Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Fortinet (NASDAQ:FTNT). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Fortinet

How Fast Is Fortinet Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Fortinet's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 39%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

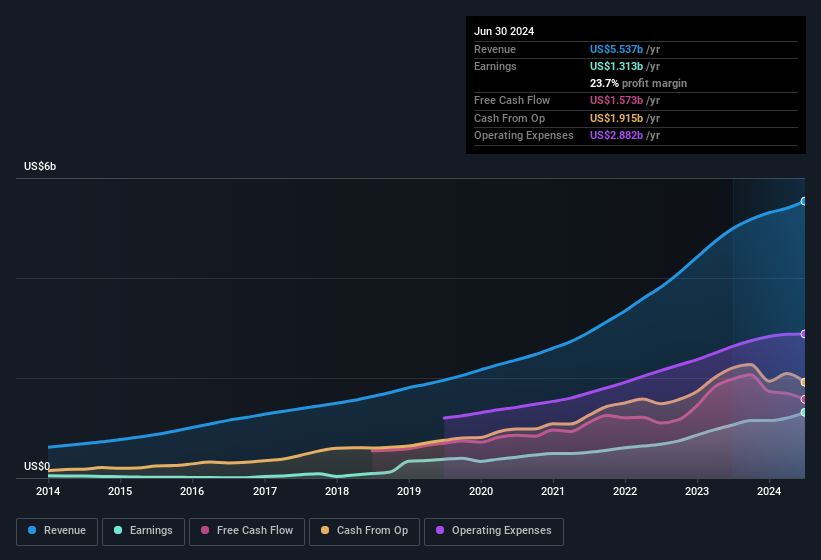

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Fortinet shareholders can take confidence from the fact that EBIT margins are up from 23% to 26%, and revenue is growing. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Fortinet's future profits.

Are Fortinet Insiders Aligned With All Shareholders?

Since Fortinet has a market capitalisation of US$62b, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. We note that their impressive stake in the company is worth US$9.8b. Coming in at 16% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Is Fortinet Worth Keeping An Eye On?

Fortinet's earnings per share growth have been climbing higher at an appreciable rate. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So based on this quick analysis, we do think it's worth considering Fortinet for a spot on your watchlist. Now, you could try to make up your mind on Fortinet by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in the US with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives