- United States

- /

- Software

- /

- NasdaqGS:FTNT

Fortinet (FTNT) Valuation in Focus as Legal Scrutiny and Analyst Concerns Shape Market Sentiment

Reviewed by Kshitija Bhandaru

Fortinet (FTNT) is attracting attention as a wave of class action lawsuits allege the company was not fully transparent about the scale and business impact of its firewall product refresh. Legal challenges are now intersecting with investor concerns about future earnings potential and putting the stock in the spotlight.

See our latest analysis for Fortinet.

This intense legal scrutiny has certainly shaken up sentiment. After some sharp moves surrounding the firewall refresh revelations, Fortinet's share price is still down year-to-date. However, long-term total shareholder returns remain robust, with more than 250% gained over five years. Meanwhile, recent news about new partnerships and continued cybersecurity demand suggest that while investor confidence has wavered in the short term, there is still optimism about Fortinet rebounding as the legal dust settles and growth drivers play out.

If you’re curious what else is taking off in the sector, now’s a good opportunity to explore the landscape with our curated See the full list for free..

This year’s legal and business turbulence has certainly weighed on Fortinet’s valuation. However, with shares still well above pre-pandemic levels and financials staying resilient, the big question is whether the dip signals a genuine buying opportunity or if the market has already factored in all future growth potential.

Most Popular Narrative: 12.9% Undervalued

Fortinet closed at $86.29, while the most-followed narrative pegs its fair value at $99.03. At current levels, the stock trades below where proponents of this narrative believe it should, setting up an intriguing valuation debate ahead.

The company offers a financial profile of outstanding and consistent GAAP profitability, with best-in-class operating margins that result from its founder-led engineering focus and proprietary ASIC architecture. It generates robust free cash flow and boasts a highly integrated, cost-effective product platform that resonates strongly across a massive customer base.

Want to know which powerful assumptions make this fair value tick? There is a bold profit outlook, a best-in-class margin trajectory, and more under the surface. See how these surprising numbers and founder-led innovations drive the full narrative.

Result: Fair Value of $99.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, recent security vulnerabilities and reliance on hardware sales remain risks that could limit Fortinet’s premium valuation or put pressure on future growth trajectories.

Find out about the key risks to this Fortinet narrative.

Another View: What Does the SWS DCF Model Say?

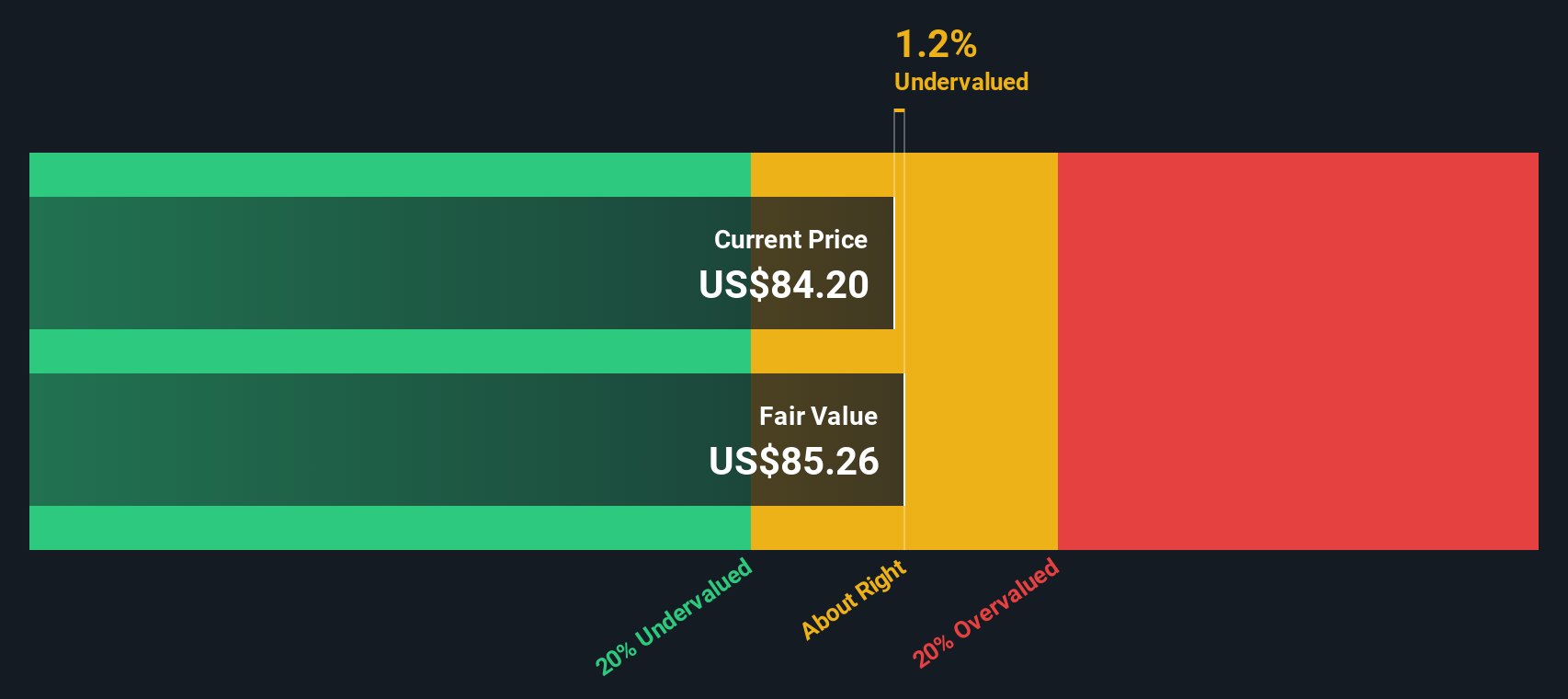

While many see Fortinet as trading below fair value based on commonly used multiples, the SWS DCF model tells a different story. Using projected future cash flows, this approach currently estimates Fortinet's fair value at $84.49, which is slightly below today's price. Does this mean optimism in the market is outpacing fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fortinet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fortinet Narrative

Of course, if these views don't quite line up with your own, you're welcome to dive into the numbers and craft your own narrative quickly. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Fortinet.

Looking for More Smart Investment Opportunities?

Don’t settle for just one stock when tomorrow’s winners are out there right now. Use Simply Wall Street’s tools to find the strategies and stories others might miss.

- Unlock potential in up-and-coming companies by sizing up these 3563 penny stocks with strong financials, which have strong financial foundations and the resilience to surprise the market.

- Capture long-term growth from the digital healthcare revolution by tapping into these 31 healthcare AI stocks, where artificial intelligence is reshaping patient outcomes and business models alike.

- Boost your income strategy with these 19 dividend stocks with yields > 3%, offering reliable yields over 3 percent and combining stability with smart returns in volatile times.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives