- United States

- /

- Software

- /

- NasdaqGS:FTNT

Should Fortinet's (FTNT) Expanded Armis Partnership Reinforce Confidence in Its Integrated Cybersecurity Vision?

Reviewed by Sasha Jovanovic

- Armis and Fortinet recently announced an expanded partnership aimed at simplifying security programs and enhancing cyber resilience for global organizations by integrating Armis Centrix with FortiOS to deliver a unified security ecosystem with real-time risk context and automated enforcement.

- This collaboration leverages Armis's extensive device asset intelligence to boost Fortinet’s automated policy enforcement and provides organizations with a more complete and proactive security posture.

- We'll assess how the expanded Armis partnership strengthens Fortinet’s platform and its investment narrative around integrated, intelligent cybersecurity solutions.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Fortinet Investment Narrative Recap

To be a Fortinet shareholder, you need to believe that accelerating demand for integrated cybersecurity platforms and ongoing enterprise digital transformation can sustain the company’s revenue growth even as hardware upgrade cycles eventually slow. The expanded Armis partnership may sharpen Fortinet’s competitive edge in automation and risk detection, but it does not materially change the most important short-term catalyst, momentum in large enterprise deals, or address the biggest current risk: a post-refresh deceleration in hardware-driven revenue. Among recent developments, Fortinet’s recognition as a Leader in the 2025 Gartner Magic Quadrant for SASE Platforms stands out. This context makes the Armis alliance even more relevant, reinforcing catalysts such as greater cloud adoption and multi-product expansion into enterprise accounts through unified, automated security solutions. Yet, what many investors might miss is that after the current hardware cycles conclude, Fortinet could face a meaningful shift if...

Read the full narrative on Fortinet (it's free!)

Fortinet's outlook anticipates $9.2 billion in revenue and $2.4 billion in earnings by 2028. This scenario assumes 13.1% annual revenue growth and a $0.5 billion increase in earnings from the current $1.9 billion.

Uncover how Fortinet's forecasts yield a $90.32 fair value, a 5% upside to its current price.

Exploring Other Perspectives

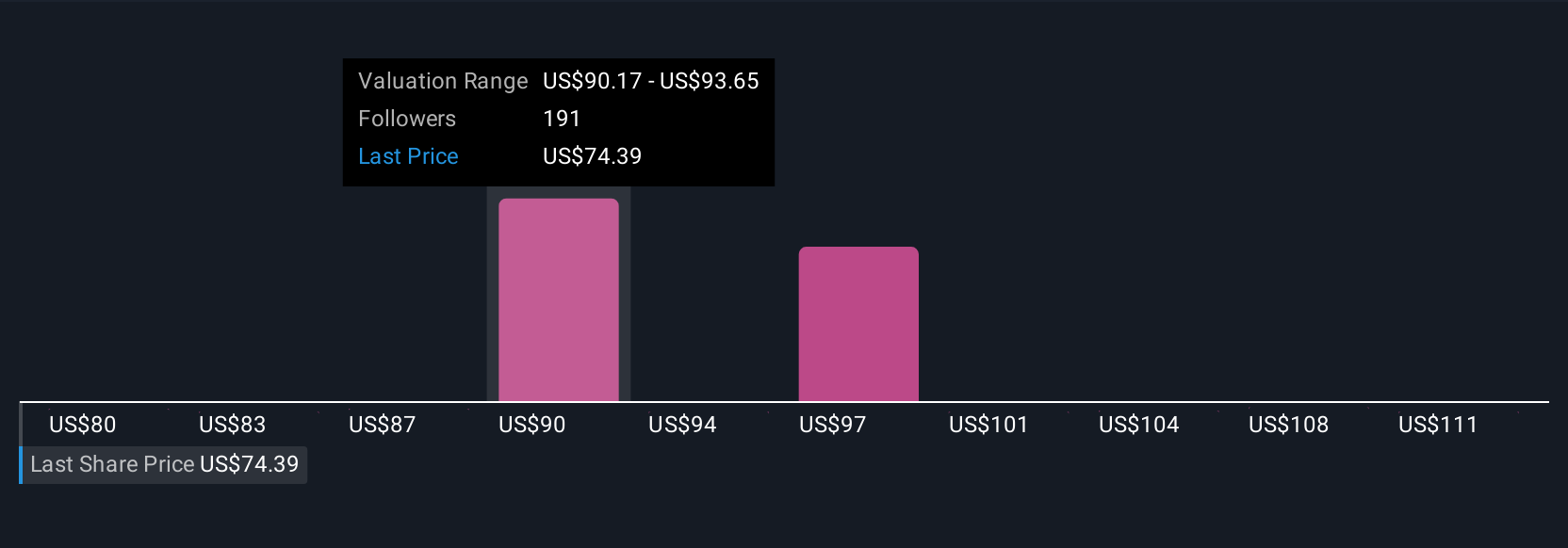

Fair value estimates from 32 Simply Wall St Community members span from US$74.10 to US$110.39 per share. While opinions vary widely, many are closely watching whether Fortinet can sustain its growth beyond the hardware upgrade cycle.

Explore 32 other fair value estimates on Fortinet - why the stock might be worth 14% less than the current price!

Build Your Own Fortinet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortinet research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Fortinet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortinet's overall financial health at a glance.

No Opportunity In Fortinet?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion