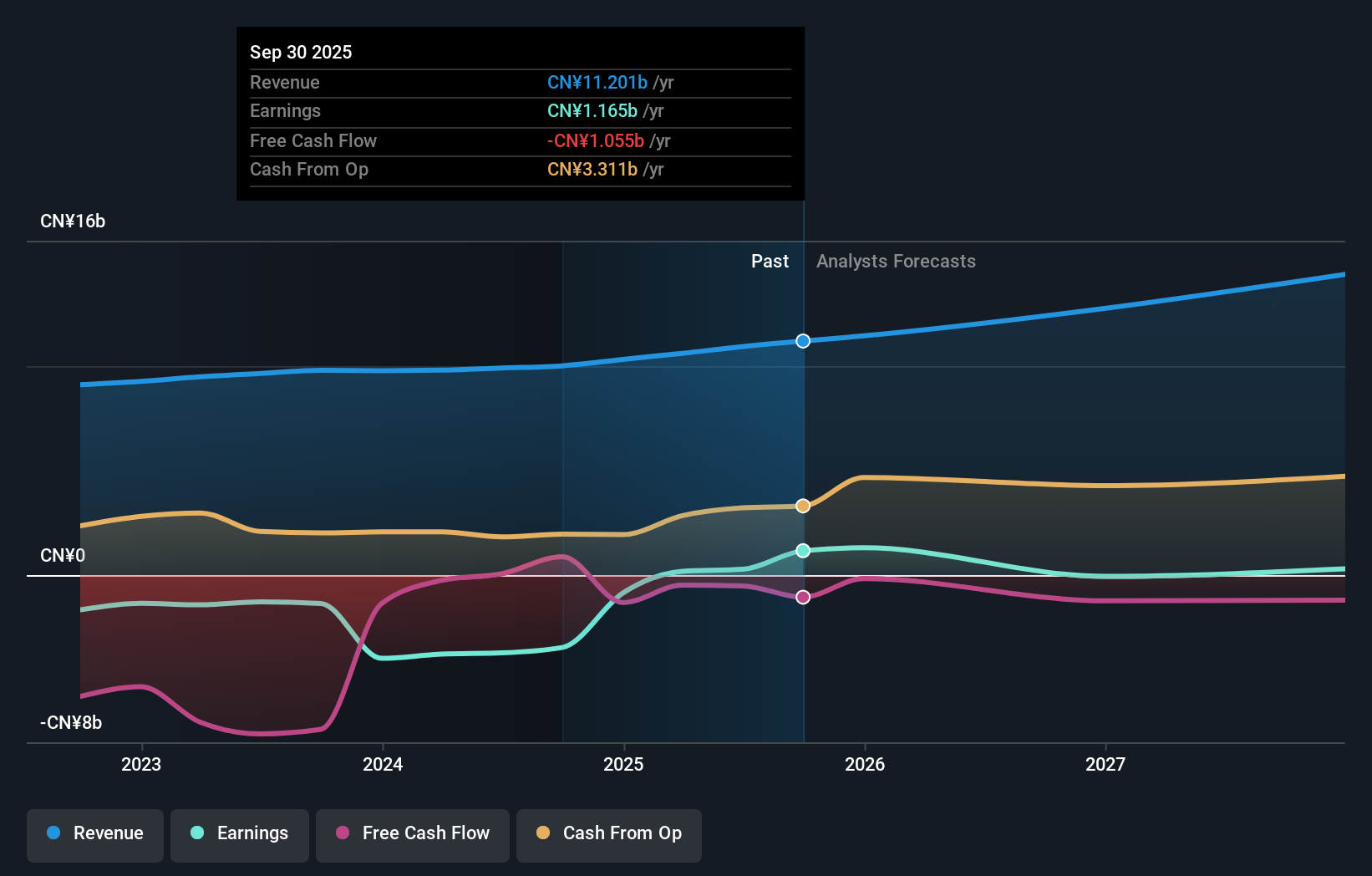

Overview: GDS Holdings Limited, along with its subsidiaries, focuses on developing and operating data centers in the People's Republic of China and has a market capitalization of approximately $4.01 billion.

Operations: The primary revenue stream for GDS Holdings comes from the design, build-out, and operation of data centers, generating CN¥10.32 billion. The company's focus is on providing infrastructure services within the data center sector in China.

GDS Holdings has demonstrated a significant turnaround, evidenced by its latest financials where quarterly revenue rose to CNY 2.69 billion from CNY 2.47 billion year-over-year, and net income surged to CNY 4.19 billion from a loss of CNY 3.17 billion. This rebound is mirrored in annual figures, with revenue increasing to CNY 10.32 billion and net income flipping to a gain of CNY 3.43 billion from a substantial loss previously. Looking ahead, GDS anticipates revenue growth between 9.4% to 12.3% for the upcoming year, reflecting optimism despite past volatility in earnings and share price fluctuations over recent months.

- Unlock comprehensive insights into our analysis of GDS Holdings stock in this health report.

Explore historical data to track GDS Holdings' performance over time in our Past section.

Rocket Pharmaceuticals (NasdaqGM:RCKT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rocket Pharmaceuticals, Inc. is a late-stage biotechnology company developing gene therapies for rare and devastating diseases in the United States, with a market cap of $696.29 million.

Operations: Rocket Pharmaceuticals focuses on developing gene therapies targeting rare and severe diseases. As a late-stage biotechnology company, it operates primarily in the United States with a market capitalization of approximately $696.29 million.

Rocket Pharmaceuticals, with its recent executive appointment and a focus on innovative gene therapies, is positioning itself as a significant player in biotech. Sarbani Chaudhuri's recruitment as Chief Commercial & Medical Affairs Officer brings a wealth of experience from Johnson & Johnson, promising to enhance Rocket's commercial strategies. Despite reporting a net loss of $60.33 million in Q4 2024, the company is optimistic about future growth, underscored by an aggressive R&D strategy that aims to leverage cutting-edge gene editing technologies. This approach could potentially reshape treatment paradigms across multiple diseases, aligning with Rocket’s projected annual revenue growth of 49%.

- Click here to discover the nuances of Rocket Pharmaceuticals with our detailed analytical health report.

Gain insights into Rocket Pharmaceuticals' past trends and performance with our Past report.

Exelixis (NasdaqGS:EXEL)

Simply Wall St Growth Rating: ★★★★★☆

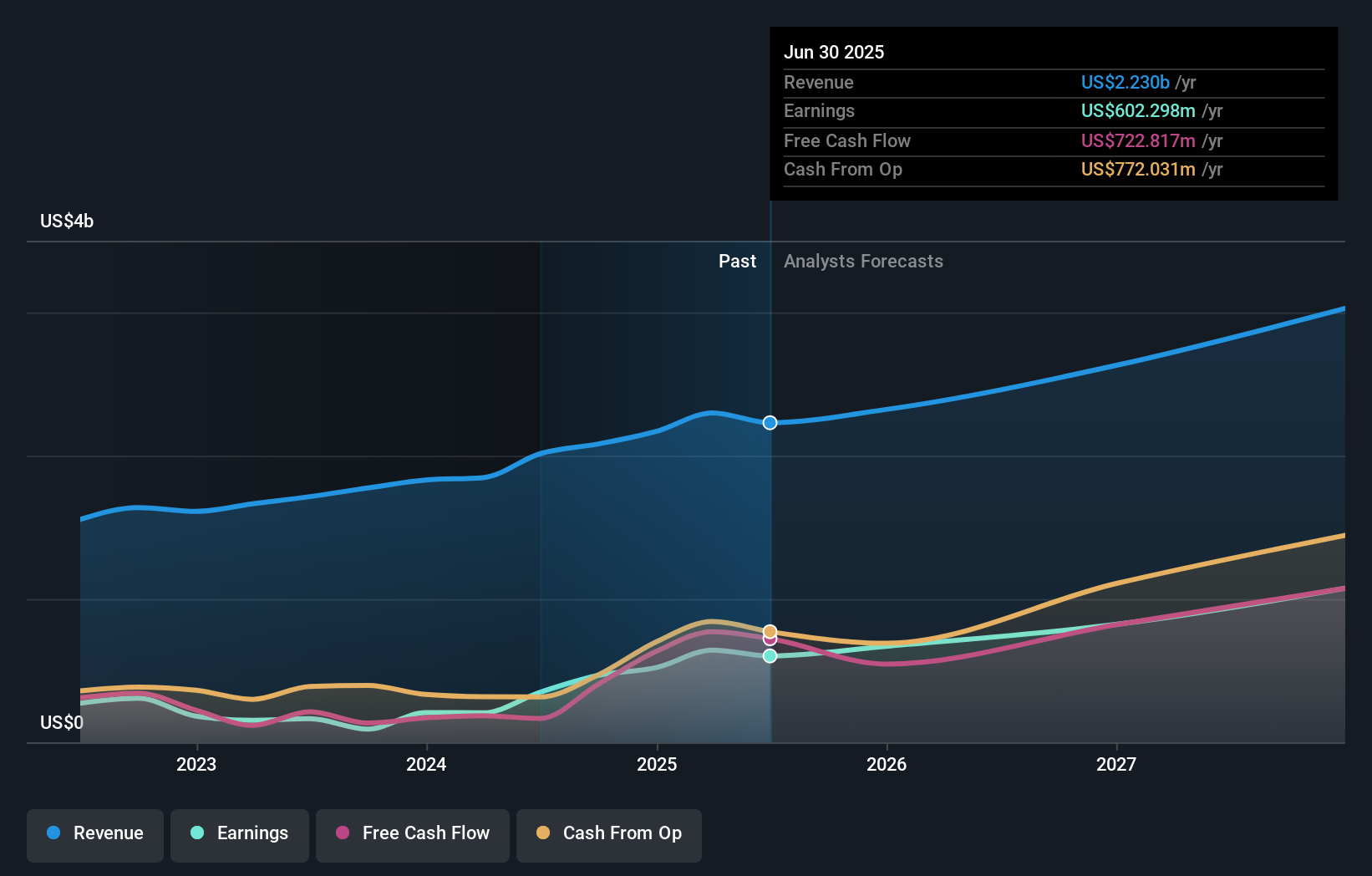

Overview: Exelixis, Inc. is an oncology company dedicated to discovering, developing, and commercializing new medicines for difficult-to-treat cancers in the United States, with a market cap of approximately $10.23 billion.

Operations: Exelixis generates revenue primarily from the discovery, development, and commercialization of new medicines for difficult-to-treat cancers, amounting to $2.17 billion. The company's operations are concentrated in the United States oncology sector.

Exelixis has demonstrated robust growth with a 10.4% annual increase in revenue and an impressive 150.9% surge in earnings over the past year, outpacing the biotech industry's average of 40.2%. This performance is underscored by strategic R&D investments, which have facilitated significant advancements in drug development, including the recent FDA approval of CABOMETYX for complex neuroendocrine tumors. The company's commitment to innovation is further evidenced by its planned $500 million share repurchase program, reflecting confidence in its financial health and future prospects. With earnings expected to grow by 22.5% annually, Exelixis is well-positioned to maintain its trajectory within the high-stakes biotech field.

- Click here and access our complete health analysis report to understand the dynamics of Exelixis.

Evaluate Exelixis' historical performance by accessing our past performance report.

Summing It All Up

- Explore the 232 names from our US High Growth Tech and AI Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade GDS Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GDS

GDS Holdings

Develops and operates data centers in the People's Republic of China.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives