- United States

- /

- Software

- /

- NasdaqGS:FRSH

Does the CEO Transition to Dennis Woodside Change The Bull Case For Freshworks (FRSH)?

Reviewed by Simply Wall St

- Earlier this year, Freshworks underwent a significant leadership change when its founder and CEO stepped down, with Dennis Woodside appointed as the new CEO.

- The company’s software solutions continue to gain traction among enterprise clients, reflecting ongoing demand and strong customer satisfaction despite heightened industry competition.

- Next, we'll explore how Dennis Woodside's leadership background may influence Freshworks' investment narrative and future growth potential.

Freshworks Investment Narrative Recap

To own Freshworks stock, you need confidence in its ability to turn traction with enterprise clients and innovative AI products into durable revenue growth, even amid industry competition and a new leadership team. The recent CEO transition and stock drop heighten near-term focus on whether leadership stability can sustain operating momentum; however, the primary catalyst remains accelerating enterprise adoption, while a key risk is customer churn among large clients. The CEO change isn’t expected to materially affect these factors in the short term.

Among Freshworks’ latest announcements, the launch of Freshservice Journeys stands out for its direct support of enterprise customer needs through AI-driven workflow automation. This product development aligns closely with the company’s business catalysts, driving productivity gains and deepening client relationships, both of which are essential in converting industry interest into recurring, high-quality revenue.

By contrast, investors should also weigh the risk of large clients shifting providers, a factor that could...

Read the full narrative on Freshworks (it's free!)

Freshworks' outlook anticipates $1.0 billion in revenue and $123.8 million in earnings by 2028. Achieving this requires a 12.6% annual revenue growth rate and a $219.2 million increase in earnings from the current level of -$95.4 million.

Uncover how Freshworks' forecasts yield a $16.68 fair value, a 14% upside to its current price.

Exploring Other Perspectives

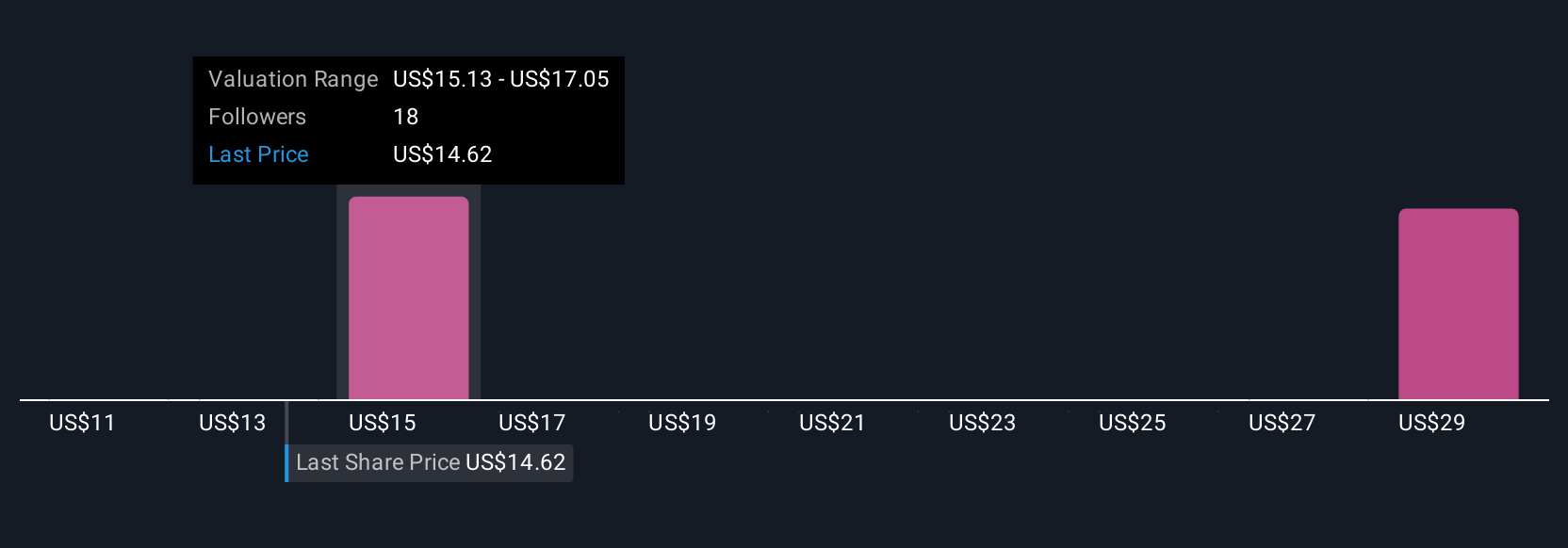

Six fair value estimates from the Simply Wall St Community place the stock’s worth between US$11.30 and US$30.45, reflecting wide variation in outlooks. Many expect continued AI-powered product growth to help offset competitive risks, but these community views show just how differently investors evaluate Freshworks’ future, see how your perspective compares.

Build Your Own Freshworks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freshworks research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Freshworks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freshworks' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FRSH

Freshworks

A software development company, provides software-as-a-service products in North America, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives