- United States

- /

- Software

- /

- NasdaqGS:FTNT

How Investors May Respond To Fortinet (FTNT) Class Action Lawsuits Over Product Upgrade Disclosures

Reviewed by Sasha Jovanovic

- In recent months, multiple law firms have filed class action lawsuits against Fortinet, alleging the company misled investors about the scope and timing of its product refresh cycle and the number of eligible FortiGate firewall upgrades, following disclosures made during its August 2025 earnings call.

- The legal actions focus on claims of concealed material information, with investors who purchased Fortinet shares between November 2024 and August 2025 encouraged to consider lead plaintiff appointments in the ongoing litigation.

- We'll examine how allegations of misleading disclosures regarding product upgrade cycles could influence Fortinet's investment narrative and future prospects.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Fortinet Investment Narrative Recap

Fortinet’s investment story is built on strong demand for cybersecurity, steady expansion into services like SASE and cloud security, and large near-term hardware upgrade cycles. The recent class action lawsuits alleging misleading disclosures about the FortiGate firewall refresh cycle have introduced uncertainty around the most important short-term catalyst for revenue growth, highlighting material risks for near-term investor confidence.

Among recent announcements, Fortinet’s expanded partnership with Armis to boost asset intelligence and security program simplification stands out. While positive for cross-selling and integrated platform adoption, this initiative comes at a time when the company’s credibility with investors and transparency about its product cycles are under closer scrutiny due to the lawsuits.

By contrast, the scope and timing of hardware upgrade cycles may still carry important consequences for Fortinet’s business that investors should be aware of, especially if...

Read the full narrative on Fortinet (it's free!)

Fortinet's outlook anticipates $9.2 billion in revenue and $2.4 billion in earnings by 2028. This assumes a 13.1% annual revenue growth rate and a $0.5 billion earnings increase from current earnings of $1.9 billion.

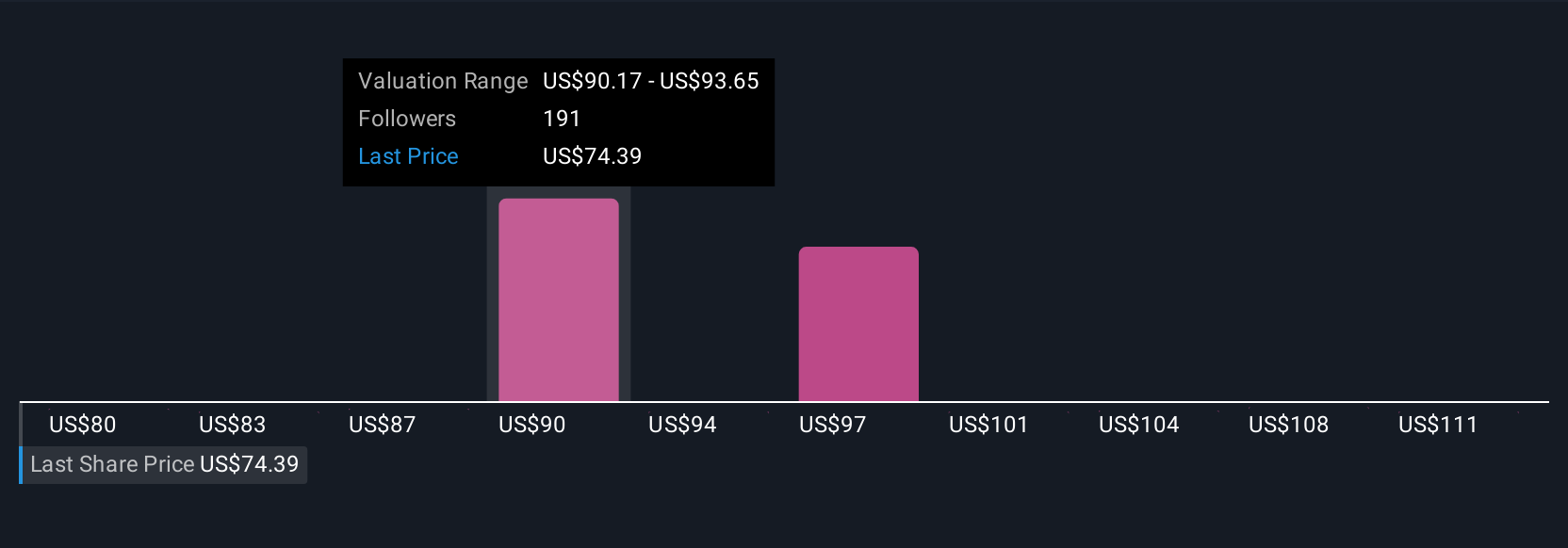

Uncover how Fortinet's forecasts yield a $90.32 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Twenty-five private investors in the Simply Wall St Community estimate Fortinet’s fair value between US$83.65 and US$110.39, showing a wide span of opinions. Given questions around the durability of hardware upgrade demand, it is worth exploring how each outlook weighs the impact of refresh cycles on future returns.

Explore 25 other fair value estimates on Fortinet - why the stock might be worth just $83.65!

Build Your Own Fortinet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortinet research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Fortinet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortinet's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives