- United States

- /

- Software

- /

- NasdaqGS:FTNT

Will Fortinet’s (FTNT) Partnership Integration Signal a New Era for Its Security Strategy?

Reviewed by Sasha Jovanovic

- Fortinet recently expanded its partnership with Armis to deliver unified asset visibility, automated policy enforcement, and enhanced cyber resilience for global organizations through deep product integrations.

- This collaboration brings together advanced asset intelligence and Fortinet’s security fabric, enabling organizations to simultaneously identify vulnerabilities and dynamically apply protection at scale.

- To assess the impact on Fortinet’s investment narrative, we’ll consider how the class action lawsuits alleging misleading statements regarding the product upgrade cycle present new business risks.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Fortinet Investment Narrative Recap

To be a Fortinet shareholder today, you need to believe in the company's capacity to maintain growth by delivering increasingly integrated, scalable cybersecurity solutions amid a fast-evolving threat environment. While the expanded Armis partnership supports Fortinet’s unified security vision and could strengthen its product offering, the ongoing class action lawsuit regarding product upgrade cycle disclosures represents a material business risk in the near term.

Among Fortinet’s recent client wins, the deployment of Security Fabric solutions with Tepper Sports & Entertainment demonstrates customer trust in Fortinet’s platform beyond traditional IT, which is relevant as the company aims for broader cross-industry adoption and deepens its moat in high-compliance sectors.

In contrast, investors should be aware that ongoing legal challenges tied to upgrade cycle communications may have implications for...

Read the full narrative on Fortinet (it's free!)

Fortinet's outlook forecasts $9.2 billion in revenue and $2.4 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 13.1%, with earnings rising by $0.5 billion from the current $1.9 billion.

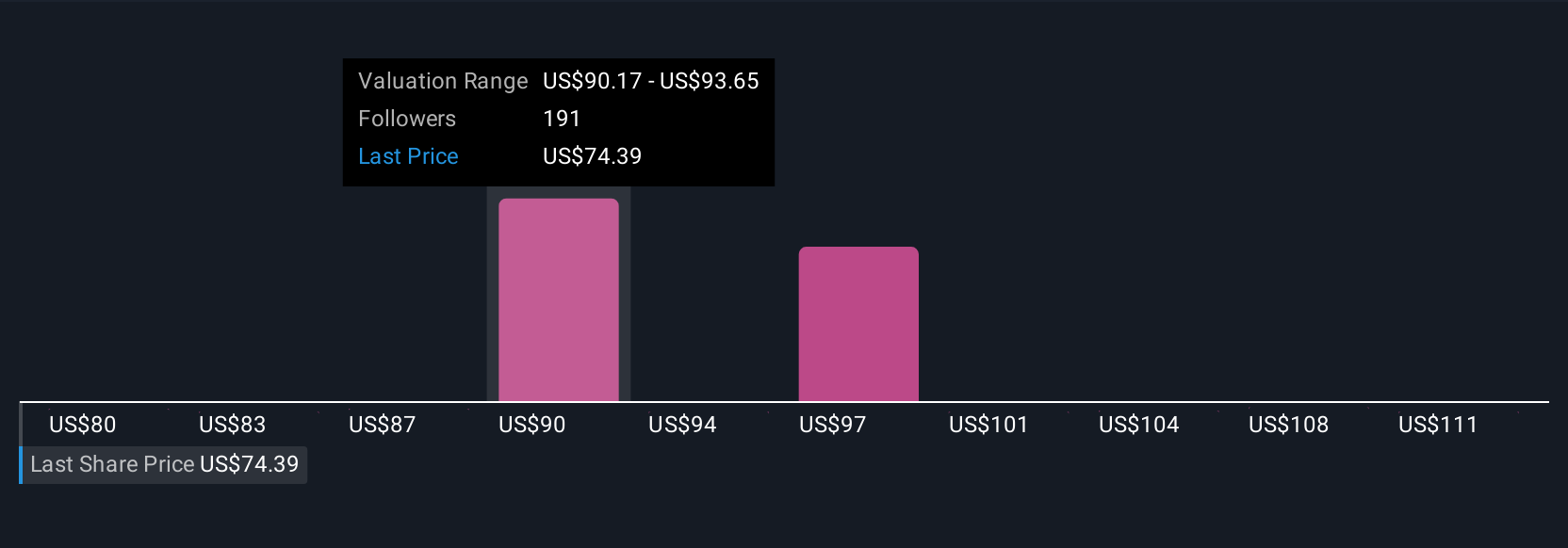

Uncover how Fortinet's forecasts yield a $90.32 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Thirty members of the Simply Wall St Community have posted fair value estimates for Fortinet, stretching from US$74.10 to US$116.91 per share. While opinions are varied, the current legal risk surrounding past product cycle disclosures could impact how future growth stories are received by the market, so consider several viewpoints before deciding where you stand.

Explore 30 other fair value estimates on Fortinet - why the stock might be worth 11% less than the current price!

Build Your Own Fortinet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortinet research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Fortinet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortinet's overall financial health at a glance.

No Opportunity In Fortinet?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives