- United States

- /

- Software

- /

- NasdaqGS:FTNT

Fortinet (NasdaqGS:FTNT) Unveils Next-Gen Firewall With Advanced AI And Quantum Security

Reviewed by Simply Wall St

Fortinet (NasdaqGS:FTNT) recently launched the FortiGate 700G Series, showcasing advanced threat protection and reduced power consumption, positioning them strongly in the cybersecurity market. This launch, alongside significant partnerships with Vodafone Business and Bell for enhanced cybersecurity solutions, likely contributed to Fortinet’s 26% stock price increase over the past month. Meanwhile, broader market events such as mixed stock performance and anticipation around Fed interest rate decisions provided a contrasting backdrop, but the company’s strong innovative strides in product offerings likely added positive momentum to its stock amidst these conditions.

Buy, Hold or Sell Fortinet? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

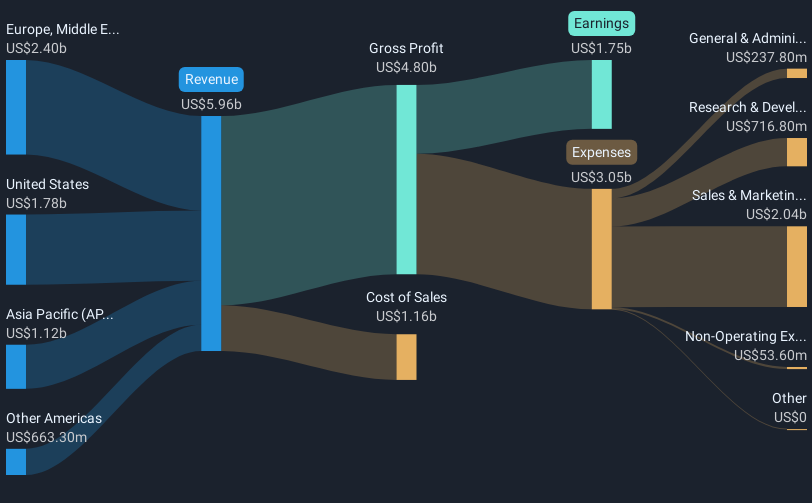

The recent launch of Fortinet's FortiGate 700G Series and alliances with Vodafone Business and Bell may enhance the company's Unified SASE and AI-driven security operations strategies. This alignment could bolster Fortinet's revenue growth and profit margins by increasing market adoption of key technologies, particularly within the SMB segment. Over the last year, Fortinet's performance outpaced the US software industry, which returned 14%. Fortinet's stock price surged 26% in the past month as a potential response to these innovations, reflecting a positive market reaction to its strategic initiatives.

Long-term total shareholder return was notably substantial at 287.09% over five years. This robust performance signals ongoing investor confidence, outperforming both the broader market and the one-year industry average. Looking ahead, analysts foresee Fortinet's revenue reaching US$8.9 billion by April 2028, with earnings at US$2.3 billion. The company's share price of US$104.21 against a target of US$113.19 suggests limited upside potential in the short term; however, strong revenue and earnings projections support sustained interest. The growth narrative remains contingent on successful execution of its plans, including managing global regulatory challenges and maximizing upsell opportunities.

The valuation report we've compiled suggests that Fortinet's current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives