- United States

- /

- Software

- /

- NasdaqGS:FTNT

Fortinet (NasdaqGS:FTNT) Expands Cloud Security Portfolio with Enhanced AWS Marketplace Offerings

Fortinet (NasdaqGS:FTNT) recently announced updates to its Lacework FortiCNAPP, enhancing the security of cloud-native applications, introducing real-time alerting and expanding its services on AWS Marketplace. Throughout the last quarter, the company’s share price increased by 5%, reflecting its advancements in cloud security solutions and market expansion. This occurred amidst global market volatility due to geopolitical tensions in the Middle East and anticipation around Federal Reserve interest rate decisions, which contributed to fluctuations across the tech sector. Fortinet's continued innovation and strategic offerings helped counter broader market uncertainty, supporting its upward price movement.

Buy, Hold or Sell Fortinet? View our complete analysis and fair value estimate and you decide.

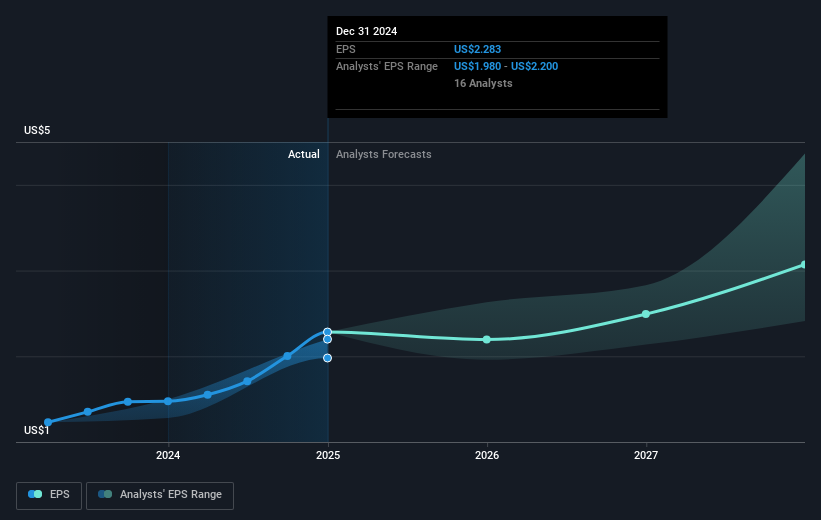

The recent enhancements in Fortinet’s Lacework FortiCNAPP are poised to bolster its position in the cloud security space, potentially driving increased adoption of its services. By focusing on real-time alerting and expanding its reach on the AWS Marketplace, this update could support revenue growth, aligning with Fortinet's strategy to tap into the AI-driven security operations and unified SASE sectors. Although geopolitical tensions and interest rate uncertainties have created a volatile backdrop for the tech sector, Fortinet's proactive innovations might help solidify its revenue projections, which analysts expect to grow by 14.2% annually over the next three years. This aligns well with the anticipated expansion initiatives based on the company's ongoing roll-out and upscale opportunities in cybersecurity solutions.

Over the past five years, Fortinet has delivered a 275.28% total return for shareholders, including share price appreciation and dividends. Compared to the US Software industry, whose earnings grew 18.9% over the past year, Fortinet's earnings growth of 56.7% places it significantly ahead in one-year performance. With the current share price of US$107.14, in light of the analyst consensus price target of US$113.01, there remains a modest room for potential appreciation. Such projections suggest that Fortinet is perceived as fairly priced by analysts, with a potential upside reflecting their faith in future earnings of US$2.3 billion by 2028. However, execution risks associated with upselling existing customers and fully integrating recent acquisitions could impact future earnings. Shareholders should consider these dynamics alongside external market conditions and regulatory landscapes while evaluating Fortinet’s investment thesis.

Unlock comprehensive insights into our analysis of Fortinet stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Goldman Sachs Group (GS) The Titan Reclaims Its Crown: Return to Core Excellence

Parker-Hannifin (PH) The Industrial Alchemist: Transforming Motion into Margin

Monolithic Power Systems (MPWR) Powering the Hyperscale Era: The Efficiency Moat

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion